Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

When it started its march, we thought, something’s percolating here, but we had no idea how crazy this thing was going to get.

Richard Mashaal of the hedge fund Senvest Management, LLC. According to The Wall Street Journal, this hedge fund profited from the GameStop short squeeze turned speculation last month to the tune of $700 million.

Market News

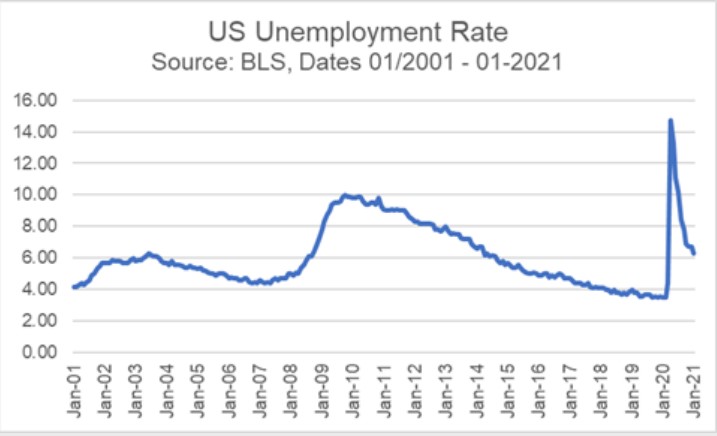

It’s time to talk about unemployment again. The US Bureau of Labor and Statistics put out the January 2021 unemployment rate last Friday. It came in at 6.3% or about 0.2% better than forecasted and a 0.4% improvement over the end of 2020. This is a huge improvement over the depths of the pandemic when the official rate spiked above 15% (see the chart below).

But let’s dig a little deeper into the numbers. The unemployment rate is judged by how many people who want jobs, have jobs. This means that if there is a decrease in the number of people wanting jobs while simultaneously no new employment happens the unemployment rate can actually drop. This was one of the knocks against the post-Great Recession job rate recovery that began in 2009. There was a very slow decrease in the unemployment rate, but that was accompanied by more and more people leaving the workforce. In 2001 there was a labor participation rate of 67%. After the Great Recession, the participation rate fell to down to 63% by the start of 2014 and stayed pretty constant until the COVID crisis hit and the rate dropped again and is now sitting at 61.4% (see the chart below). This is quite a bit of potential earnings that has been removed from our economy. For a full recovery, we need to not only get the unemployment rate back down, but we need to get the participation rate up. These two things must work in tandem.

An important input into the potential gross domestic product (GDP) growth rate is labor force participation. So a decrease in the labor force participation rate means that the potential for future GDP growth has been hamstrung. Just a rebound back to 63% would be a positive sign, but it would be great to see us back up at the 65% level. Remember that as of January 15th, there were roughly 17 million people receiving some form of unemployment assistance between State and special Pandemic Unemployment benefits. That is still significantly up from the roughly 2 million who were receiving benefits prior to COVID, though down significantly from the 32 million who were receiving benefits at the height of the crisis.

Model Update

On Monday, February 1st, the Fortunatus ETF Opportunity models underwent their monthly relative strength rotations. The Global model broadened its exposure to emerging markets equities and added a commodity fund as a hedge against increasing inflationary pressures. On Tuesday, February 2nd, the Equity Dividend model added a new utilities stock to its portfolio.

All remaining Fortunatus models were unchanged during the week. The major equity market sectors maintain their long-term uptrend, and the Asset Allocation models continue to overweight domestic stocks versus international equities.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on January 29, 2021 to closing price on February 5, 2021

1 Month = closing price on January 5, 2021 to closing price on February 5, 2021

3 Month = closing price on November 5, 2020 to closing price on February 5, 2021

YTD = closing price on December 31, 2020 to closing price on February 5, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.