Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

Excessive optimism, euphoria, complacency, speculative fervor, whatever terminology you want to use, absolutely represents a risk. But in and of itself, it doesn’t tell you anything about when there’s going to be that spark that kind of turns the market in the opposite direction.

Liz Ann Sonders, chief investment strategist at Charles Schwab, discussing the recent speculative craze around digital collectibles called non-fungible tokens (NFTs) and what it says about the broader financial markets.

Market News

Demographics can be a tricky subject. There is definitely a science in there somewhere and over the long run they tend to be predictive. But as Keynes said “In the long run we are all dead”. Predicting change over the course of a month is very difficult, let alone 10 to 20 years. And the demographic effects on the stock market over the short and intermediate term are non-predictive. We know Boomers are retiring and coming behind them is the smaller birth cohort (some say the best cohort) of Gen X. The demographic predictions from 10 years ago have not quite played out the way that many thought they would as more Boomers are working deep into retirement than previously thought, many not out of necessity but out of desire. This is good for the economy, as it increases the labor input that is one of the key drivers of potential economic growth. However, the overall Total Fertility Rate in the US is also declining more than was predicted a decade ago.

One of the demographic ideas early in the pandemic was that it would produce a renewed baby boom. Many have heard the apocryphal stories of baby booms following the great blackouts of 1965 and 2003. So the thought was that having people stuck in their homes would surely lead to more births. Wiser people predicted that the fear of the unknown and instability surrounding COVID would lead to less births. The early data indicates that the pessimists are winning the debate. CBS News reported that in 2020 after 32 states have reported their birth rates, there has been a decline of -4.4% in births year-over- year. This is more troubling when we realize that births have a lag time of roughly 40 weeks. This means that much of the 2020 decline in birth rates could be the result of a decline in 2019 fertility with a final drop in December that reflects the difficulties associated with the virus.

A very small sample size has seen the California birth rate in January of 2021 declining -19% from the pre-pandemic 2020 January level. This is concerning on a long term basis. Of course the most frustrating part of this type of study is that we have to wait 12 more months to see if those rates will come back up. The problem is that births may only come back up to trend, and the trend was falling, for a long time.

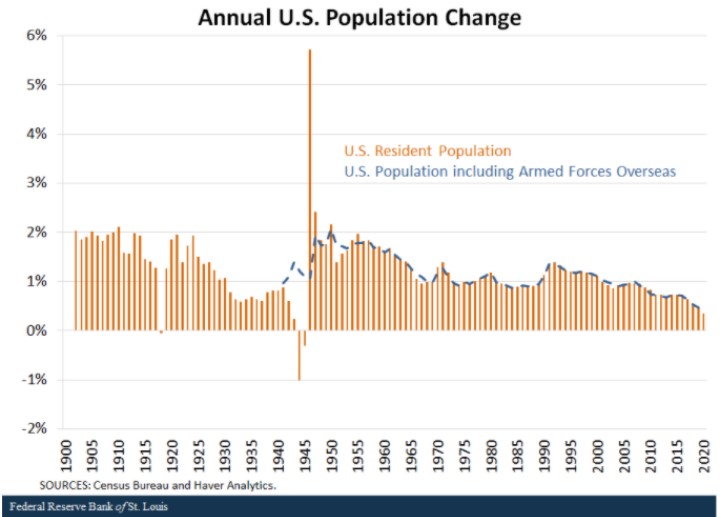

According to the US Census Bureau the increase in the US population for 2020 would be just 0.35%. That would be the lowest increase since 1900 outside of wartime. We could count this as anomalous due to COVID, but it fits in with the trend as seen on the chart below. If the population does not grow, we need greater technological advances than we have seen in the past for the economy to keep growing.

Model Update

There were no trades in the Fortunatus models during the week ending on March 20th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

EWM News

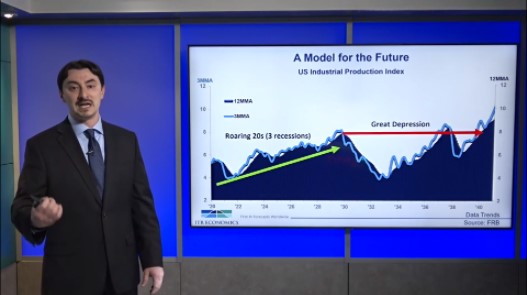

For those clients who were unable to view our most recent Economic Forum in real time on Monday, March 15, we are pleased to provide you with a video link of the event below. We found it highly informative and hope you will as well:

Lighter Note

Roses are red

Violets are blue,

Sugar is sweet,

And so are you

This poem is a fraud. Not the last two lines of course, we’re sure that all of our clients are as sweet as sugar. No, the lie is that violets are blue, when they are most definitely purple in color. This bit of poetic fibbery has been perpetrated for centuries, going back at least as far as Edmund Spenser’s The Faerie Queene from 1590. The reason most often given for this treachery is that there are no words that rhyme with “purple”, but we believe that lyricists just aren’t trying hard enough. A thorough search of the dark recesses of an unabridged dictionary produces two candidates of Scottish origin: curple ( a horse’s backside) and hirple ( a painful limp). Now, we are free to bepurple our poetry and versify without the lie:

| Roses are red Violets are purple, Of course I love you Don’t be a curple. | Roses are red Violets are purple, Missing you hurts Like a really bad hirple. |

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on March 12, 2021 to closing price on March 19, 2021

1 Month = closing price on February 19, 2021 to closing price on March 19, 2021

3 Month = closing price on December 18, 2020 to closing price on March 19, 2021

YTD = closing price on December 31, 2020 to closing price on March 19, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.