Much of the market pain right now can be attributed to anxiety over inflation expectations. With these heightened inflation expectations comes an increasingly hawkish Federal Reserve, as they attempt to return inflation to their 2% target. The important question now is what happens next. While we don’t know, and don’t make predictions, we can look to the past to give us some guidance. There have been periods of high inflation in the past similar to our current situation. Each time we have experienced high and rising inflation, we have seen an inverted V-top to the chart pattern (as shown below). The period of high inflation has been followed by rapid disinflation. Disinflation is when the inflation rate is slowing but still positive. This is what the next step in our current inflation story will most likely be. We likely will not see the overall cost of living fall anytime soon, but instead returning to a normalized inflation rate. In such an environment, prices on some individual goods may fall, but the cost of the aggregate of consumer goods would still increase – at a slower, steadier rate. To see an overall decline in prices, or deflation (shown in red in the chart below), would be a very dangerous sign for the economy.

So when will inflation turn? That is something that we cannot know at this time. But we have seen some encouraging signs of prices on individual goods stalling out or falling. Looking at used cars in the chart below is a good example of stalling inflation that is actually bringing some falling prices to that corner of the market. Currently, used car inflation makes up 4.14% of the Consumer Price Index (inflation) calculation. With used car prices falling over the past three months, we are beginning to see this portion of the market making a negative contribution to the Consumer Price Index following a period of very high price hikes in this area. If more market sectors follow this pattern, we may be left with permanently higher overall prices but the rate of change in price increases should begin to flatten and turn.

What happens when inflation expectations tip over? In the past when we have seen this, commodities have fallen, gold has fallen, and bonds have halted their yield gains/price declines. There are several research shops out there calling for March to have been the peak inflation number. We are not sure if that is the case. We also don’t how much disinflation it would take before the Federal Reserve would return to a non-hawkish monetary stance. A return to a non-hawkish stance would most likely be a positive for the equity markets, and the fixed income markets as well. As always we are keeping abreast of actual trends as they happen and shaping our response to what is happening in the financial markets.

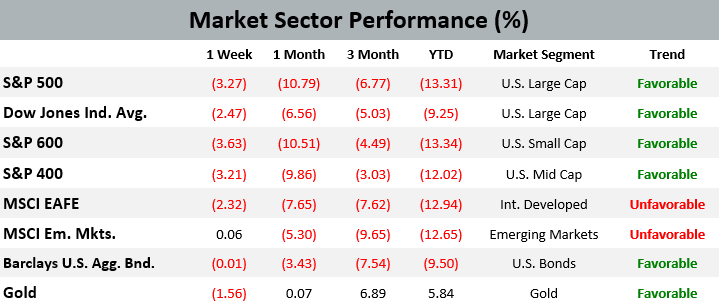

Performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

Last week, the EWM Investment Solutions Equity Growth and Emerging Growth Companies models continued to make moves in their underlying holdings in response to the changing financial landscape. Both models added more exposure to the energy sector, and both models trimmed positions in service companies that are facing major headwinds in the current economic environment. There were no other trades in the EWM Investment Solutions models during the week ending on April 30th, 2022. Domestic equity market sectors still maintain their long-term favorable trend and their overweight position versus international stocks in EWM’s Asset Allocation models.

Quote of the Week

This is laying the groundwork for what I expect to be a very exciting 2030.

Mark Zuckerberg, CEO of Meta Platforms, Inc. (née Facebook), commenting during his company’s quarterly earnings call last week about the importance of taking the revenue generated from apps like Facebook and Instagram and investing it into virtual reality and the metaverse. This capital, he continued, will help Meta become the “premier company for building the future of social interaction.” So you have that to look forward to.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on April 22, 2022 to closing price on April 29, 2022

1 Month = closing price on March 28, 2022 to closing price on April 29, 2022

3 Month = closing price on January 28, 2022 to closing price on April 29, 2022

YTD = closing price on December 31, 2021 to closing price on April 29, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.