We know that there are differences between long-term existential crisis and short-term market uncertainties. It is often difficult to parse between the two on a forward-looking basis as the unknown can easily exaggerate normal uncertainty into the fear of existential crisis if we are not careful. And so, we are here with equity markets pulling back over the short-term and we ask ourselves “is this short-term uncertainty over where the market is going, or is this existential crisis?”

This commentator is not one to opine for the old days when things were “simpler”, and everything made sense. Those days never existed, and we only think there was simplicity because we know the outcomes. Life is always full of risk and uncertainty. But what is uncertainty from a financial perspective, and what could be considered an existential crisis? A breakdown in the rule of law would be a crisis. If companies cannot have some amount of certainty that the contracts they make will be upheld by all parties, then that would put a massive damper on commerce and innovation. The Global Financial Crisis (2007-2009) was an existential crisis where the very bedrock foundations of our financial institutions were threatened. COVID was an existential crisis, where most of the world shut down and nobody really knew what was going to happen looking forward in early March of 2020. On the other hand, the taper tantrum in 2013 was market uncertainty, when the Fed began signaling to the market that it would stop buying government bonds. The Greek debt crisis was also market uncertainty.

There are several issues confronting the financial markets right now. There is a risk of Russia invading Ukraine, we saw markets move sharply lower on Friday over this threat. There is the risk of high inflation. There is the risk of the Fed raising rates, the equity markets began their descent in January after the Fed’s notes from their December 2021 meeting came to light in which there was a hawkish bent. We must ask ourselves if these events create uncertainty or an existential crisis.

Inflation at the levels we are seeing is not an existential crisis. If we were to get to hyper-inflation, that would become dangerous. But as of right now, companies have been able to pass along price increases to customers, and the customers have absorbed them and increased spending even faster than inflation. According to the data provider FactSet, companies in the S&P 500 saw sales grow 16.7% in 2021 while inflation grew at 7.1% in 2021 for a real sales growth number of 9.6%. When we think of inflation, quite a bit of the number has been coming from unexpected places. Looking at the chart below we can see that there had been consistent deflation in durables since the turn of the millennium that has changed course since the pandemic. The inflation in services has stayed pretty steady over that same time frame. The supply chain is healing and spending patterns will most likely shift back to previous trends over time. The Fed increasing rates and ceasing their balance sheet expansion will also bring inflation down.

A Russian invasion of the Ukraine would create an existential crisis for the Ukraine (see their national anthem “Ukraine Has Not Yet Perished”), but for financial markets in the US it will create uncertainty. Uncertainty particularly around the sanctions that will be placed on Russia and how much LNG (liquefied natural gas) we can shift to Western Europe. We are feeling the uncertainty of the Russia situation in our energy prices right now. Speculators, traders, and companies have pushed energy prices to recent highs during this period of heightened uncertainty. But it will take more than an invasion to elevate that situation to existential crisis.

The Fed tightening could become problematic if they tighten too far too fast, but it is still more of an uncertainty as to how this will go down rather than anything that could totally break the financial system at this point. According to the Chicago Mercantile Exchange, there is now a 64% possibility of a 50bps (or 0.50%) increase in the target rate at the upcoming March Fed meeting. This won’t end the party, but it could send a couple of players heading for the exits. At this time, this threat does not rise to an existential crisis for the markets. What could be a larger risk is the roll off of the Fed’s balance sheet. Pre-pandemic the Fed was rolling assets off their balance sheet and the market was fine with it. They were raising rates, and the market was fine with that until December of 2018. Then they cut rates. The market pulled back -19%, but did not go into any crisis mode. The roll off and monetary tightening will need to be stage managed, but at this point we have seen this movie before and it ended without much fanfare.

We are watching to see if any situation develops further into a possibility of a crisis, and we have a plan to adjust our strategies based upon price movements. If the time comes we will execute our plans, but that time is not here yet.

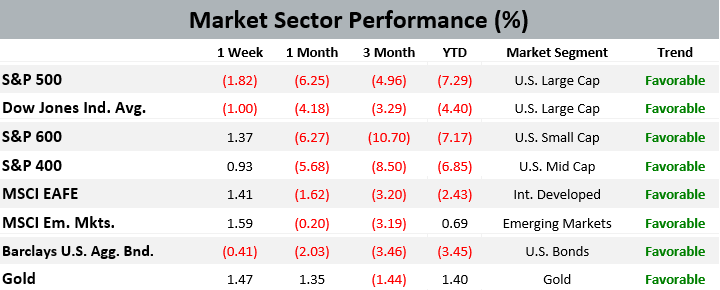

Performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

On Thursday, February 10th, the Emerging Growth Companies model added a new cloud computing software company to its holdings, while the Equity Dividend model picked up a business in the financial services industry.

There were no other trades in the EWM Investment Solutions models during the week ending on February 12th, 2022. The major equity market sectors remain in a long-term favorable trend, and the Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Quote of the Week

I remember the $0.05 hamburger and a $0.40-per-hour minimum wage, so I’ve seen a tremendous amount of inflation in my lifetime. Did it ruin the investment climate? I think not.

An observation on inflation from the vice-chairman of Berkshire Hathaway, Charlie Munger. The right-hand man of Warren Buffet, Mr. Munger celebrated his 98th birthday this January.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on February 4, 2022 to closing price on February 11, 2022

1 Month = closing price on January 11, 2022 to closing price on February 11, 2022

3 Month = closing price on November 11, 2021 to closing price on February 11, 2022

YTD = closing price on December 31, 2021 to closing price on February 11, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.