There seems to be a bifurcation in the minds of the American public. On one level, consumer confidence levels are falling, indicating a feeling that the economy is not doing well. Many are worried about inflation, and rightly so. On the other hand, a record 4.4 million Americans quit their jobs in September. That indicates that people feel that they can get better future work, which would indicate an optimistic feeling about the economy. Retail sales are still up significantly from pre-pandemic levels. We still have over 10 million open jobs left to fill and wages are moving up. As usual, nothing is ever as good or bad as it seems. We are being hit over the head with news of inflation and supply chain constraints constantly, but we forget some of the good things that have happened to offset those challenges.

What is inflationary and what points to disinflation? In the inflationary camp, we have the big one – domestic fiscal policy – as the US has spent bigly and continues to deficit spend. This is just status quo at this point for our country. We saw this after the last crisis, but even more so now. Money supply has gone way up, public debt is at all-time highs, and wages are picking up as there is a labor shortage. Those are a lot of factors stacking up in the inflationary camp, and we have seen that reflected in the Consumer Price Index (CPI) numbers. But there are also forces working for disinflation. Those include consumer demand, which is tapering from pandemic highs. Demographic changes are supporting this trend as we shift more of the population out of working age and into retirement (which COVID accelerated) which comes generally with a longer-term decline in consumption. The velocity of money is another disinflationary indicator. Just having more money does not mean that that money will get spent. Lasting inflation comes when more money is passed around at a faster rate. Currently, the velocity of money is at all time lows. The final disinflationary factor is the growth of technology, as automation and algorithms advance, prices are pushed down.

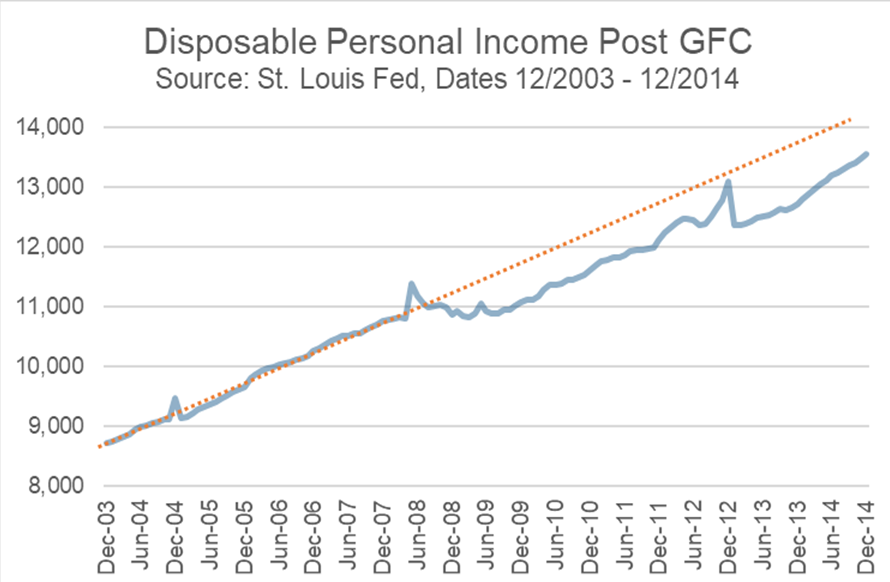

The long run is always what is important. In the long run, inflation will most likely return to its targeted rate once the supply issues are over and the excess demand from the stimulus checks is finished working its way through the system. The question comes down to are we currently in a better position to handle inflation than after the Global Financial Crisis (GFC) of 2008-2009? From a personal income standpoint, we most certainly are. Any inflation was damaging coming out of the GFC as incomes had fallen dramatically. The chart directly below shows that disposable incomes had not return to the pre-GFC trendline (orange dotted ling) even six years after the start of the crisis. Strong inflationary pressures in this period would have ground the economy to a halt.

