Last week saw a disappointing jobs report. We have seen blame thrown around from the Delta variant to enhanced unemployment benefits. In the next few months the rubber will meet the road for these theories as the COVID case loads have turned negative from a rate of change point of view. Couple that with the enhanced unemployment benefits running out (ironically on Labor Day), and we will see if the predicted surge in employment will occur now that the conditions appear to be ready for it. We still have roughly 5 million fewer people employed than we did before the pandemic, so there is a huge capacity gap right now that needs to be plugged.

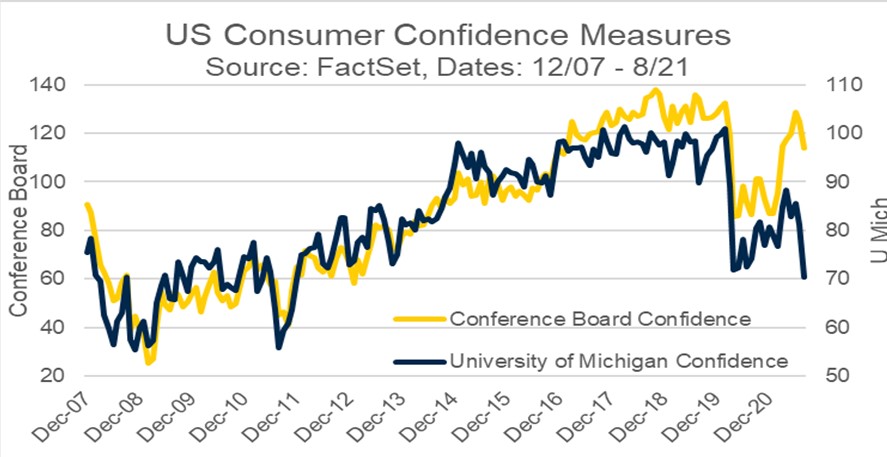

Right now, there appears to be a stalling out of the recent rebound in consumer confidence. Both the Conference Board and The University of Michigan reported very disappointing numbers as represented in the chart below. Could the anticipated loss of unemployment benefits and the previously rising case counts be the cause of these numbers? Maybe. What do these readings mean?

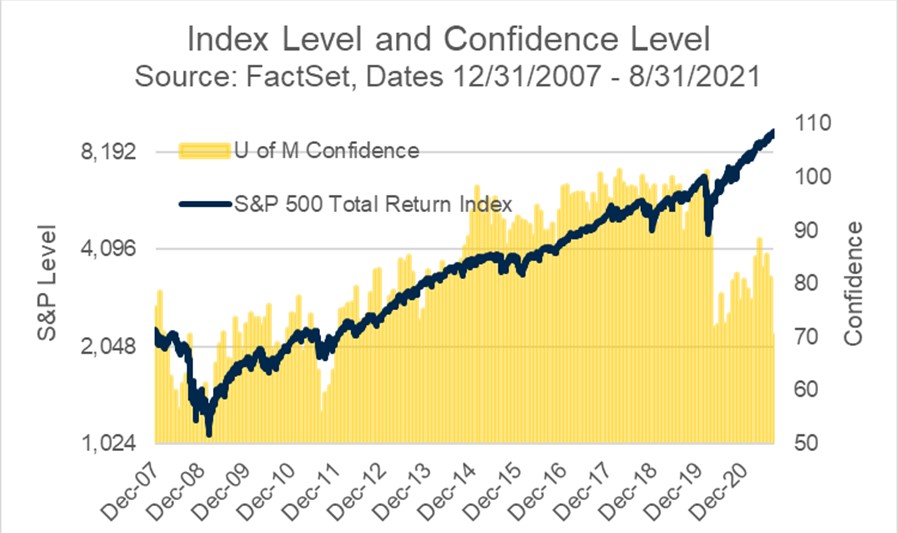

They likely means less than you think for the stock markets. These are sentiment indicators; they are picking up on feelings of the general populace. The general populace can be highly susceptible to a news cycle that may not contain useful information for the future of the economy. Contrary to the way in which is it often reported, these are not a leading indicators for stocks. They generally follow the market down. However, in the era of massive Federal Reserve intervention, it seems as though after sentiment dips the market marches higher.

Take for instance the low consumer confidence levels from 2010 through 2014. This was an excellent time to be long the stock market, but the public was climbing a wall of worry the entire way up. We are conditioned to react poorly to the bad news that swirls around us and that can at times hinder our ability to invest with courage.

There are thousands of indicators for the stock market out there. Pulling any one indicator out and using that out of context can make for good headlines but poor investing outcomes.

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Update

On Monday, August 30th, the Fortunatus Opportunity models underwent their monthly relative strength rotations. The Global model eliminated its allocations to commodity and natural resources funds in order to increase its exposure to domestic equities. The U.S. Growth model enlarged its holding in tech stocks while removing a low-volatility fund.

There were no other trades in the Fortunatus models during the week ending on September 4th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on August 27, 2021 to closing price on September 3, 2021

1 Month = closing price on August 3, 2021 to closing price on September 3, 2021

3 Month = closing price on June 3, 2021 to closing price on September 3, 2021

YTD = closing price on December 31, 2020 to closing price on September 3, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.