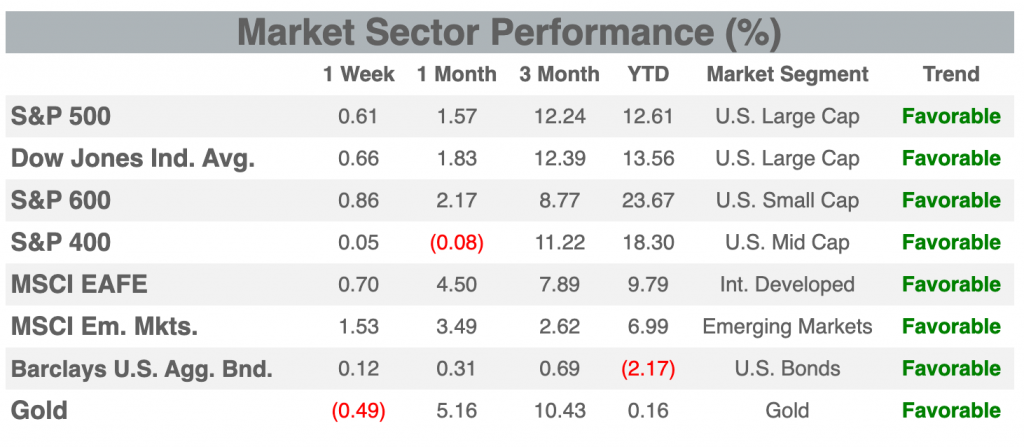

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

We believe that the recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last … Under the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.

A very blunt, bold-typed warning to potential investors from AMC Entertainment Holdings, Inc., in their latest equity offering prospectus filed with the SEC last Thursday. The once moribund movie theater chain has seen their stock price go on a roller-coater ride in 2021 as AMC has become the new “King of Internet Meme Stocks”.

Market News

Natura non facit saltus (“Nature does not make jumps.”) is a famous principle of the 17th-century German mathematician and co-creator of calculus, Gottfried Leibniz. The quote is part philosophical statement that all change is gradual and part admission that humanity can find sudden transitions unnatural. Well, if anything ever caused the global economy to jump it was COVID-19. International commerce was shut down quickly in early 2020, and attempts to reopen for business in 2021 are moving fast. Flipping an economic on-off switch can be discombobulating for employees, business owners, and market analysts. Supply chains are entangled – delivery times for materials to U.S. manufacturers are the longest in 35 years. The labor market has fallen out of sync – employers worry about worker shortages but labor force participation actually declined in the latest jobs report.

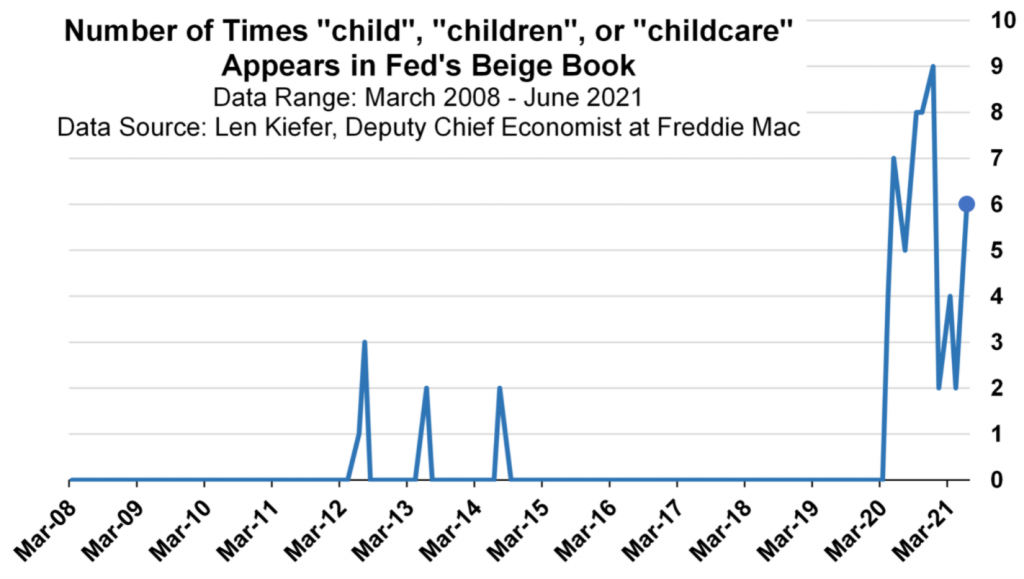

One of the biggest impediments to the labor market correcting is the increased burden on working parents since the lockdowns began. These hardships have been noted in the Federal Reserve’s Beige Book, a brief qualitative summary of current economic conditions and risk factors issued 8 times a year by the U.S. central bank. Len Kiefer, Deputy Chief Economist at Freddie Mac, did a data analysis of the Fed’s wording in these reports from the most recent Beige Book released last week to the spring of 2008. He noted that the words “child”, “children”, or “childcare” have been consistently mentioned in the texts since April 2020, while rarely coming up before the lockdowns (see chart below):

