With equity prices falling, it is time to check in again on valuations in the market. What do we look at when we talk about valuations, and where are they heading? Well, we look at where current valuations are versus historical points and averages. We saw valuations as measured by the Price-to-Earnings (PE) ratio spike in the wake of the COVID epidemic to places we had not seen since before the tech stock blow up of 1999. One of the reasons that PE ratios spiked was that analysts did not have a framework to model the sudden stop of much of the economy coupled with the unprecedented fiscal support that the US government unleashed onto both the financial and real markets. This meant that their forward-looking guidance was inaccurately low when looking out a year into the future. Equity prices kept rising while analysts were cutting forward looking earnings and/or not raising forecasts fast enough to account for the rebound that was under way. This meant that the PE ratio of the S&P 500 rose all the way to 24.1 which was a post Tech Bubble high.

The S&P 500 PE ratio currently stands at 17.6 as of Friday. A reading at this level is below what we saw in the immediate lead up to the global COVID outbreak at the start of 2020. This is not what anybody would consider cheap, though it is closer to broader historical norms. The current earnings forecasts have stabilized. In the chart below, you can see big swings in the NTM EPS (next twelve month earnings per share) forecasts during and following COVID. Analysts tend to be driven more by sentiment than they would like to admit. Looking back at the chart above, we can see that price led the forward-looking estimates down in both late 2018 and during the COVID crisis since earnings – the denominator in the PE ratio – were going up as indicated by the dotted S&P 500 EPS NTM line. So far this year, we have had five months of downside pressure on equity market prices, but we have not seen any lowering of forward looking EPS guidance. The chart below illustrates that we have been seeing upside revisions to forward looking guidance this entire year.

Overall, this means that analysts are still bullish on the prospects of economic- and company-specific growth for the next twelve months. Of course, economic conditions can change rapidly and looking out a whole year to determine whether or not you are overpaying for something can be a dangerous pastime.

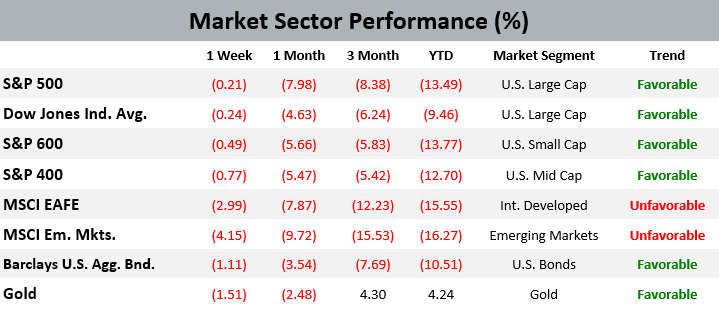

Performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

There were no trades in the EWM Investment Solutions models during the week ending on May 7th, 2022. Domestic equity market sectors still maintain their long-term favorable trend and their overweight position versus international stocks in EWM’s Asset Allocation models.

Quote of the Week

We could solve all our problems if only we were the efficient, rational human beings of standard economic theory.

Jeremy Grantham, co-founder and chief investment strategist of the asset management firm Grantham, Mayo, & van Otterloo (GMO)

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on April 29, 2022 to closing price on May 6, 2022

1 Month = closing price on April 6, 2022 to closing price on May 6, 2022

3 Month = closing price on February 4, 2022 to closing price on May 6, 2022

YTD = closing price on December 31, 2021 to closing price on May 6, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.