For two weeks, participants in the financial markets have belabored the definition of “recession,” so it seems only fitting that the actual labor market would give us the latest economic data to dissect. On Friday, the Bureau of Labor Statistics reported that the U.S. added 528,000 jobs in July, more than double the average analyst prediction; and the broadest measure of unemployment, the U-6 rate, remained at its lowest level since the data series’ inception in 1994. Also, average hourly earnings for employees rose 0.5% in July, marking the third straight month of acceleration in wage gains.

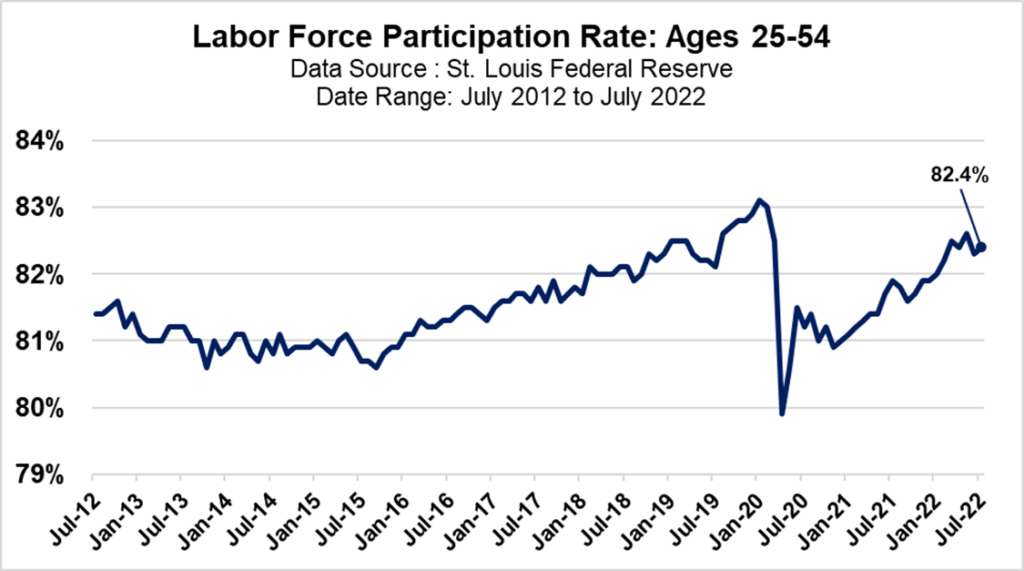

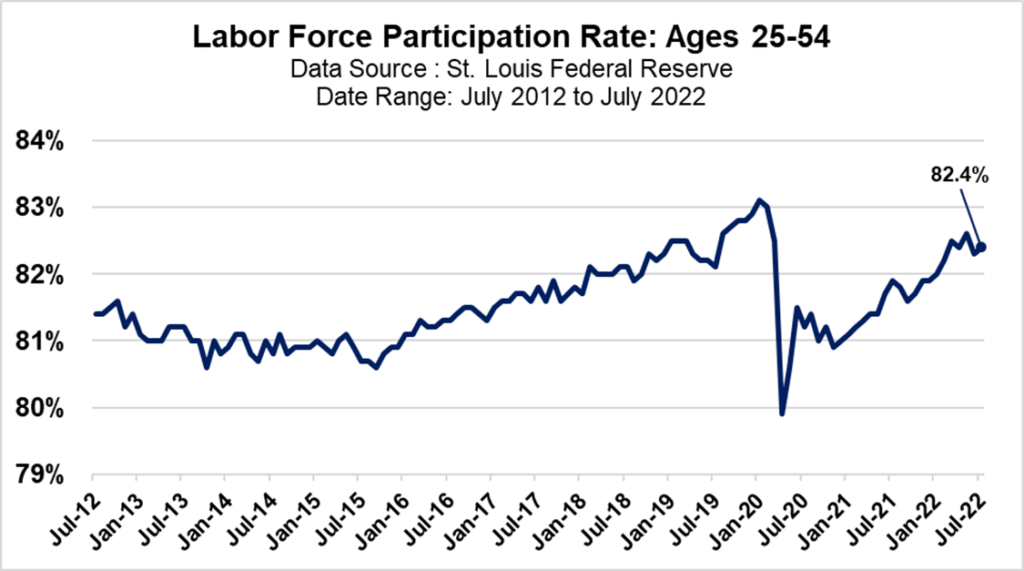

One bearish signal in the jobs report repeated by many commentators was the slight drop in the official Labor Force Participation Rate last month to 62.1%, which is significantly lower than the pre-COVID number of 63.4%, which itself was significantly lower than the participation rates during the 1980s through the early 2000s. However, using this number to gauge the American public’s willingness to work can be misleading, as the domestic labor pool has made some demographic changes throughout the years. The official Labor Force Participation Rate looks at the workforce of people 16 and older, but the increase in college attendance amongst younger people and the large cohort of baby boomers entering retirement age ensure that there are large groups at both ends of the current labor pool that have rather tenuous attachments to the job market. If we look just at people in the prime working ages (25-54), the participation rate actually went up last month to 82.4%, and, while it remains below its January 2020 pre-COVID level, looking at the graph below shows that it is higher than its average level over the last 10 years.