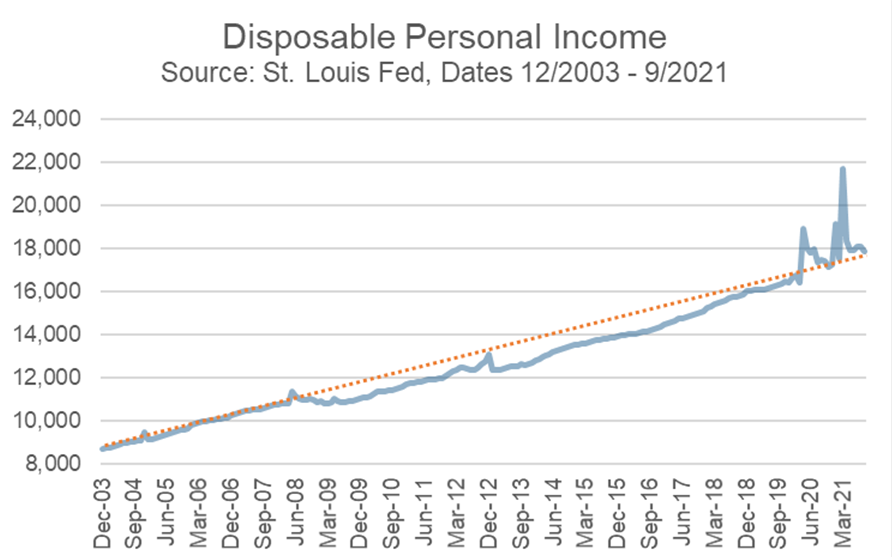

However, that isn’t our current situation. The chart below illustrates that in the last year incomes have returned to the pre-GFC slope of increase. The printing of money that went along with the COVID crisis allowed our economy to rebound quickly. This is not to say that we desire inflation, but that this current situation is mild compared to what could be going wrong right now had there not been a significant influx of cash over the last year.

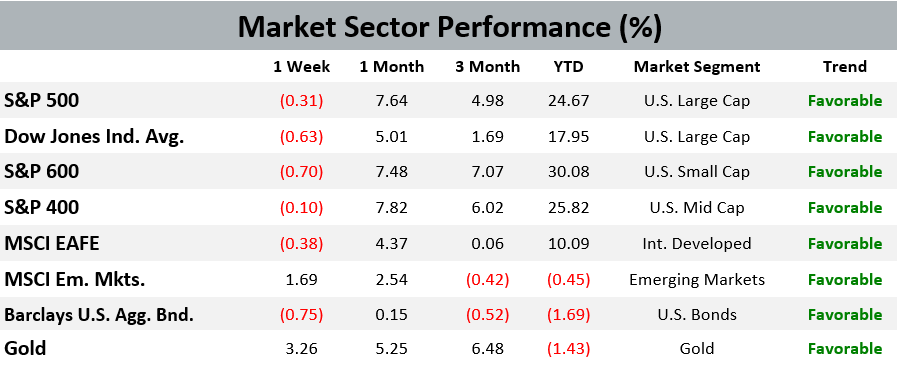

Finally, how does this affect your investments. So far, having an overweight allocation to equities and being shorter duration in fixed income than your benchmark has been largely beneficial and has allowed you to mitigate the effects of inflation. The equity market in particular has not struggled with this bout of inflation and has in fact has made significant gains this year even when inflation is rising.

Model Update

There were no trades in the Fortunatus models during the week ending on November 13th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposures with domestic stocks favored over international shares.

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly-owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. The data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

I am befuddled by people pointing at higher than expected inflation prints as an evidence that the inflation is not transitory. “Transitory” is a statement about the persistence of inflation in time, not about its magnitude.

Alex Gurevich, founder and Chief Investment Officer of HonTe Investments, commenting on the interpretation of inflation data in a recent tweet.

EWM News

The EWM website has a wealth of resources to help clients meet their financial planning goals. We’ve included links to a couple of especially relevant articles written by our advisors:

As we wrap up the 2021 year, it’s a good time to check off those planning items that you meant to get around to doing. As a financial advisor at Executive Wealth Management, we talk about various topics with our clients throughout the year, and the following are a few of the year-end financial planning conversations we are having that you should consider. Read more …

Congress is debating tax law, and change is coming. Some changes will happen automatically. That is the one certainty that I can give to any estate planning client – tax law will change. Read more …

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on November 5, 2021 to closing price on November 12, 2021

1 Month = closing price on October 12, 2021 to closing price on November 12, 2021

3 Month = closing price on August 12, 2021 to closing price on November 12, 2021

YTD = closing price on December 31, 2020 to closing price on November 12, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.