The narrative being spun in the financial media right now is that inflation is going to cause the Federal Reserve to raise interest rates sooner rather than later and that these rate hikes will help to curtail the inflation situation that we have been seeing develop over the summer. The Fed still says inflation is transitory but has not backed itself into a corner by defining what their version of transitory means. There is a danger raising rates too soon. That danger is that it slows the pace of the recovery.

The Fed cannot do anything to alleviate the supply chain issues that are causing the inflationary pressures. And if they raise rates, they could turn a supply issue into a demand issue quickly which could torpedo the economy. As of now, the market is pricing in at least 2 rate hikes by the end of 2022, but just because that is priced in does not mean it will happen.

We should also look at what the Chinese government is currently doing to control its internal real estate bubble and contain the damage done by debt-ridden property developer Evergrande. 20% of the world steel production is for Chinese consumption; and of that, a sizeable portion goes toward housing production. With the Evergrande debacle, we are already seeing steel prices begin to turn back south, off -44% from recent highs. Long-term, China tackling their housing affordability problems could be deflationary for the world economy.

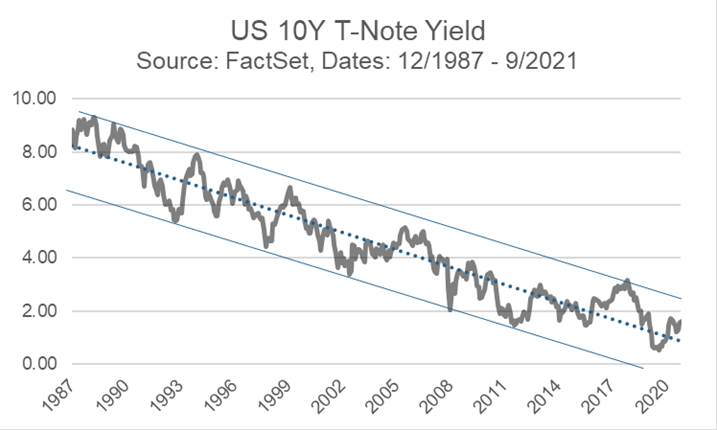

We have said in the past that there is no such thing as “normal” rates. Rates, valuations, and other measuring sticks in the financial world are extremely market regime dependent. So the idea that we have to get back to “normal” rates depends on what that actually means and the reality is that it means only something to the commentator who is pontificating at that moment. Looking at the rate chart below of the U.S. 10-year Treasury note confirms the point, as one cannot point to a “normal” rate anywhere on the chart.

Consensus is in the rising rates camp and sometimes the market likes to punish consensus more than it likes to reward it.

Model Update

On Wednesday, October 20th, the Fortunatus Emerging Growth Companies Equity model added two new holdings: a company involved in developing the charging infrastructure for electric vehicles and a company providing the digital infrastructure for the cryptoeconomy.

On Thursday, October 21st, the Fortunatus Alternative Asset ETF Opportunity model took a small position in a fund that has long exposure to Bitcoin.

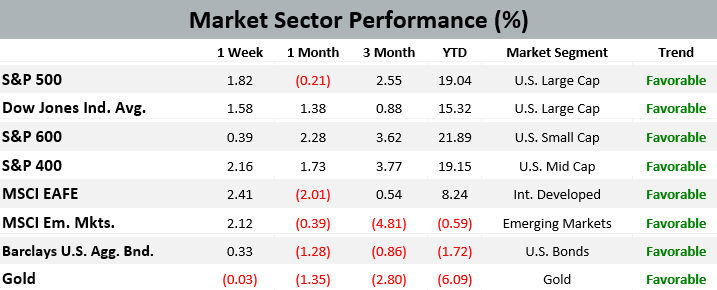

There were no other trades in the Fortunatus models during the week ending on October 23rd, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

Facebook is planning to change its company name next week to reflect its focus on building the metaverse, according to a source with direct knowledge of the matter.

From an article by The Verge’s Alex Heath. The social media giant’s coming name change is expected to be announced during the company’s annual Connect conference on October 28th. The metaverse is a nebulous concept that refers to a potential computer network of persistent and immersive virtual worlds that has become a key interest of CEO Mark Zuckerberg over the last couple of years.

On a Lighter Note

Can you smell a smile? Color a feeling? Dance a sunset? I don’t know, maybe. But one thing you can definitely do now thanks to scientists in Japan is weigh a taste – or maybe it’s taste a weight.

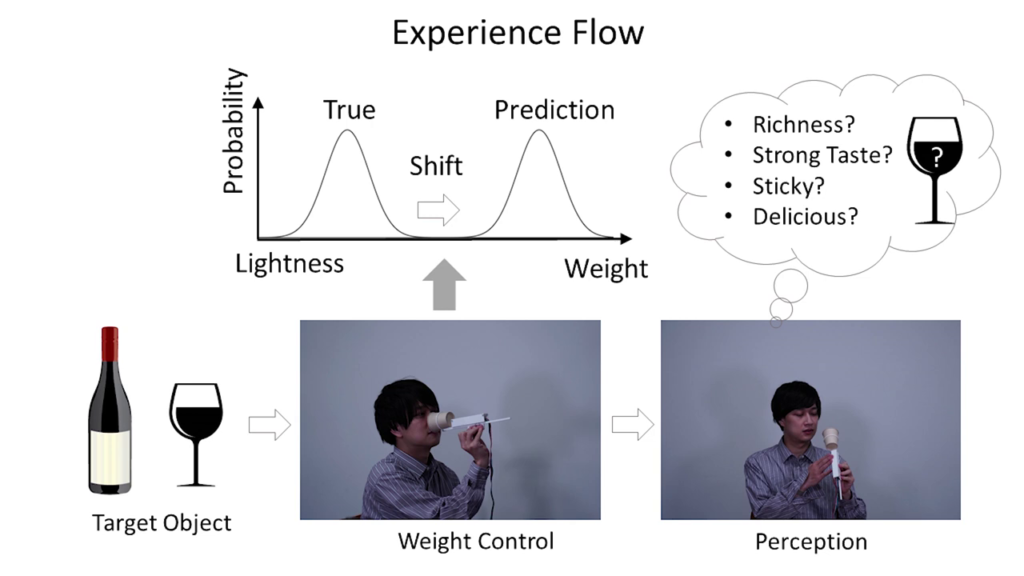

Anyways, people have known for centuries that the drinking experience can be altered by adjusting a liquid’s look and smell. Researchers at the University of Tokyo wondered if modifying a fluid’s weight might also change its taste. Drinking could become a much more enjoyable activity if they could just find a way to add more ballast to the beverage.

Early attempts at calibrating a drink’s bulk by pouring sand into its cup left most test subjects with a disagreeable gritty aftertaste. However, researchers eventually hit upon the idea of a motorized sliding weight mechanism attached to the cup that shifts the drink’s center of gravity as the user tilts the cup. The contraption left test drinkers with a befuddling if somewhat positive experience. This liberation of libations from the confines of one single weight promises to revolutionize the refreshment industry. Of course, there are some people who doubt the value of this line of inquiry; but, as you can see from the sample below, the research team has cobbled together a nice little PowerPoint presentation with bell curves and flow charts so the science seems to be legit.

Is research like this the path to madness? Possibly. But at least now all those Negative Nellies who always see a glass as half-empty will feel that the glass is half-full.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on October 15, 2021 to closing price on October 22, 2021

1 Month = closing price on September 22, 2021 to closing price on October 22, 2021

3 Month = closing price on July 22, 2021 to closing price on October 22, 2021

YTD = closing price on December 31, 2020 to closing price on October 22, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.