Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

YouTube revenue soared 46% in the quarter, as advertisers flocked to the video-sharing platform amid the pandemic. The company said the platform now reaches more users between the ages of 25 and 49 than all cable networks combined.

An excerpt from a Wall Street Journal article detailing one of the highlights from Google parent company Alphabet Inc.’s 2020 fourth quarter earnings report, released earlier this month. The online video-sharing platform YouTube, which was purchased by Google in 2006, thrived during the pandemic-induced lockdowns last year.

Market News

With the snap of incredibly cold weather hitting the majority of the United States, it might be a good time to reflect on inflation. Specifically much is currently being made about the seizing up of the Texas power grid and spiking energy prices. But there is much more going on under the surface. We remember that the pandemic caused some massive distortions last year, and we went over those in detail at the time. What we are seeing now may be somewhat distorted, but is interesting nonetheless.

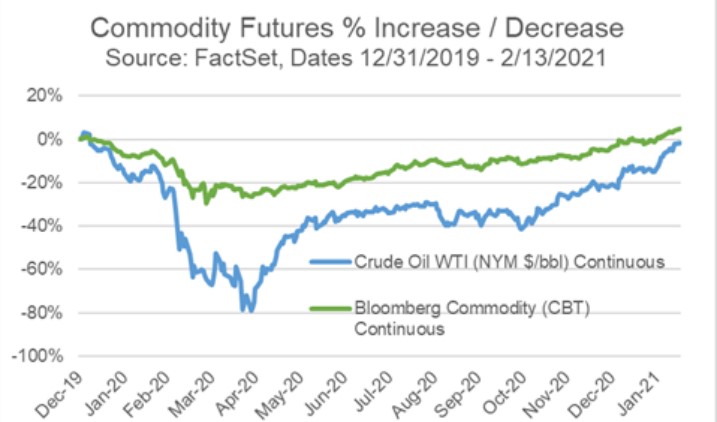

Inflation can be caused by basic inputs into the economic cycle increasing in price. This can be seen in the futures markets. The makeup of the Bloomberg Commodity index is heavily tilted toward energy. We can see in the chart above that the West Texas Intermediate (WTI) futures are basically back where they were at the end of 2019. This has been accomplished in two ways. First, there is some pickup in demand; but more importantly, there are still production restraints in place from OPEC. The price of oil is still quite easily manipulated by OPEC, when they decide to turn the taps back on the price will likely cease to rise at such a pace.

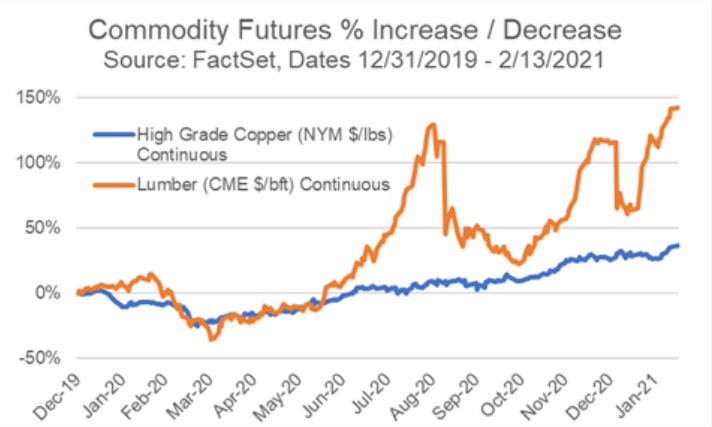

More interesting is what is happening to other inputs into the economic cycle. The cost of lumber is up 140% since the end of 2019 (see the chart directly below). You can feel this every time you walk into the local lumber yard for a home project and are hit with sticker shock. The cost of remodeling has shot through the roof. The price of copper, one of the most important industrial metals, has likewise risen 31% over the same period. While the rise has not been as dramatic as lumber it is still very significant.

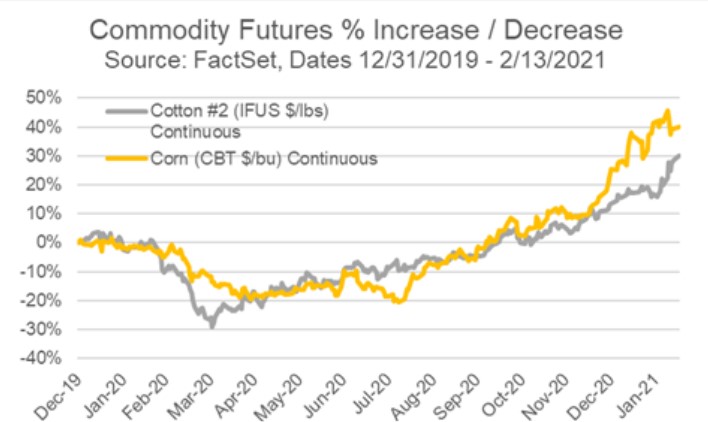

We are also seeing prices rise in other types of inputs. Cotton, so useful in clothing, has risen 28% since the start of 2020 ( see the chart directly below). Corn is up 38% over the same period.

The question is, should we be alarmed by this? Not at this point. A modest amount of inflation is healthy in the economy. The Federal Reserve has a long-term inflation target of 2%, and has said that it will continue to support the economy with dovish policies. The current 10-year breakeven inflation rate is sitting at 2.2%, this is not high and does not warrant significant moves to hedge portfolios.

So what can be done to combat inflation? Well, modest inflation of the type that we are seeing now is best hedged out through equities. Companies will be able to raise prices and generate more revenue in modest inflationary cycles. This means that by simply being slightly overweight equities you can combat much of the inflation that we are seeing. You can also be on the shorter end of the yield curve for your fixed income. Inflation is most pernicious to fixed income. In fact, the real return of intermediate-term government bonds is currently negative.

To the vast majority of our readers stay warm out there. To the lucky few in southern Florida, spend some time at the beach.

Model Update

There were no trades in the Fortunatus models during the week ending on February 13th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on February 5, 2021 to closing price on February 12, 2021

1 Month = closing price on January 12, 2021 to closing price on February 12, 2021

3 Month = closing price on November 12, 2020 to closing price on February 12, 2021

YTD = closing price on December 31, 2020 to closing price on February 12, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.