“Nikola Corporation is an American company that presented a number of zero-emission concepts during 2016–2020” is the current (8/2/2021) opening sentence of the Wikipedia article for the Nikola Corporation. It is odd that a company that just produces concepts – or since it is now 2021, once produced concepts – should have public stock valued at $4.5 billion as of 7/30/2021. The valuation is even odder given the fact that the company’s founder and former CEO Trevor Milton was charged with securities fraud by the SEC last week. These facts have helped Nikola become the poster child for the excesses of the market’s current SPAC-mania.

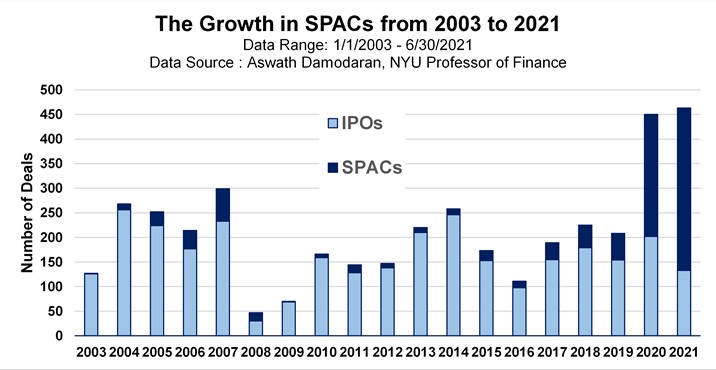

There are always difficulties and frictions when a private company decides to go public. The traditional method, an initial public offering (IPO) of stock organized by an investment bank, has been criticized by companies for its high fees, restrictions on disclosures, and drawn-out procedures. An alternative method that has gained popularity in recent years is the Special Purpose Acquisition Company or SPAC. A SPAC is created when a SPAC’s sponsor raises investment capital through a traditional IPO. The sponsor will then use their connections and the new capital to try and find a private company to merge with and take public through a process called a “de-SPAC merger.” SEC regulations limit the time the SPAC founder has to find a deal (usually two years) until they have to return the money back to SPAC shareholders. If they do find a deal in time and the SPAC shareholders approve it, then the SPAC shares are converted into shares of the newly public company with the SPAC sponsor getting a sizable chunk of the new company’s equity. The chart below shows how quickly SPACs have grown in recent years, from virtually nothing in 2003 to more than doubling traditional IPOs so far this year. But why have they grown so explosively?

Well, traditional IPOs can take longer than a de-SPAC merger, especially if a company is relatively unproven and needs to go on a “IPO road show” with an investment bank to promote itself to potential institutional investors. But maybe the major advantage a SPAC has over a traditional IPO is the reduced restrictions on financial projections. In a traditional IPO, the SEC strictly limits a company’s ability to forecast revenues or earnings. Only mature public companies are allowed to make good-faith estimates. However, a SPAC, as an ongoing public company, can make projections about a potential target it is thinking about merging with. Therefore, the SPAC mechanism provides tech startups with lofty goals but little in terms of earnings the platform to promote their companies to public investors. That is why SPACs were the method by which so many electric vehicle companies went public over the last couple of years. Many of these company were long on theoretical engineering concepts but short on actual financial revenues, but that wasn’t an impediment to public investor capital in the SPAC world.

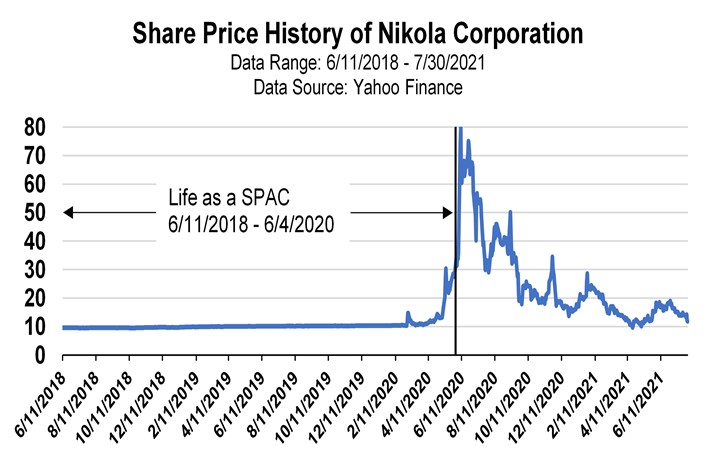

The chart above shows the price history of the Nikola Corporation (ticker: NKLA). The prices from 6/11/2018 to 6/4/2020 are for the SPAC VectoIQ Acquisition Corporation which eventually merged with Nikola. SPAC shares start at $10 and will only make major movements as rumors of a merger grow louder. On the days immediately following the merger, shares of Nikola shot up to almost $80 thanks to an aggressive social media marketing campaign from then CEO Trevor Milton that promoted the company and their electric trucks. Since then, the stock has plummeted in value as public scrutiny has shown many of Milton’s pronouncements to be fraudulent, including the release of video that allegedly featured a fully functional Nikola One electric semi-truck but actually was a taped-together metal shell rolling down a hill.

The charges against Milton and recent public statements by SEC officials show that the federal government is ready to re-examine rules around disclosures for Special Purpose Acquisition Companies. Any investor looking into this financial fad should realize the risks involved and the potential that in the near future the SEC could declare that “SPAC is wack!”

Quote of the Week

| FICO is becoming a smaller factor in underwriting decisions at Citizens Financial Group Inc. When shoppers apply for its buy-now-pay-later loans, the bank considers factors including the products they are buying, according to a person familiar with the matter. Fitness equipment, for example, is viewed as a sign of creditworthiness because it suggests a positive change in the applicant’s behavior. Excerpt from a recent Wall Street Journal article about how big lenders are using the plethora of publicly available purchasing data to develop proprietary scores to rate creditworthiness. It is uncertain whether these credit benefits extend to the case where new dumbbells will only be used as paperweights and doorstops. |

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Update

There were no trades in the Fortunatus models during the week ending on July 31st, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

On a Lighter Note

Nowadays, we see many reports in the media about how cow emissions are destroying the environment. In these articles, the animals are always portrayed as the gassy bad guys that are heating up our planet. Well, this writer is never cowed by popular opinion, and he remembers a time when his bovine buddies were respected for their charm and wisdom.

For example, we use the word ruminate to mean “to reflect or to think deeply about something”, but its original definition was “to chew cud like a cow”. Humans adopted the word because we once admired the cow’s philosophical meditations. And back when this writer was attending finishing school, elocution lessons always started with the greeting “How now, brown cow?” because back then cows were prevalent in society’s upper crust, and bovine banter was always witty and delightful.

In fact, one of mankind’s oldest writing styles was a zig-zag pattern that was read left to right, then right to left, and so on … named by the Greeks boustrophedon, which literally means “turning like a cow”. This is because to the ancients there was no more literate animal than the cow.

So now you can see that cows were once praised for their quips and intelligence, and now they are only attacked for their burps and flatulence. Holy cow, what a downfall!

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on July 23, 2021 to closing price on July 30, 2021

1 Month = closing price on June 30, 2021 to closing price on July 30, 2021

3 Month = closing price on April 30, 2021 to closing price on July 30, 2021

YTD = closing price on December 31, 2020 to closing price on July 30, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.