Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

I am not a cat.

An impromptu anthropomorphic update from stock trader Keith Gill during his opening remarks to Congress last week. Gill, who goes by the pseudonym “Roaring Kitty” on YouTube and whose Internet posts became closely associated with the surge in GameStop Corp. shares, testified before the U.S. House of Representatives’ Committee on Financial Services about the upswing in volatility and trading disruptions brought about by the excitement over “meme stocks” in 2021.

Market News

Way back in 1972, after seeing how enthralled Europeans were with any music associated with the United States, Italian singer Adriano Celentano decided to test their appreciation of anything American when he released “Prisencolinensinainciusol“. The song’s lyrics were intended to sound like American English to foreign ears, but were actually nonsense verse. The meaningless music became a top 10 hit on the pop charts of several countries in the Old Continent, proving that in the right market environment pure gibberish can be smashing success. In fact, videos of live performances of the song on Italian television, which include throngs of choreographed background dancers, have become a bit of an internet meme over the last decade.

Just looking at the news headlines, an internet meme celebrating nonsense could seem fitting for the financial markets in 2021. Stocks shoot up in value and then quickly plummet in price, not due to changes in a company’s projected cash flows but due to chatter on message boards. New software companies, cryptocurrencies, and even parodies of cryptocurrencies rise in value thanks to celebrity tweets. At times like this, financial security selection can devolve from a cleverness competition to a gambling game to ultimately a farcical frenzy. Concerns about irrationality often lead to worries that we may be in a market bubble. While bubbles are only easy to predict in hindsight, there are reasons why long-term investors can remain bullish about the current stock market.

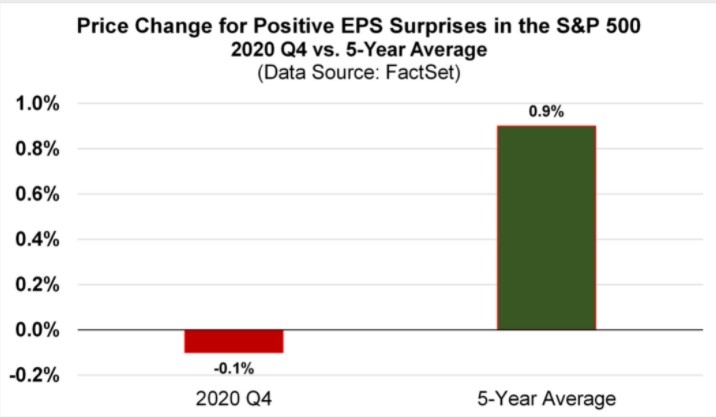

First, corporate earnings are good and somewhat underappreciated. With over 80% of the companies in the S&P 500 having released their fourth quarter 2020 (Q4 2020) financial reports, the largest US companies are beating analysts’ earnings estimates by an average of 14.6% – the fourth-largest earnings surprise percentage since data provider FactSet began tracking the metric in 2008, and the companies are issuing positive guidance for the first quarter of 2021 at an above average rate. The market has yet to reward this positive news as it has in the past. Over the last five years, companies that have reported positive earnings-per-share (EPS) surprises have seen their stock price increase +0.9% on average two days before the earnings release through two days after the earning release. For this earnings season, companies with good news have actually seen their shares fall slightly (see the chart below).

Secondly, the latest economic data show strong consumer sentiment. January retail sales advanced 5.3% – well ahead of the consensus market estimate of 1.1% – with gains across the broad spectrum of retail stores. Surveys of managers in both the manufacturing and services sectors released last week indicated that positivity about the near economic future remains very high.

Finally, the federal government is positioned to bolster equity prices. Trillions in fiscal stimulus for pandemic relief and infrastructure spending have been proposed for this year. Federal Reserve Chairman Jerome Powell reiterated last week the central bank’s plans to maintain an accommodative monetary policy until employment returns to normal levels. Under such an impecunious interest rate environment, equities will remain a strong option for income investors. So as Adriano Celentano’s catchy tune shows, nonsense has always been with us, and it doesn’t mean that everything is going to fall apart.

Model Update

There were no trades in the Fortunatus models during the week ending on February 20th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on February 12, 2021 to closing price on February 19, 2021

1 Month = closing price on January 19, 2021 to closing price on February 19, 2021

3 Month = closing price on November 19, 2020 to closing price on February 19, 2021

YTD = closing price on December 31, 2020 to closing price on February 19, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.