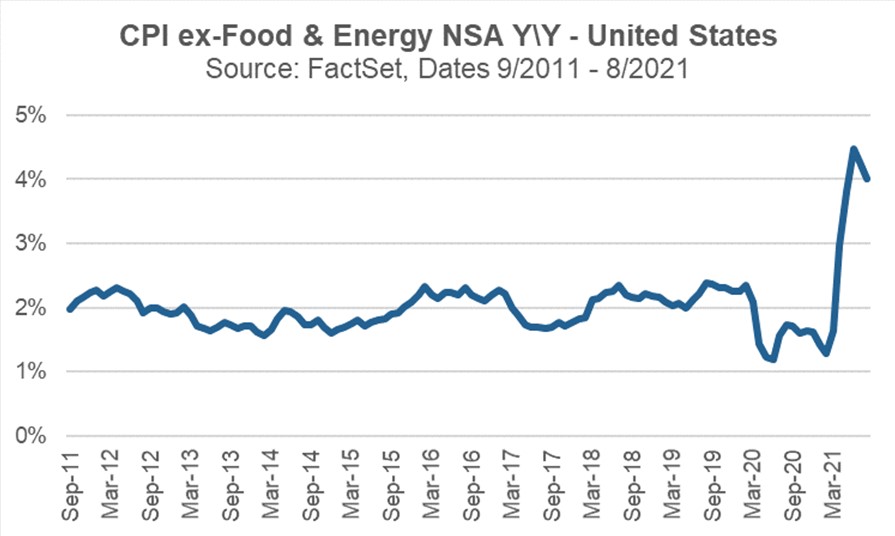

We received a favorable inflation reading last week on Tuesday. Inflation continues to inflect from a rate-of-change basis to the negative as can be seen in the chart directly below of the year-over-year (Y\Y) non-seasonally adjusted (NSA) consumer price index (CPI) excluding food and energy. This is good for the “Inflation is Transitory” crowd, while some on the other side of the argument are still claiming victory since inflation is still running at 4% on a year-over-year basis.

Aside from the personal toll inflation can have on your pocket book as it seeks to hoover up more money than before, it can also have deleterious effects on many sectors of the economy. So checking in to see the status of inflation on those sectors will be helpful.

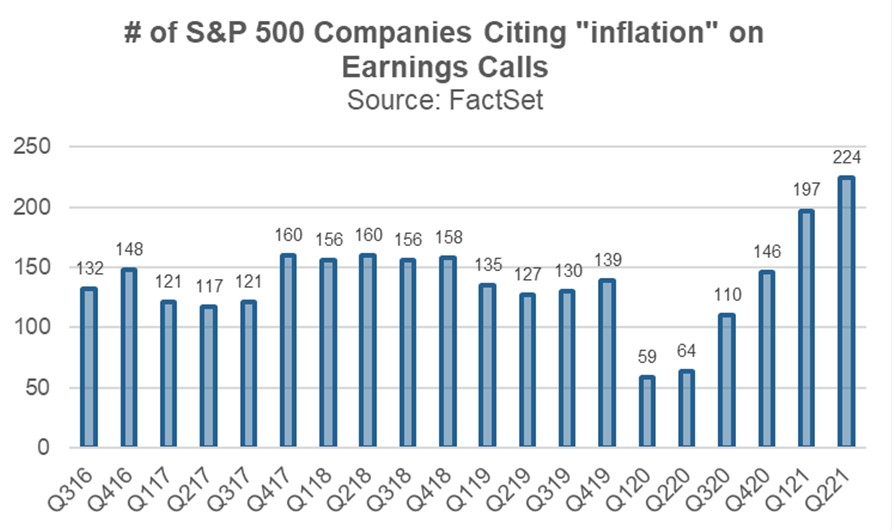

Everybody can see and feel that spike in inflation on the graph above that started its inflection in April of this year. It reached a rapid zenith (for now, hopefully) in June and thus fully encompassed the second quarter (Q2) of 2021. So we should be able to see some of the ill inflationary effects on the corporate reporting season that has just finished for Q2. According to data provider FactSet, a spike of worry about inflation has hit the business sector with nearly 50% (224) of the companies in the S&P 500 discussing inflation during quarterly earnings calls over the past 3 months (see the chart below).

