Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

Look, it is not negotiable for us to comply with our financial requirements and our clearinghouse deposits. We have to do that.

Robinhood Markets Chief Executive Officer Vlad Tenev defending his firm’s decision on Thursday to halt the buying of certain extremely volatile stocks on his platform during a Bloomberg Television interview.

Market News

The goal of much of modern technology is to create software applications that can abstract away the difficulties and complications of daily life. As the coronavirus curtailed face-to-face interactions in 2020, many of these services became almost ubiquitous. The ability to have food delivered to your house by just pressing a button on your phone or to conduct business meetings without having to trudge through morning traffic became an integral part of many people’s lives. However, no matter how useful and powerful these apps can be, they can’t always hide the underlying complexities of the real world, as last week’s financial markets demonstrated.

First, a quick excursion into the plumbing of the financial markets. When one party agrees to purchase a security from another party, there is a delay between the agreement to execute the trade and the actual settlement of the trade, when money is exchanged and the transfer of ownership is officially recorded. As of 2017, the settlement period for stock trades was two business days, or T + 2 in the financial vernacular (T = initial transaction day). During this settlement time both parties of the transaction are subject to risks, especially in volatile markets. The seller of the security may not receive his payment on the agreed upon date, a concern called credit risk; while the buyer also bears the risk that he might not receive the security at the given time. Throughout history, market mechanisms have been created and government legislation has been passed to help mitigate these risks. A system of clearing houses has been established to act as intermediaries to guarantee proper processing of trades with the arrangement overseen by the Depository Trust & Clearing Corporation (DTCC) . These clearing houses require the brokers that deal directly with them to post collateral to ensure that transactions are settled. The more imbalanced a broker’s position is on a trade in terms of buys or sells or the more volatile the security, then the more collateral that is needed for the markets to function properly.

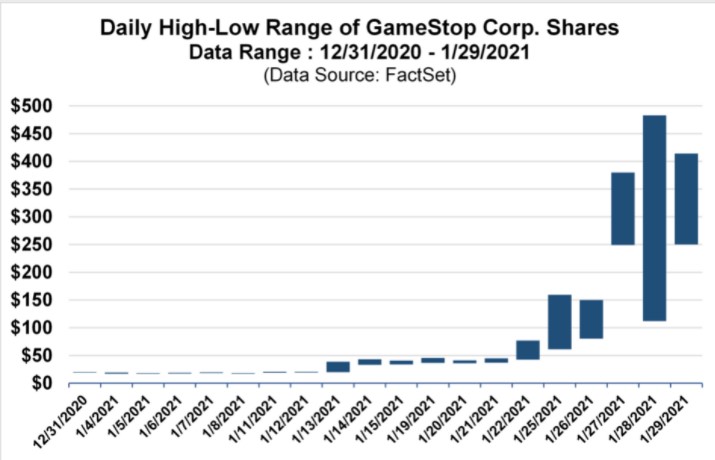

Now, financial services company Robinhood Markets had great success in 2020, as its software app has removed many of the obstacles preventing retail investors from engaging in day trading and option purchasing. Following the company’s mission to “democratize finance”, Robinhood users were easily able to create leveraged positions in securities that would have been unthinkable for retail investors only a few years ago. And it is this ease of use that put the company in a precarious position as internet forums encouraged traders to purchase shares of heavily-shorted companies, most notably GameStop Corp, at the beginning of this year. GameStop, a seemingly moribund brick-and-mortar retailer of video games, became the most traded stock in the country with wild swings in its share price. On Thursday, January 28th, 2021, shares of GameStop reached a high of $483.00 followed by a low of $112.25 only two hours later after opening the trading day at $265.00. This extreme volatility plus the fact that many of Robinhood’s customers were on one side of the trade while using leverage, left the company’s brokerage vulnerable. When the DTCC demanded that significantly more collateral was needed to ensure these trades could be properly settled, Robinhood struggled to supply the extra cash. To ensure their liability couldn’t increase, Robinhood halted the buying of shares of GameStop and a few other volatile securities. This has caused an uproar throughout social media and may lead to government hearings, as many people look for the nefarious forces ultimately responsible for this disruption in trading. But the search for a bad guy will probably be fruitless, as last week may have just been one of those times when the magical software facades that control much of modern life weren’t able to completely contain the real world lurking underneath.

Model Update

There were no trades in the Fortunatus models during the week ending on January 30th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold

1 Week = closing price on January 15, 2021 to closing price on January 22, 2021

1 Month = closing price on December 22, 2020 to closing price on January 22, 2021

3 Month = closing price on October 22, 2020 to closing price on January 22, 2021

YTD = closing price on December 31, 2020 to closing price on January 22 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.