As December’s end draws nearer, we would like to consider the key elements that drove the financial news of 2021. And by key elements, of course, we don’t mean some abstract themes but the actual chemical substances that made this year happen:

Silicon. A main component of sand, this brittle semiconductor is the substrate upon which all microchips are created. As supply chain problems began to dominate the news this year, the major culprit cited by one analyst after another was a shortage of semiconductors. Almost every industry, from automobiles to video games, couldn’t get the digital hardware it needed. And while the microchip’s raw materials are just a beach away, the facilities to produce top-of-line chips require multi-year investments of several billion dollars. Only three companies in the world have the necessary resources: Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, and Intel. The global shutdown in 2020 caused the world leader in microchip production, TSMC, to readjust its schedule, causing ramifications that are still being felt today. Meanwhile, new Intel CEO Patrick Gelsinger has promised major changes in the former microchip king in an attempt to address this global supply chain semiconductor bottleneck.

Lithium. The universe’s lightest metal brings the reactivity and size necessary to produce the world’s top-performing batteries. Lithium batteries are essential to make functional electric cars, and electric cars were a major focus of the financial news in 2021. The social media posts of Tesla CEO Elon Musk increased the volatility of several markets this year. Seeing an opportunity to compete with Tesla, several new electric vehicle companies went public in 2021 through special purpose acquisition companies or SPACs. The SPAC structure allows companies to make more unconstrained projections about future revenues than traditional initial public offerings (IPOs). Dubious data from some of these debuts has led the SEC to look for tougher rules for SPACs, yet the market’s continued enthusiasm for lithium-powered automobiles allowed upstart Lucid Motors to temporarily surpass both Ford and General Motors in market capitalization in November.

Carbon. Carbon is the backbone of every biological molecule; life would not be possible without it. Yet a key theme of 2021 investing was to “de-carbonize” the economy. Why? Burning fossil fuels (which are essentially long chains of carbon) for energy produces carbon dioxide which can increase the possibility of global warming and ocean acidification. Decarbonization is a major focus of ESG (Environmental, Social, and Governance) funds, and ESG funds continued to see increasing investor inflows in 2021. Even oil & gas behemoth Exxon Mobil was forced to announce a new “Low Carbon Solutions” corporate initiative after it lost a proxy battle with activist hedge fund Engine No. 1 this summer.

Model Update

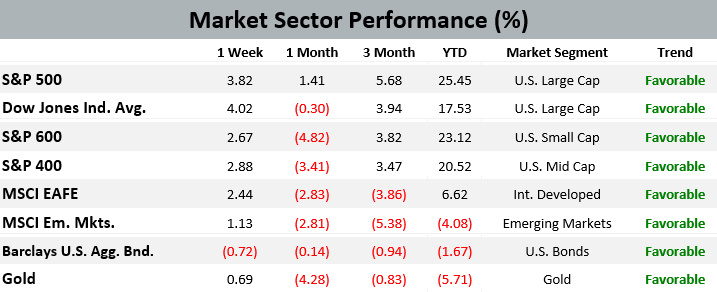

There were no trades in the Fortunatus models during the week ending on December 18th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly-owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. The data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

Mentions of the word “journey” by S&P 500 executives on conference calls this year have soared almost 70% to 3,091, making it one of the fastest-growing corporate buzzwords in recent memory

From Matthew Boyle’s recent article Business Has A New Favorite Buzzword. Unfortunately for investors, the CEOs mentioned in the article were using “journey” as a euphemism for an expected period of underperformance and not as a reference to the 70s supergroup responsible for “The Wheel In The Sky“

The holiday season is one of the most significant times for scams to occur! According to the Internet Crime Complaint Center’s (IC3) 2020 report, non-payment or non-delivery scams cost people more than $265 million. Credit card fraud accounted for another $129 million in losses.

We know they are out there, now we need to ask ourselves:

1.) How do we recognize the scams?

- Scammers are clever; their job is to trick people. If you are buying or selling online, check the individual’s available public profiles such as Facebook, LinkedIn, Twitter, etc. See how long they have had established profiles.

- Urgency is generally a red flag. Unless, of course, you are looking for something to be shipped by Christmas, but that is your urgency, not the seller’s. Suppose a seller needs payment NOW; it’s likely a scam. If it sounds too good to be true, it probably is.

2.) How can we be proactive?

- Utilizing secure forms of payment helps if you do get scammed. PayPal Goods and Services, or a credit card, among other available options, are resources you can go back to if there is an issue, and they will help you resolve it. Never send a wire as a form of payment.

- Track your shipping. Get tracking numbers, set up alerts, and confirm that the item is on the way.

- If you do get a call or email from someone you “know” asking for money or gift cards, hang up and call the person directly on the phone number you have for them. Never send gift cards or codes to a new email address.

- Check your credit card statements often. Bring unknown charges up with the credit card company quickly to stop any further charges and resolve the issue.

At Executive Wealth Management, we want you to BUILD your knowledge on these issues so you can DEFEND yourself in the face of a scam ADVANCING together. All so you can ‘Live with Confidence.’

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on December 10, 2021 to closing price on December 17, 2021

1 Month = closing price on November 17, 2021 to closing price on December 17, 2021

3 Month = closing price on September 17, 2021 to closing price on December 17, 2021

YTD = closing price on December 31, 2020 to closing price on December 17, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.