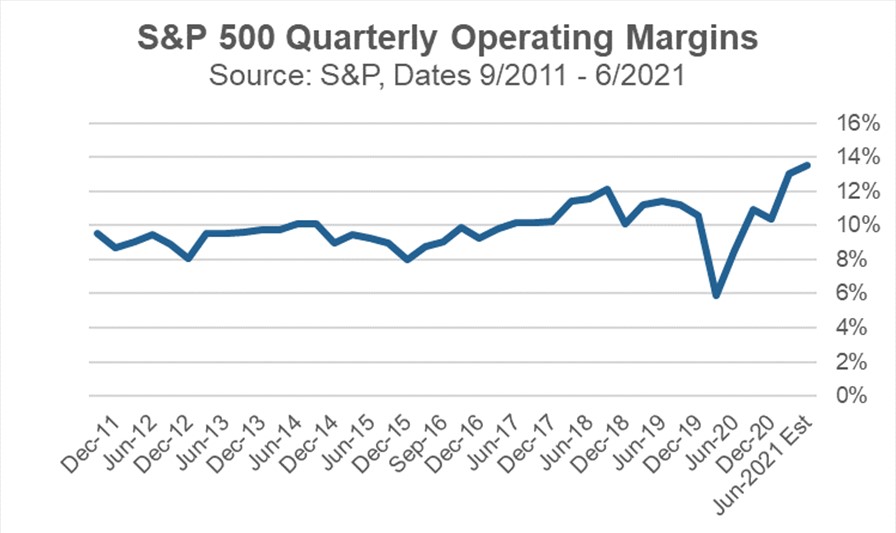

But are we seeing ill effects in the corporate income statements yet? No, not yet. As we can see from the chart below operating margins hit a high last quarter. Companies have been able to either hedge their exposure to input inflation in the short-term or have been passing on price increases to the end customer, the public, such that they are making more than ever. Margins most likely cannot continue this upward trajectory forever, but it remains to be seen if it will be inflation as measured by CPI or wage inflation that will begin eat away at the margin advances of the past few years.

Model Update

There were no trades in the Fortunatus models during the week ending on September 18th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

I was in my peak physical condition when I was about like, one. Oh God, I looked good. Young and fresh. You wouldn’t know me now if you’d seen me when I was one. I even looked good for my age. People would come up and go, “What are you, zero?” And I’d go, “No, I’m one over here.”

Canadian comedian and raconteur Norm Macdonald reliving his glory days during one of his earlier standup performances. Macdonald passed away at age 61 last Tuesday leaving the world with a dearth of mirth that will be difficult to replace.

On A Lighter Note

Fame is a fickle beast. Even the most talented people can lose touch with the spirit of the times and quickly squander their popularity. Take the example of Robert Recorde of Wales. In 1557, he introduced the equals sign (=) to the world and quickly skyrocketed to celebrity status. No longer burdened with writing out the cumbersome words “is equal to”, mankind seemed to have no limit to what it could now accomplish thanks to Robert’s two little parallel lines.

However, the public’s insatiable need for new content soon caught up to Robert. Everywhere he went, people asked him when he was going to drop his next big symbol. Well, this Welshman was not a man to welsh on an obligation, so a few months later to much fanfare Robert released The Whetstone of Witte, a mathematics book introducing his newest creation to the public – the zenzizenzizenzic (333), which was composed of three script capital Z’s that looked a lot like 3’s. This symbol according to its creator “doeth represent the square of squares squaredly” and comes from a repetition of the German word zenzic meaning a number squared (or a number multiplied by itself).

The public’s reaction to this new symbol was less than ecstatic:

Suddenly Robert’s stardom began to dim. After the zenzizenzizenzic’s release, no one returned his calls, partly because it was the 16th century and the science of telephony was not yet developed, but mostly because no one wanted to talk to him now. In fact, according to the Oxford English Dictionary, the word zenzizenzizenzic would never appear in another textbook again. It exists now only as an object of linguistic and mathematical mockery; a word, like razzmatazz and razzle-dazzle, that has too many z’s for its own good.

Unfortunately, Robert Recorde fell victim to the fate all content creators must eventually face – one day your new creations will lose their sparkle with the public. For some that day comes when they create a zenzizenzizenzic, for others it may come when they write a short article about the creation of the zenzizenzizenzic.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on September 10, 2021 to closing price on September 17, 2021

1 Month = closing price on August 17, 2021 to closing price on September 17, 2021

3 Month = closing price on June 17, 2021 to closing price on September 17, 2021

YTD = closing price on December 31, 2020 to closing price on September 17, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.