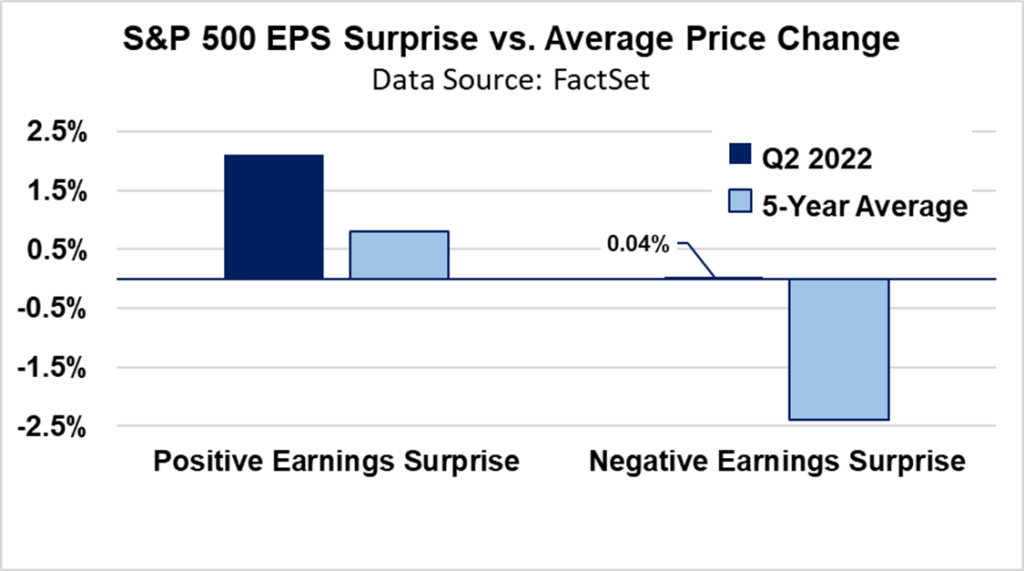

It was noted with surprise by many commentators that equities did not have an extremely negative reaction to the news of a possibly overheating labor market. By Friday evening, the futures market was pricing in a two-thirds chance of a 0.75% hike in the Federal Reserve’s benchmark short-term interest rate at their next policy meeting in September, up from the 34% probability of such a hike on Thursday. Interest rate increases can be a bearish signal for stocks, but economic growth is the ultimate bullish signal. Thus, the importance of the second quarter (Q2 2022) corporate earnings season for S&P 500 companies which was almost finished by week’s end. The market has reacted very positively to quarterly earnings-per-share (EPS) announcements that beat expectations, with companies with positive surprises seeing a 2.1% average bump in share price during the period of their announcement compared to only a 0.8% average bump over the last five years. What’s even more interesting is that companies with negative earnings surprises have not seen their stocks drop, when negative news has led to a -2.4% drop in recent years (see the chart below). The reason given for the market’s overall positive attitude is that companies have been a lot less negative about third-quarter guidance than expected.

