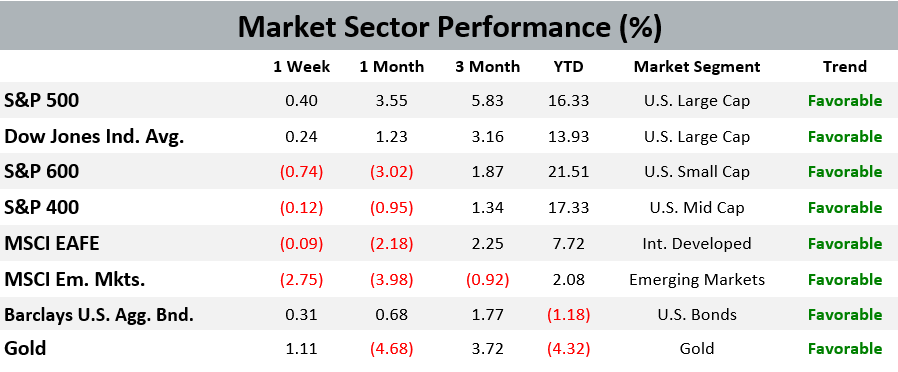

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

Godzilla vs. Kong marked the return of Americans to the movies. The monster mashup, from Warner Brothers and Legendary Pictures, sold $32 million in tickets over Easter weekend and $48.5 million in its first five days, for an international total of $285 million, the best movie opening since March 2020.

Al Root of Barron’s commenting about the first, tepid signs of a global return to the movie theatres.

Market News

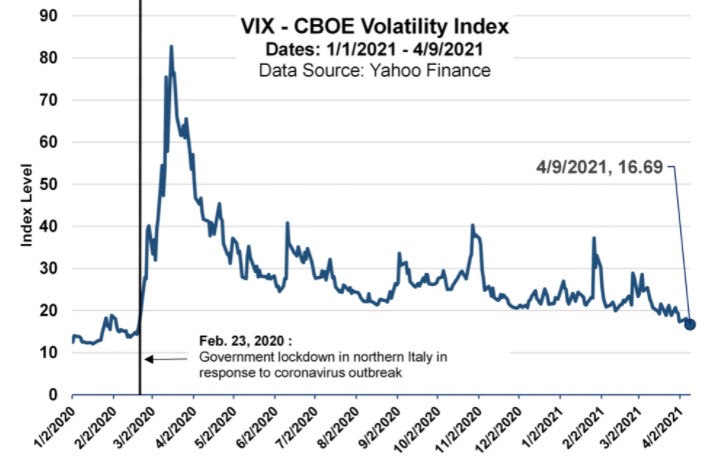

An expectation-smashing jobs report for March and the impressive pace of vaccinations both helped bolster market enthusiasm, pushing the S&P 500 to a new all-time high by market close on Friday. A broad selection of qualitative sentiment gauges continue to indicate a significantly optimistic financial environment. In our previous newsletter, we mentioned the 37-year high registered in a closely watched survey of manufacturing managers, and last week, the traditional “fear gauge” of Wall Street – the Chicago Board Options Exchange’s (CBOE) Volatility Index – has fallen back to pre-pandemic levels. More commonly known as the “VIX”, this index is calculated from the prices of near-term options on the S&P 500 and can be used to measure the market’s expectation of short-term volatility in the benchmark index. The higher the VIX index level, the greater the expectation, or fear, of market volatility.

The VIX was at 17.1 before the first coronavirus-induced government lockdown outside of China was implemented on February 23, 2020, in northern Italy. It had not fallen back below that level until last week, finishing on Friday at 16.69. However, increasing serenity about the stability of the S&P 500 can be taken as a bearish signal, and many fear that much of the current positivity about the post-pandemic economy has already been baked into the forward-looking stock market. What can help propel stock prices upward in the near future?

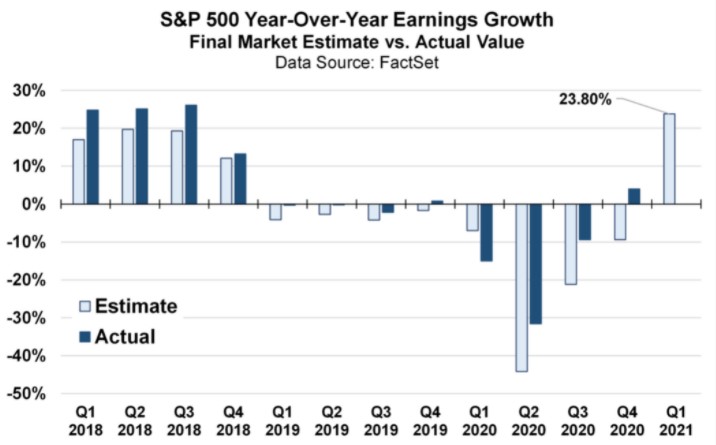

To this point, some cynics will use the financial acronym “TINA” – There Is No Alternative. Extremely low yields on fixed income securities make equities the only option for many investors looking for returns. But on a more traditional basis, stock prices are moved by companies’ earnings growth, and this Wednesday will officially start the first quarter (Q1) 2021 earnings season when the major investment banks release their reports before the stock market open. Corporate financial data is often measured on a year-over-year basis, and we have mentioned in the past how the shutdown of global commerce during the pandemic lockdowns in 2020 will wildly distort these numbers in 2021.

The chart above shows that according to data provider FactSet, market analysts are predicting significant growth in earnings for companies in the S&P 500 last quarter since the base line of the comparison occurred during the start of lockdowns. Thus, it is possible we could see headlines about record-breaking earnings growth over the next couple of weeks still receive a negative response from investors.

Model Update

There were no trades in the Fortunatus models during the week ending on April 10th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on April 1, 2021 to closing price on April 9, 2021

1 Month = closing price on March 9, 2021 to closing price on April 9, 2021

3 Month = closing price on January 8, 2021 to closing price on April 9, 2021

YTD = closing price on December 31, 2020 to closing price on April 9, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.