Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

Both your heart and your principal will be protected forever.

The English-translated lyrics of the latest song from Koko-chan, the fixed-income mascot of Japan’s Finance Ministry. In an attempt to get younger Japanese to buy their country’s debt, the agency created a cutesy cartoon character who serenades youthful concert-goers on the virtues of purchasing low-yielding but safe financial instruments. Her latest hit is featured below:

Market News

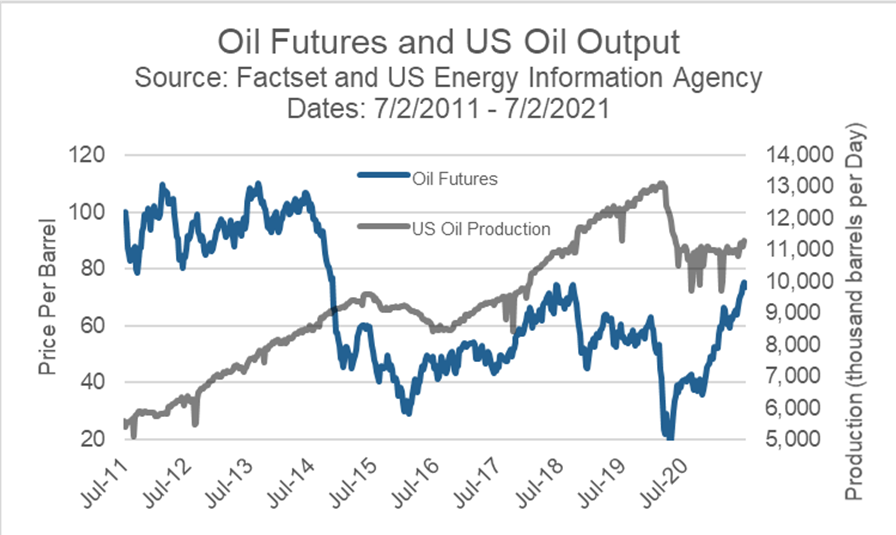

Those of us traveling by car this summer have been hit with the normal rise in petrol prices at the pump. This can play into those inflation fears that many have been harboring since the beginning of 2021. Last year saw oil futures reach an impossibly low price that was the result of a compounding effect of the COVID lockdowns shutting off most demand and a disagreement between OPEC and Russia that did not allow for the world economy to scale production down fast enough. That confluence of events saw a supply glut that brought futures prices below $20 per barrel for a short time. With prices so low, a natural slashing of supply worldwide was in order and it is something that we saw happen. The chart below is specific to the US as our pumps are more market driven and price sensitive than other international markets.

For U.S. oil frackers to be profitable the price per barrel of oil needs to be roughly $40 according to data provided by Bloomberg. So the dip below $20 was painful, and we saw plenty of bankruptcies for energy companies last year. This is part of the boom and bust cycle that is a natural part of a market segment that is extremely high risk/high reward. They did not make an entire 80s soap opera about oil tycoons for no reason. That price drop left slack in the US oil output in addition to the international slack waiting for prices

to move above the profitable range and stay there long enough to ensure not restarting production on unprofitable terms. In the US, we are still -14% off the all time high for oil production. With prices rising back to levels not seen since 2018 at over $70 per barrel, we have seen an uptick in US production for the first time since the lockdowns began. Couple this with the OPEC increases in supply and prices cannot go vertical for very long, and there will be some price correction and an equilibrium will be found eventually.

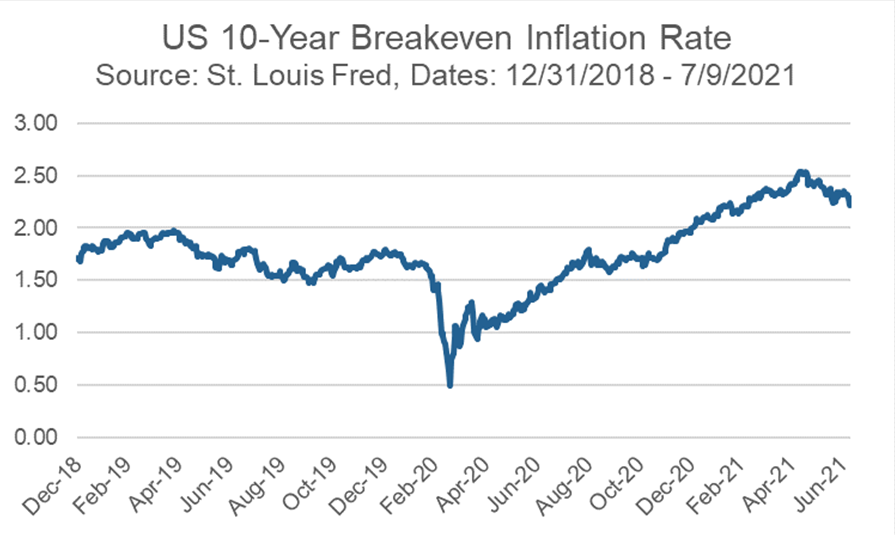

We talk about oil prices because we still see inflation fears running around the internet and rising prices at the pump are often cited as proof positive that inflation is here to stay. It is easily forgotten that oil is not a direct contributor to the core inflation metric used by the Federal Reserve even though we do feel it in our pocket book. Checking in on the fixed income market shows that inflation expectations peaked in April. Below is a chart of the breakeven inflation rate that is implied in the bond markets. Inflation expectations in the bond markets are very important as inflation can eat away at returns there faster than in other markets

since generally the cash flows from the bonds your own don’t adjust for inflation expectations. You can see inflation expectations rise significantly from April 2020-April 2021. Since that point we have seen the market peak and begin to decline. Is this a perfect indicator of future inflation? Of course it is not, but we are seeing market sentiment toward continually rising inflation break down just as the media has picked up on the rising theme and driving it home with great regularity. Where inflation and oil go from here are still to be seen, but we are keeping our eyes open on the trends in the marketplace and make reactions as we see need for them.

Model Update

There were no trades in the Fortunatus models during the week ending on July 10th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

On a Lighter Note

Cancel culture has been a big topic in the news lately with many people concerned that they will be expunged from polite society for the slightest transgression. Various groups are blamed for starting the canceling; and those groups, in turn, blame their accusers. Well, this section always tries to unite instead of divide, and when it comes to the origins of cancel culture we believe that we all have one true common enemy — algebra homework.

On the left, we have a standard algebra problem with solution. Notice that at the start of the problem, the 2 is just minding its own business, participating in both the left- and right-hand side of the equation, getting both points of view. However, the overlords of algebra won’t allow such open-mindedness and demand that we must cancel the number, sending it back to the anonymity of the number line before we can arrive at a solution.

Even simple fractions aren’t immune to this fixation with cancellation, as we see in the problem below. The 6 was just seeing what life was like on both the top and the bottom right before it was cancelled. Its attempt at impartiality was brutally rejected by the rules of algebra.

It is these lessons that we learn from our high school homework that ultimately divide us and subtract from our mental well-being, reducing our society to the lowest common denominator. For it’s not just the math we do in life that haunts us, but also the aftermath.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on July 2, 2021 to closing price on July 9, 2021

1 Month = closing price on June 9, 2021 to closing price on July 9, 2021

3 Month = closing price on April 9, 2021 to closing price on July 9, 2021

YTD = closing price on December 31, 2020 to closing price on July 9, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.