The increase in inflation brings with it the possibility of lower profit margins for companies on a forward looking basis. Inflation can work in two ways: it can push up the cost of goods sold through higher input prices, or it can push up wages. Both of these have deleterious effects on margins if companies are not able to raise prices fast enough to cover the increase in costs. After the Global Financial Crisis of 2008, margins had been generally stable for the S&P 500 around the 10% – 11% mark. However, since the start of the COVID pandemic, we have seen margins spike up to over 12%. While that may not seem like much from a percentage basis, think of the actual dollar amount the difference entails. In the fourth quarter (Q4) of 2021, S&P 500 companies had sales of roughly $3.7 trillion. If they had increased margins on those sales by 1%, then there would have been roughly $37.5 billion more added to the corporate bottom line quarterly. That is a lot more money that can be used for business expansion or returning capital to shareholders.

In 2021, companies did not see dropping margins even with the significant amount of inflation that we saw through the year. Q1 2022 earnings season has begun in earnest, and we are paying close attention to current margins and company commentaries around their ability to pass price on to consumers. If inflation begins to eat away at margins, then the earning power of companies will begin to erode. If investors are only willing to pay a certain amount for each bit of earnings, then higher inflation could eventually lead to lower equity prices.

This brings us to the next point of “windfall” profits for energy companies. Looking at historical profit margins of energy companies versus the profit margins of the S&P 500 as a whole, we can see there has been a historical disconnect between the two. This phenomenon began during the great fracking boom which started in the 2010s and has continued to this day. Even with oil prices rising in 2021, the energy sector was only able to reach a margin 2.7% less than that of the broad S&P 500 (see the green bars in the chart above). If we are to look at the average margin over the past 10 years (see the chart below), the S&P 500 comes in at 10.1% while the energy finishes at 4.4%, a whopping -5.6% less than the domestic benchmark. We have discussed several times that energy companies are hesitant to explore and develop new sources of oil due to the historical boom and bust cycle of the sector. Examining margins over time paints a good picture of how this happens. Why invest in energy when the returns have just not been there over the last decade?

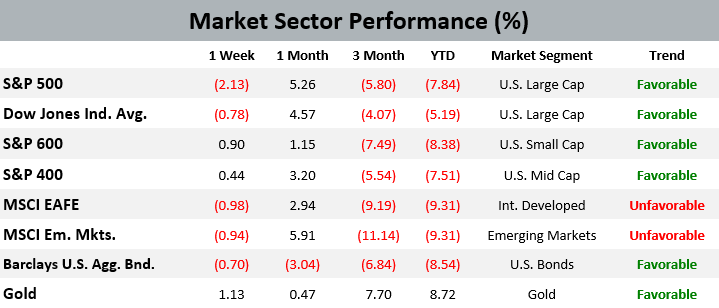

Performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

There were no trades in the EWM Investment Solutions models during the week ending on April 16th, 2022. Domestic equity market sectors still maintain their long-term favorable trend and their overweight position versus international stocks in EWM’s Asset Allocation models.

Quote of the Week

Milwaukee Bucks superstar Giannis Antetokounmpo had more banks than letters in his name before Avenue Capital Group founder Marc Lasry stepped in.

Opening paragraph from Claire Ballentine’s Bloomberg Wealth article on the previous investing habits of the National Basketball Association’s two-time most-valuable player. Mr. Antetokounmpo had placed his considerable NBA earnings into over 50 different bank accounts, each one holding up to the Federal Deposit Insurance Corp.’s coverage limit. Hedge fund manager and Bucks co-owner Marc Lasry advised his young star on a more efficient way to maintain a conservative investment profile.

EWM News

All Executive Wealth Management offices along with the domestic security markets will be closed April, 15th, in observance of Good Friday. We hope all of our clients have a happy Easter and joyous Passover.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on April 8, 2022 to closing price on April 14, 2022

1 Month = closing price on March 14, 2022 to closing price on April 14, 2022

3 Month = closing price on January 14, 2022 to closing price on April 14, 2022

YTD = closing price on December 31, 2021 to closing price on April 14, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.