Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

| Bitcoin: the ultimate inflation hedge, cannot be manipulated, independent of traditional finance and central bankers. Also Bitcoin: A CEO tweeted something negative about us so now we must die Bloomberg financial journalist Tracy Alloway summarizing in a tweet the highs and lows felt by Bitcoin enthusiasts last week as Tesla CEO Elon Musk announced on Twitter that his company will stop accepting the fashionable cryptocurrency for car purchases, citing environmental concerns. |

Market News

Last week’s stock price excitability was caused in large part by the latest reading of the Consumer Price Index (CPI), a closely watched inflation gauge. According to the U.S. Bureau of Labor Statistics, prices rose 0.8% in April – more than quadrupling market expectations. Concerns that this sudden increase in inflationary pressures would cause the Federal Reserve to adjust its accommodative monetary policy helped reduce share prices, but stock were able to gain back some territory by the end of the week. We have mentioned previously in this newsletter that the peculiarity of 2020 would distort economic data through 2021 leaving analysts to expect the unexpected. Two weeks ago, the April jobs report missed forecasts by the biggest margin on record. Last week, inflation made an unexpected ascent. “There is unprecedented volatility in the [economic] numbers, ” wrote Deutsche Bank macro strategist Alan Ruskin on Friday; and, unfortunately, that volatility can spill over into the financial markets.

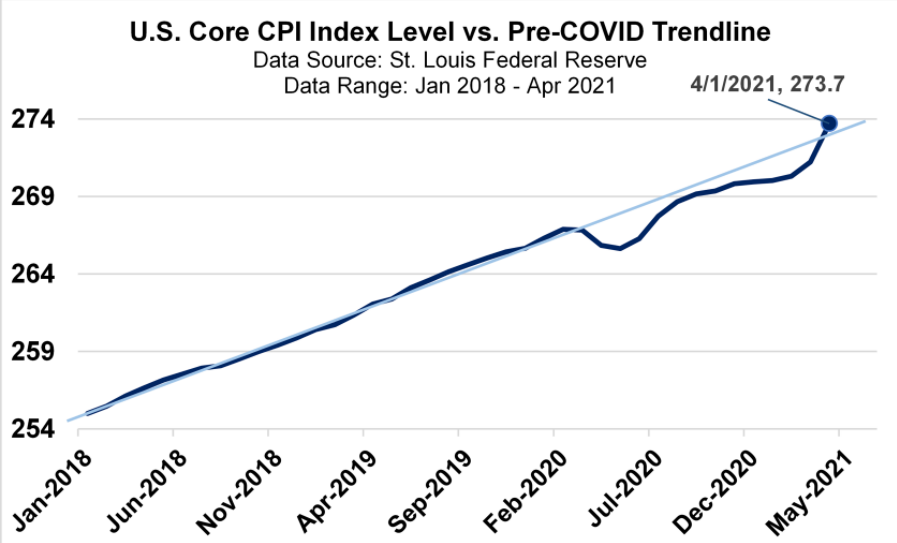

So what should we make of the inflationary data? Well, the numbers may not be as ominous as they first appear. If you look at the U.S. Core CPI Index level, which excludes the volatile food and energy sectors, then even with April’s surprising surge in prices, the index is just slightly above its plodding pre-pandemic pace (see chart above). Fed Chairman Jerome Powell labeled the data change as “transitory”, and that it should fade away as the bursts of reopening energy dissipate.

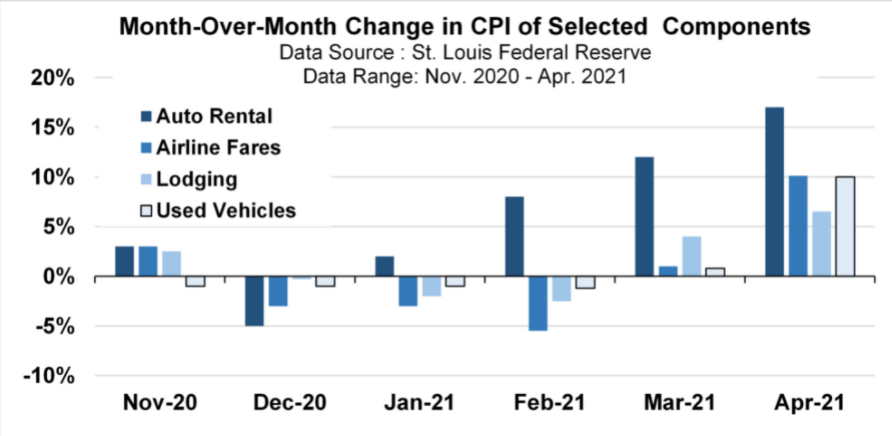

The global shortage in automobiles, caused in large part by the supply crunch in semiconductors needed for the new cars’ electronics, had a significant influence on the inflationary spike. Increasing travel demands caused auto rentals and used vehicles to have their largest monthly price increases in over seventy years last April. The chart below shows that a few select COVID-sensitive components of the CPI had a very outsized impact on the 0.8% gain in prices last month. These fluctuations should diminish as commerce starts to return to normal this summer.

This doesn’t mean that inflation can’t become the long-term problem that many grocery shoppers, home buyers, and consumers fear. However, as far as equity investors are concerned, last week’s data, by itself, is not enough to cause the central bank to adjust their interest rate plans. Michael Pearce, senior U.S. economist at Capital Economics, commented about the data, “We doubt this report will change Fed officials’ view that those pressures are ‘largely transitory’. It’s just that there’s a lot more ‘transitory’ than they were expecting.”

Model Update

On Monday, May 10th, the Fortunatus Alternative Asset ETF Opportunity model added a new fund that seeks to hedge the risk of rising inflation. The remaining holdings were re-balanced to properly position the commodity and gold holdings.

On Thursday, May 13th, the fixed income portion of the Fortunatus Asset Allocation models adjusted its yield curve exposures so that its duration is closer to its benchmark. These models remain near their maximum allowable equity allocations with domestic stocks favored over international shares.

On a Lighter Note

Et tu, Brute?

(English Translation: You too, Brutus?)

Those were the last words of Julius Caesar according to William Shakespeare. However, neither contemporary chroniclers nor later historians have agreed about what actually was the parting shot from the famous Roman general and statesman as he was stabbed to death on the Senate floor in 44 BC. Some of the top contenders for closing comments include:

- Never forget the croutons

- Pizza! Pizza!

- Ouch.

Nevertheless, new groundbreaking research indicates that we shouldn’t see Caesar’s assassination as the outcome from a dispute between political parties, but rather as the outcome from a dispute at a party of politicians. On that fateful day, legislators had arrived at the Senate to celebrate Ides of March Madness, and they had ordered takeout from a local sports tavern for the occasion. When a heated argument arose over the partition of the appetizer sampler plate, Julius demanded, “Render unto Caesar the wings that are Caesar’s.” His fellow partygoers were aghast at this etiquette faux pas, leading to a scuffle and a very one-sided knife fight.

Would Caesar have avoided assassination if just accepted the platter of jalapeno poppers?

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on May 7, 2021 to closing price on May 14, 2021

1 Month = closing price on April 14, 2021 to closing price on May 14, 2021

3 Month = closing price on February 12, 2021 to closing price on May 14, 2021

YTD = closing price on December 31, 2020 to closing price on May 14, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.