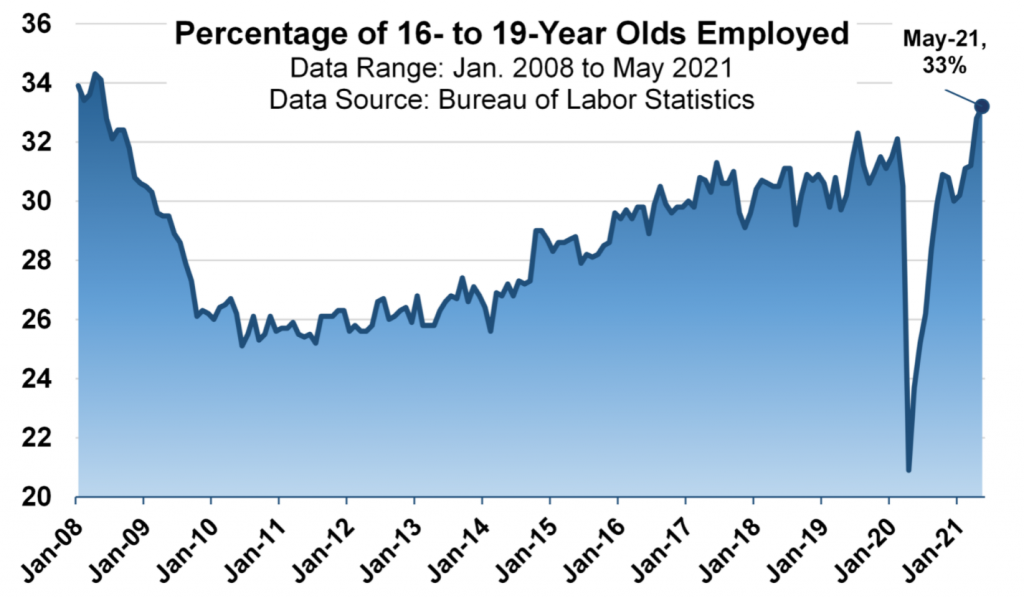

While some segments of the labor force struggle to return to their previous level of employment, other groups have been pulled into the job market in even greater numbers. The percentage of teenagers in the labor force has not only surpassed the 2020 pre-pandemic levels, it is at its highest level in over 12 years according to the latest data from the Bureau of Labor Statistics (see the chart below):

With several states ending emergency unemployment benefits this month, there should be even more churn in the labor markets. How soon we can approach a “normal” labor market is uncertain.

Concerns that this jostling over jobs along with rising prices and increased government spending could lead to an extended period of increasing inflation are common. Addressing those concerns, Federico S. Mandelman of the Federal Reserve Bank of Atlanta published a report last week detailing the parallels between our current situation and another sudden “jump” in the U.S. economy – the aftermath of World War II. Similar to now, there was a big increase in government debt helped by Fed bond purchases and a population with a large pent-up demand for goods. The significant increase in money velocity (the rate at which money is exchanged) as consumers where freed from war rationing did lead to a spike in inflation, but it was transitory. The economy was able to quickly stabilize even with the massive adjustment in the labor force due to all the returning troops.

So it is natural to be concerned about jumps in the economic system, but we have landed on our feet before.

Model Updates

On Tuesday, June 1st, the Fortunatus ETF Opportunity models underwent their monthly relative strength rotations. The Global model reduced its allocation to domestic mid- and small-cap stocks so that it could add one fund featuring European equities and another fund focused on international frontier markets.

The remaining Fortunatus models were unchanged during the week ending on June 5th, 2021; and the major equity market sectors maintain their long-term favorable trends.

On A Lighter Note

Summer is traditionally the season of re-runs, and with over five years of episodes, we decided now was the time to strike a syndication deal to allow our readers to re-visit their favorite (or least favorite) Lighter Note topics. The green button below takes you to our landing page with links to every Protactical with an “On A Lighter Note” segment. Feel free to peruse the whole panoply of poorly executed punnery at your leisure:

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on May 28, 2021 to closing price on June 4, 2021

1 Month = closing price on May 4, 2021 to closing price on June 4, 2021

3 Month = closing price on March 4, 2021 to closing price on June 4, 2021

YTD = closing price on December 31, 2020 to closing price on June 4, 2021All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.