All of this does not mean that we are in a blockbuster economy. There are obviously serious problems from consumer sentiment to global supply chains. However, what last week’s data does emphasize is that we are in an unusual environment – but maybe not an unprecedented one. Some economic observers have drawn parallels between our current circumstances and the economy of 1947. The second and third quarters of that year saw real GDP decline, but the National Bureau of Economic Research (NBER) didn’t declare it a recession because of positive growth in employment and consumer spending. The country was coming off a period of massive government spending to fight WWII, and the transition from a wartime to a peacetime economy tied many supply chains into knots – conditions very similar to our post-COVID economy of 2022. Eventually, all the post-war adjustments did lead to an official recession about a year later in November of 1948, so whether history will repeat itself remains to be seen.

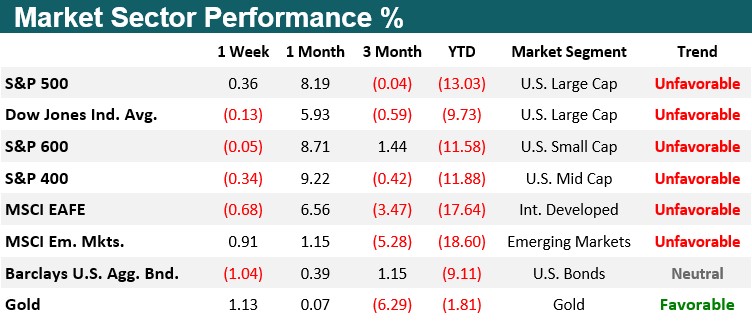

Past performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

On Tuesday, August 2nd, the Equity Growth model reduced its cash allocation in order to add more exposure to the internet retail industry. On Wednesday, August 3rd, the Emerging Growth Companies equity model eliminated a holding in the communication services sector in order to increase exposure to consumer staples stocks.

There were no other trades in EWM Investment Solutions models during the week ending on August 6th, 2022. All major equity market sectors are currently in a long-term unfavorable trend, and the Asset Allocation models remain at their lowest possible tactical equity exposures, with domestic stocks favored over international shares.

Quote of the Week

“In the analogue world, a Pearson text book was resold up to seven times, and we would only participate in the first sale. The move to digital helps diminish the secondary market, and technology like blockchain and NFTs [non-fungible tokens] allows us to participate in every sale of that particular item as it goes through its life.”

– Andy Bird, CEO, Pearson Plc

Andy Bird, chief executive officer of Pearson Plc, talking to reporters after Pearson released their quarterly results on Monday.

As CEO of one of the world’s largest textbook publishers, Mr. Bird was excited about the ability of the latest technology trends to

ensure his company gets paid every time a Calculus I book changes hands.

Out & About

Join the EWM team in supporting this year’s Livingston County Walk to End Alzheimer’s! Anyone is welcome to join us in the walk on September 24, 2022, or you can simply donate to the organization. Learn how to become more involved by clicking the link below!

EWM Update

We are excited to formally introduce four additional partners to the firm, totaling nine owners, retroactive to January 2022. These additions include Albert P. Herzog IV, Robert B. Larsen, Zachary Messina, and James A. Plaskey, Jr.

The firm is beyond excited to expand our group of owners to serve better our clients, employees, and communities we work in for years to come.

A Live With Confidence Minute: Compassion

A Great Dane with a Great Bladder

‘This clearly was a Great Dane with a Great Bladder,’ stated an auctioneer after selling a portrait of Juliana and one of two Blue Cross medals the dog earned for extraordinary acts of courage in WWII.

In 1941 Germany was dropping countless bombs designed to start fires over Britain. Once, such a device made its way into a shop owner’s home and began a fire threatening to burn down the residence and residents. Juliana quickly jumped into action and urinated on the device, putting out the flames, earning her a Blue Cross medal.

The canine’s second medal was earned after alerting the homeowners of another fire in the owner’s shoe shop, allowing them to flee to safety.

Julianna died in 1944 after being exposed to poison delivered to the owner’s letterbox, possibly saving lives again.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on August 26, 2022 to closing price on September 2, 2022

1 Month = closing price on August 2, 2022 to closing price on September 2, 2022

3 Month = closing price on June 2, 2022 to closing price on September 2, 2022

YTD = closing price on December 31, 2021 to closing price on September 2, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.