The third quarter or Q3 earnings season is behind us, and now we are looking forward to the Q4 season. If the latest reporting period taught us anything, it is that the market is becoming less forgiving. Slight misses or a scintilla of negativism in guidance will get your stock price punished. This is a change from the months following the COVID-induced market decline of 2020 when it was only the most egregious mistakes that the market took poorly; every other company just seemed to see their price go up on any small news.

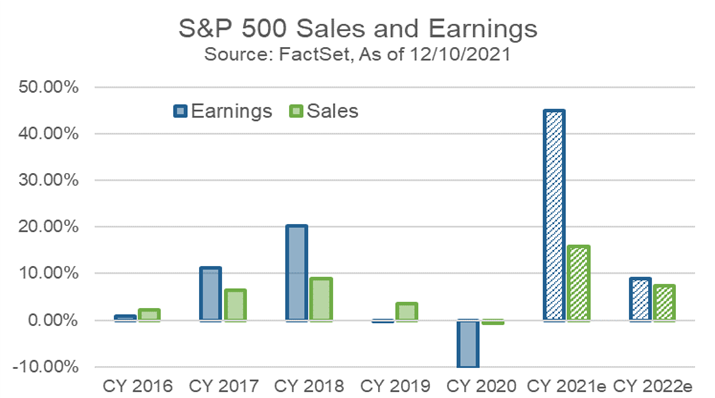

We have pointed out several times in the past that in calendar year 2022 (CY 2022) huge earnings and sales increases along with massive upside surprises will most likely cease to be the norm, as COVID-stricken 2020 will no longer be used as the baseline for year-over-year data points. As seen in the chart above, the estimated forward sales and earnings one-year growth rates are forecast by data provider FactSet to return to the single digits next year (the CY 2022e data columns). We suppose this is the return to normalcy we have all been looking forward to. Remember normal?

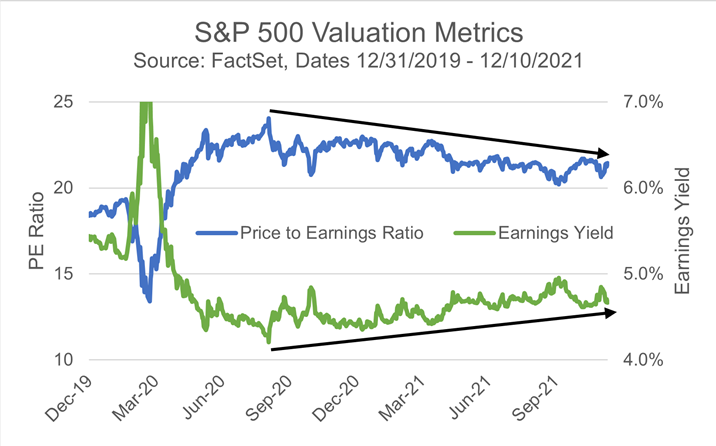

The huge pop in earnings in 2021 (the blue column for CY 2021e in the chart above) has done quite a bit to bring down valuation metrics from their extended ranges during the pandemic. The forward Price-to-Earnings (P/E) ratio of the S&P 500 has fallen from a high over 24 to 21 (see the chart below). All of this while the S&P 500 is +31% over that same time frame. Usually the only way that valuation metrics go down like that is if there is a drop in share price since that is the numerator (or the P in P/E). This has been the the case for some of the most speculative stocks that shot up during the second half of 2020. We saw last week that these speculative stocks, as represented by the ARK Innovation ETF (ticker: ARKK), have actually been in a bear market for the majority of 2021, while the broader market has been chugging higher this year due to the gains in earnings.

As to where the stock market and valuations head next year, we don’t make predictions, but the underlying earnings potential of most companies is still strong. We won’t like it if valuations begin to accelerate to the upside again, yet higher valuations in a vacuum are not themselves a bad sign. Remember those forward valuations were elevated and continued to rise for several years in the 1990s. Valuations and their ranges are non-stationary and should not be used as a determining factor where markets must react if a predetermined valuation level has been breached. However, caution should be exercised if they rapidly trend upwards again.

Model Update

On Wednesday, December 8th, the Fortunatus Equity Dividend model added a new holding in the computer networking hardware industry.

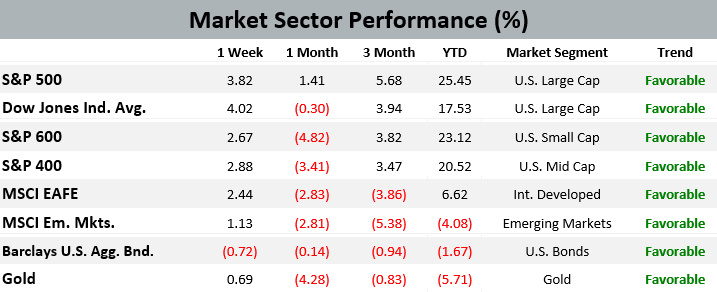

There were no other trades in the Fortunatus models during the week ending on December 11th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly-owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. The data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

The outage at Amazon.com Inc.’s cloud-computing arm left thousands of people in the U.S. without working fridges, roombas and doorbells, highlighting just how reliant people have become on the company as the Internet of Things proliferates across homes.

The opening sentence from a Bloomberg News article by Isabella Steger detailing the ramifications of the severe server problems experienced by Amazon Web Services last Tuesday. Users of Amazon’s voice assistant Alexa found that the service disruption left their smart homes acting very, very dumb.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on December 3, 2021 to closing price on December 10, 2021

1 Month = closing price on November 10, 2021 to closing price on December 10, 2021

3 Month = closing price on September 10, 2021 to closing price on December 10, 2021

YTD = closing price on December 31, 2020 to closing price on December 10, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.

![AdobeStock_456847377 [Converted] AdobeStock_456847377 [Converted]](https://ewmadvisors.org/wp-content/uploads/2021/12/AdobeStock_456847377-Converted.png)