Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

Investors have become uninterested in worrying about downside risks.

Tobias Levkovich, chief U.S. equity strategist at Citigroup, commenting last week about the inability of negative signals from the coronavirus pandemic or the labor market to deter investors’ enthusiasm for the stock market.

Market News

We have taken time to discuss the US Treasury yield curve in the past, but we wanted to take a moment to point out some of the issues currently infecting the broader fixed income market. Due to the pandemic and the intense market constriction earlier this year, the Federal Reserve needed to take action to make sure that there was liquidity in the market. They did an admirable job with that, injecting enough cash into the system to keep the gears of finance moving when everybody else was too scared to take a risk. What they have also done is to destroy (in the short term) the risk/reward interplay in the fixed income markets.

We are watching investors now comfortable with the Fed backstop for bonds move down farther on the risk spectrum in a desperate search for more yield.

We can see in the chart directly above that yields on investment grade US bonds went from 2.84% at the start of this year to 1.82% as of 11/27/2020 (Yield To Worst is the minimum yield that can be received on a bond, assuming no defaults). This is during a period when actual long-term risk to individual issuers has only increased, but yields have fallen -35% giving some investors a false sense of long-term security.

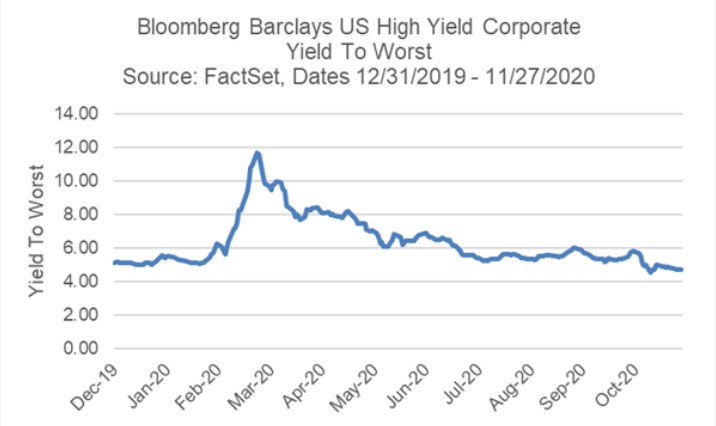

The chart directly above spans the last fifteen years. Looking at the data during the Global Financial Crisis of 2008, it took yields roughly a year to fall back to pre-crisis levels compared to the 2 months it took this year. This phenomenon extends to other sectors of the fixed income market. Junk (or high-yield corporate) bonds are issued by companies that generally have a higher risk of default than bonds issued by investment grade companies. In the chart below, we see that for this market sector things are back to where they started this year in terms of Yield To Worst.

There are deals to be had still in the fixed income market. But be careful because the going-forward risk may not be appropriately reflected in the yield of the bonds that are in the marketplace.

Model Update

For the week ending on November 28th, 2020, there were no changes made to the Fortunatus models. All major equity market sectors are in a long-term favorable trend, and our Asset Allocation models maintain an overweight position in domestic stocks in relation to international shares.

EWM News

This November, there were two big, new additions to the Execution Wealth Management team at the main office in Brighton. Check out their snazzy bios below:

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on November 20, 2020 to closing price on November 27, 2020

1 Month = closing price on October 27, 2020 to closing price on November 27, 2020

3 Month = closing price on August 27, 2020 to closing price on November 27, 2020

YTD = closing price on December 31, 2019 to closing price on November 27, 2020

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.