We are seeing some volatility return to the market after a long absence. As of right now (10/4/2021), this appears to be episodic and non-trending in nature, but we are keeping an eye on it. In the past, we have hit on the concept of valuation, and what is a fair price to pay for something. There are still a swell of voices saying that the stock market is overvalued, so we wanted to take a moment to check in and see if that is the case.

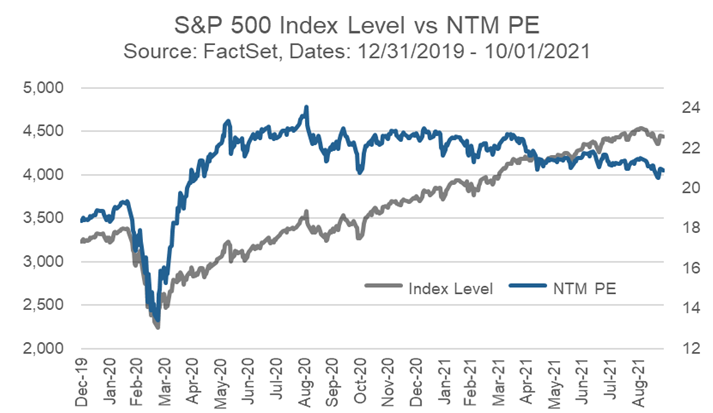

As we know, a value is just a price the public is willing to pay for something. So a value can be high in relation to history, but something can never really be overvalued if people are paying that price. Since the height of the pandemic inflated valuations, the S&P 500 valuation – as measured by projected price-to-earnings ratio over the next twelve months (NTM PE) – has fallen almost -15% while the index itself has climbed +21% (see the above chart). This means that maybe the crowd buying late last year had it right, that earnings per share (EPS) would go up more than price.

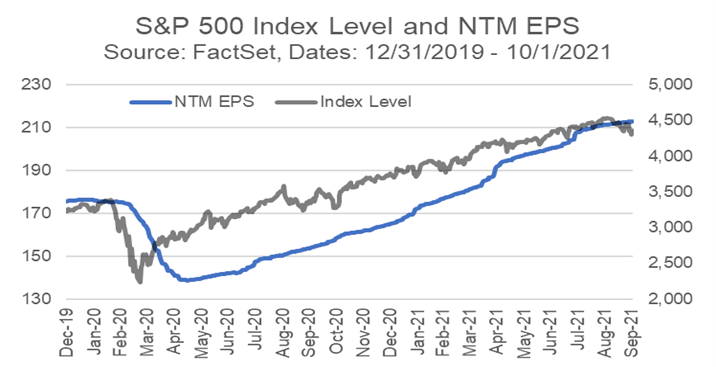

There is a rosy picture that is being forecast for next year. Retail sales and demand continue to be extremely strong. Due to supply chain issues, inventories are falling on those strong sales. As of now, retail sales are not predicted to reverse course. This means that for some time in the future there will be a somewhat frantic restocking that should occur. This is good for manufacturers as that means that their future sales look better than normal. This is some of the reason that earnings estimates for 2022 continue to be revised up as you can see in the chart below.

The question facing the market now is when do those estimates stop being revised up. The normal course in the US is for a high 1-2 year out forecast and then for those estimates to be revised down over the course of the year. We suspect there will be a reversion to the normal pattern, but we don’t know when that will happen. We also don’t know what effect said shift will have on the market.

What will happen when companies are not beating estimates by large margins? As we head into the Q3 reporting season, it will be interesting to see if estimates will become more accurate. While a full blown bear market is less likely, individual companies that cannot beat the low estimates will most likely be punished harshly. The market is currently on tenterhooks, though it is important to point out that we are still within 5% of the all-time highs achieved in August. As always, we will continue to monitor the situation.

Model Update

There were no trades in the Fortunatus models during the week ending on October 2nd, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

For decades, our customers have enjoyed the ‘thrill-of-the-hunt’ for value at one dollar – and we remain committed to that core proposition – but many are telling us that they also want a broader product assortment when they come to shop.

A statement from Dollar Tree President and CEO Michael Witynski about his company’s announcement last week that they will “break the buck” and begin pricing items above $1. Although inflationary pressures have helped push the company to make the change, they already had been testing higher price points in the “Dollar Tree Plus” sections of stores at select locations for some time. Nevertheless, Mr. Witynski made no comment about whether the company planned to stop selling trees too.

On A Lighter Note

According to a recent post on the technology blog The Verge, there is a serious problem vexing professors at our top schools of science – their students don’t understand the concept of computer folders. When asked to retrieve a file from a nested hierarchy of directories, the country’s brightest young minds simply proclaim the task to be impossible. Having grown up in the easy-breezy era of search engines and smart phones, students of today expect their files to just appear when summoned, emerging effortlessly from the clouds.

Attempts by teachers to provide real world analogies in order to ease understanding have been fruitless mainly because their students seem to spend so little time in the real world. Physical filing cabinets have only been seen briefly during field trips to museums, and comparisons of organizing files in folders to sorting silverware or separating laundry are met only with blank stares – apparently doing household chores is not part of a modern STEM education. Occasionally, a student might recall hearing their great-grandparents talking about the good old days when they navigated a C drive using a combination of DOS commands and backslashes but the student quickly dismissed these old war stories as too outlandish to be true.

This generational divide is inevitable as our ubiquitous technological systems constantly evolve. It is difficult to go beyond the mental framework established by the tools we first use, and we shouldn’t be too judgmental as skill sets change. Even the simplest symbols can have different meanings to different generations. What do you call the # symbol? A “hashtag”, a “pound sign”, or an “octothorpe“? Ok, if you call it an octothorpe you are definitely weird. Nevertheless, this meditation on tech mismatches has helped us understand why so many interns at the “On A Lighter Note” offices get barking mad when they are first introduced to our phone systems:

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on September 24, 2021 to closing price on October 1, 2021

1 Month = closing price on September 1, 2021 to closing price on October 1, 2021

3 Month = closing price on July 1, 2021 to closing price on October 1, 2021

YTD = closing price on December 31, 2020 to closing price on October 1, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.