Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

The near doubling of the 10-year yield was overall good for the stock market. It’s an unusual combo, but investors saw [the jump in yields] as moving away from deflation, instead of moving toward inflation.

Dave Donabedian, chief investment officer at CIBC Private Wealth Management

Market News

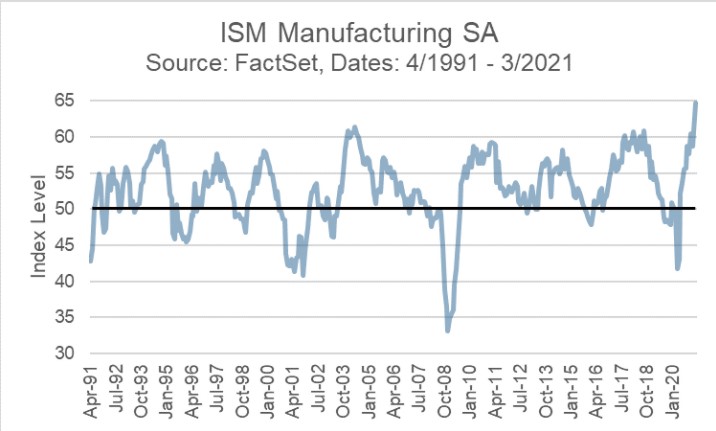

The Federal Reserve has said that it is their desire to run the economy hot, and the way that the Institute of Supply Management (ISM) Manufacturing Index is looking, they are getting their wish. As seen in the chart below of the seasonally adjusted (SA) index, manufacturing sentiment is running hotter than it has in the past 30 years.

The graph above is a diffusion index where any value above 50 is considered expanding and anything below 50 is considered contracting. It is interesting to note that even in the depths of the COVID lockdowns, the index never reached the levels it did during the Great Recession of 2007 to 2009. However, the real reason that manufacturing is running hot right now is that inventories are getting threadbare. Inventories are below the levels seen in the Great Recession. We expect to see the great industrial optimism begin to abate over the course of 2021, as inventories begin to fill back up. This does not mean that the future is not bright. Many industrial firms have already been given credit in their share price for the optimism being shown now in this index. ISM sentiment and equity returns do not go hand in hand.

We have also seen several auto manufacturers halting some production lines due to inventory shortages. This is a problem that will figure itself out over time. The real question will be what the overshoot in inventories will be. Prior to COVID, there was a large decline in the ISM Manufacturing index. Sentiment swings rapidly and all of 2019 saw a rapidly declining manufacturing sentiment. 2019 was a good year for equity returns, even with sentiment slipping. Sentiment and equity gains do not always go hand in hand during non-recession periods. Another instance of this phenomenon that can be seen in the chart above is during the popping of the Internet bubble in 2000-2002. Manufacturing sentiment surged afterwards and then declined for over three years leading into the financial crisis of 2007. This did not mean that equity returns were poor during that time.

Why do we focus on this? It is important to filter out the good data from the constancy of headlines. We will surely be hearing in the near future about declines in many sentiment gauges. These declines are coming from all-time highs and do not necessarily portend the end of a bull market.

Model Update

On Monday, March 29, 2021, the ETF Opportunity models underwent their monthly relative strength rotations. The Global model decreased its allocation to international equity so that it could increase its exposure to large-cap domestic stocks. The US Growth model added new two positions focused on value stocks and high-dividend companies.

The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

On a Lighter Note

Charlie M. of Paw Paw, MI, writes in: “Hey, On A Lighter Note, what was the deal with the Holy Roman Empire?”

Sure thing, Charlie. At the end of the eighth century, what remained of the Roman Empire was ruled by a mother-son duo: Irene and Constantine. Irene thought that her son was acting very bratty, so she decided to remove him from office. She asked him to pick two fingers, and since it would be another millennium before the Three Stooges would develop effective defensive techniques against ocular attacks, Constantine was blinded by his mother’s eye pokes and never heard from again.

Upon hearing this news, the people of Italy said, “Man, Irene sounds like a real meanie, maybe we should start seeing other people.” But who? They looked north to the king of the Franks, Charlemagne. Possessing a righteous beard and standing 6’4” during a time when humans were hobbit-sized, Charlemagne was the dreamboat of the Dark Ages. The Italians asked him to come to Rome so he could begin a new rule of cool, but he politely declined because he already had too many obligations. “That’s ok,” they said, ” There would be no real responsibilities with the new position. It’s really just to keep up appearances on our social media accounts.” Eventually, Charlemagne relented and in 800 AD, Pope Leo III crowned him the first “Holy Roman Emperor”.

For the next thousand years, successors to Charlemagne would continue this ruse as a make-believe monarch all while being neither Holy, nor Roman, nor Emperors. Now, it is fundamental law of nature that what starts tall must end small. So it was inevitable that the diminutive dictator Napoleon Bonaparte would be the one to put an end to all this nonsense in 1806 when he disposed the last Holy Roman Emperor while on one of his many jaunts through Central Europe. The end.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on March 26, 2021 to closing price on April 1, 2021

1 Month = closing price on March 1, 2021 to closing price on April 1, 2021

3 Month = closing price on December 31, 2020 to closing price on April 1, 2021

YTD = closing price on December 31, 2020 to closing price on April 1, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.