“Software is eating the world,” proclaimed venture capitalist Marc Andreessen in a famous editorial in The Wall Street Journal back in 2011. Mr. Andreessen’s thesis that computer code and the companies that create it would disrupt all traditional industries and market sectors has certainly proven prescient. In fact, some recent business headlines demonstrate how much software is changing one traditional business in particular – the automobile industry.

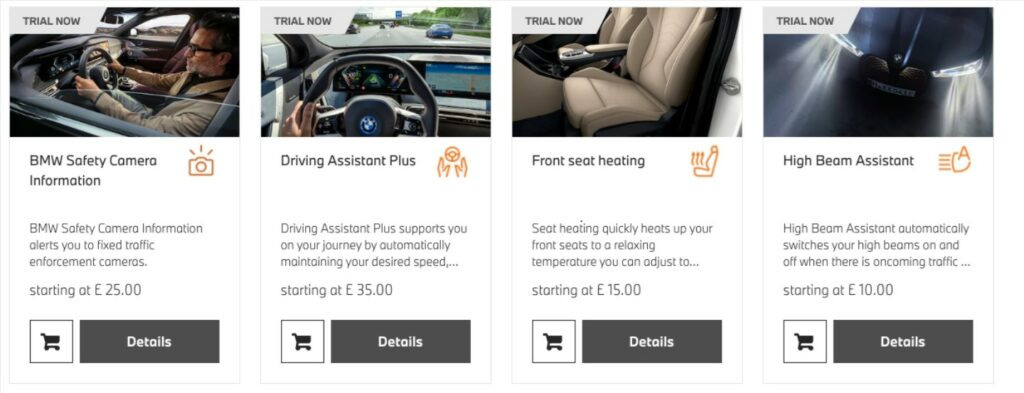

Last week, several news outlets reported that BMW was selling access to heated seats in its cars for around $18 monthly in some major non-US markets – such as South Korea, South Africa, the UK, Germany, and New Zealand. Paying a recurring fee would unlock the software that controls how toasty the driver can make his ride during a cold day. This was just the latest subscription-based feature that BMW had added to its digital store, BMW ConnectedDrive, since 2020, including services like adaptive cruise control, automatic high beams, and the ability to play engine sounds in your car – and you probably thought that just driving the car would produce engine sounds. A small screencap of BMW’s UK digital store and a selection of available subscriptions is shown below:

BMW is not alone in what it calls the automotive “microtransaction” business: Toyota started a subscription service for remote start functionality last year, and Volkswagen has been considering offering autonomous driving for a fee as soon as it figures out exactly how to do it. Car companies around the world desire to replace the discrete, irregular transactions of the past with the recurring revenue of software services. This business strategy, however, has met some pushback in the United States. American consumers have always been willing to pay more for additional hardware on their automobiles, but the idea that access to that hardware has to be incrementally purchased has proved to be very unpopular. Agricultural equipment manufacturer John Deere is facing a class-action lawsuit from farmers for basically having the same subscription model for its machinery. Plaintiffs, in that case, have objected to the company’s software restricting users’ “right to repair” their machines.

An earlier failed attempt by BMW to offer subscription services to American consumers started back in 2016 with yearly user fees for CarPlay, the software that allows an Apple iPhone to interface with a car’s built-in entertainment and information systems. After significant negative user feedback, the service is now offered for free. The importance Apple puts on this piece of car software was demonstrated at its latest Worldwide Developers Conference (WWDC) earlier this June. Apple announced that the next generation of CarPlay will expand beyond infotainment to additional screens throughout the vehicle, and it will also show critical driving data like speed, fuel level, and engine temperature. As shown in the WWDC screencap below, CarPlay would become the driver’s software user interface for the car.

Back in 2014, Apple began working on “Project Titan”, a massive venture aimed at creating a self-driving electric vehicle. The project has been shrouded in mystery and beset with delays, but the company’s recent announcement about CarPlay shows that it believes that controlling the car’s software interface is the most important and most valuable part of any future automotive enterprise. Car manufacturers, like Ford and General Motors, have made no specific public commitments about integrating this new version of CarPlay into their vehicles, while they have been working fervently with Google to develop their own user experience (UX) software systems. No car company wants to be the low-margin automobile maker whose product serves as the hardware substrate for a software company’s money-making user interface. Software may not be eating the automobile industry, but it is certainly gobbling up its share of the profits.

Past performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

There were no trades in EWM Investment Solutions models during the week ending on July 16, 2022. All major equity market sectors are currently in a long-term unfavorable trend, and the Asset Allocation models remain at their lowest possible tactical equity exposures, with domestic stocks favored over international shares.

Quote of the Week

The remarkable thing about Bitcoin isn’t that it’s down from a high of $68,000 to around $21,000. It’s that internet tokens that were conjured into existence less than 15 years ago are still selling for more than $21,000 apiece.

Barron’s columnist Jack Hough commenting last week about the current condition of Bitcoin and the recent decline in the broader cryptocurrency market space.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on July 8, 2022 to closing price on July 15, 2022

1 Month = closing price on June 15, 2022 to closing price on July 15, 2022

3 Month = closing price on April 14, 2022 to closing price on July 15, 2022

YTD = closing price on December 31, 2021 to closing price on July 15, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.