Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

People got mad that investment banks get big fees for taking companies public, so they said “what if we found a new way to go public, one that reduced the power of the banks?” And the banks put on trench coats and fake mustaches and went to companies and whispered “you could do a direct listing, or go public by merging with a special purpose acquisition company [SPAC]; that’ll show those evil banks!” And then companies started doing that, and the banks laughed uncontrollably and raked in so, so, so much money.

Bloomberg Opinion columnist Matt Levine describing one of the reasons that the major investment banks had such a profitable year in 2020 despite attempts by some companies to reduce the role of the big banks in financial market operations.

Market News

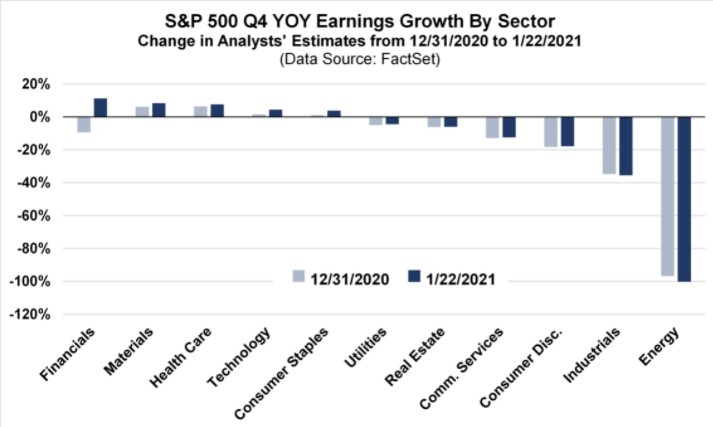

The S&P 500 had its best week of the new year, as corporate earnings season began in earnest last Tuesday. Netflix garnered most of the headlines by beating Wall Street expectations on subscriber and revenue growth during the fourth quarter (Q4) of 2020 as it continued to benefit from coronavirus lockdowns. The media streaming service reported that now with more than 200 million subscribers worldwide paying on average $11 dollars a month, the company will be able to generate enough cash to cover its production costs. Positive earnings surprises weren’t just limited to the biggest technology companies either, as the financial sector handily beat expectations last quarter. Volatile capital markets and a record number of new companies going public last quarter helped boost the financials of the biggest companies in finance, including JPMorgan Chase, Goldman Sachs, Citigroup, and Morgan Stanley. The big news from the big banks helped push the year-over-year (YOY) 2020 Q4 earnings growth for the S&P 500 Financials sector from an estimated – 9.4% on 12/31/2020 to 11.3% as of last Friday (1/22/2021) according to data provider FactSet. That would give the sector the greatest growth in the S&P 500 as indicated in the chart below.

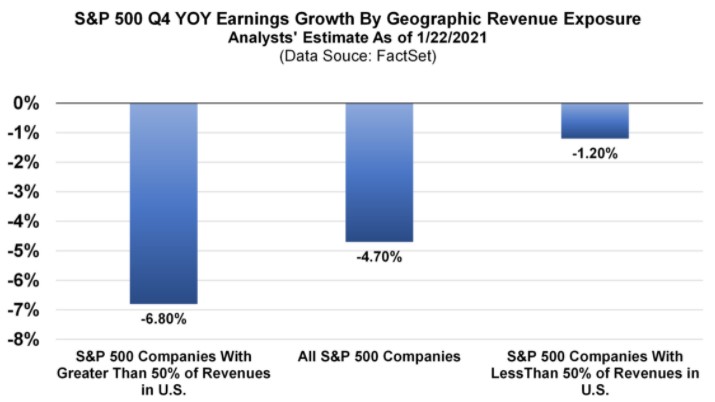

With only 13% of the S&P 500 reporting actual results as of 1/22/2021, companies are reporting positive earning-per-share (EPS) surprises and positive revenue surprises at the highest rate since FactSet began tracking the metrics in 2008. The early good news has boosted the aggregate analyst estimate of S&P 500 earnings growth for Q4 from -9.2% on the last day of 2020 to – 4.7% as of Friday. The percentage of companies issuing positive projections (or guidance) for the current quarter is also well above recent results.

The upcoming week will deliver a more complete verdict on the current upbeat data, as 118 companies in the S&P 500 will report their quarterly results including three of the biggest companies by market cap (Apple, Facebook, and Tesla) on Wednesday. The global reach of the biggest tech behemoths should help bolster their results as the data so far shows that companies with geographically diversified revenue exposure have weathered the 2020 storm better than companies with more concentrated domestic revenues (see chart below).

Model Update

There were no trades in the Fortunatus models during the week ending on January 23rd, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on January 15, 2021 to closing price on January 22, 2021

1 Month = closing price on December 22, 2020 to closing price on January 22, 2021

3 Month = closing price on October 22, 2020 to closing price on January 22, 2021

YTD = closing price on December 31, 2020 to closing price on January 22 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.