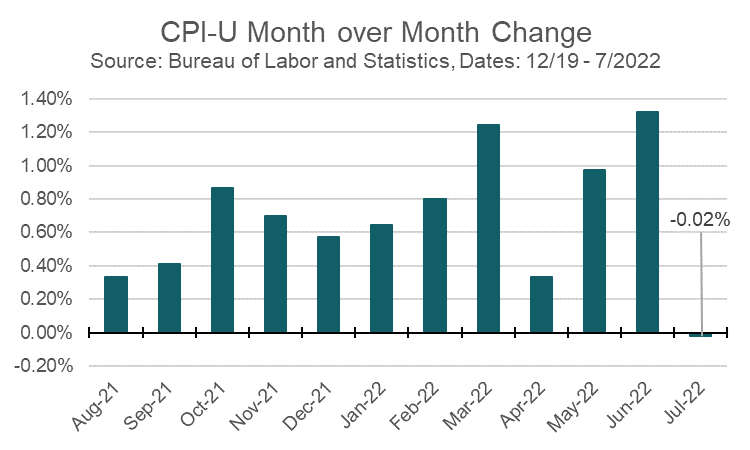

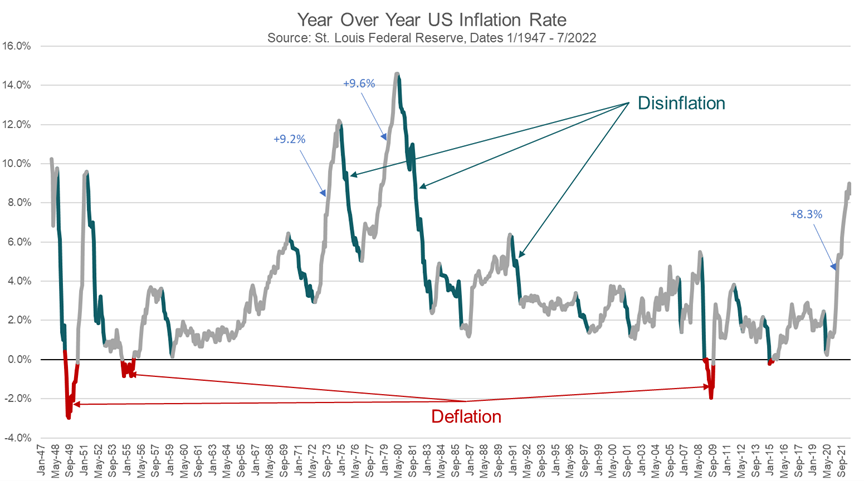

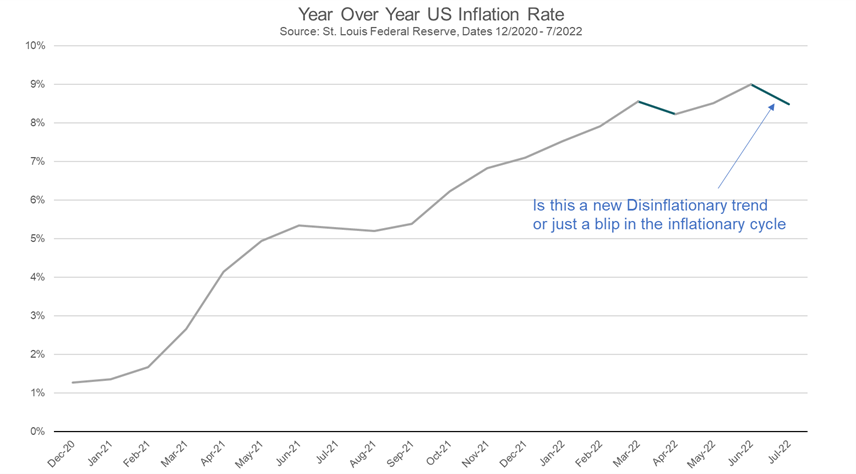

Was that the inflation report we have all been waiting for? In the initial reporting, there was no headline inflation for the month of July, while core inflation was below expectations. The year-over-year inflation rate suggested disinflation, or falling inflation rates, as the year-over-year rate slowed from 9.1% in June to 8.5% for July. This means that all of the price increases in the year-over-year number occurred in the 11 months leading up to July 2022. The equity markets took this as good news and the S&P 500 bounced +2% the day the report was released. And looking at a chart of the monthly changes in the Consumer Price Index (CPI) shows just how much the July data point stands out from recent numbers.

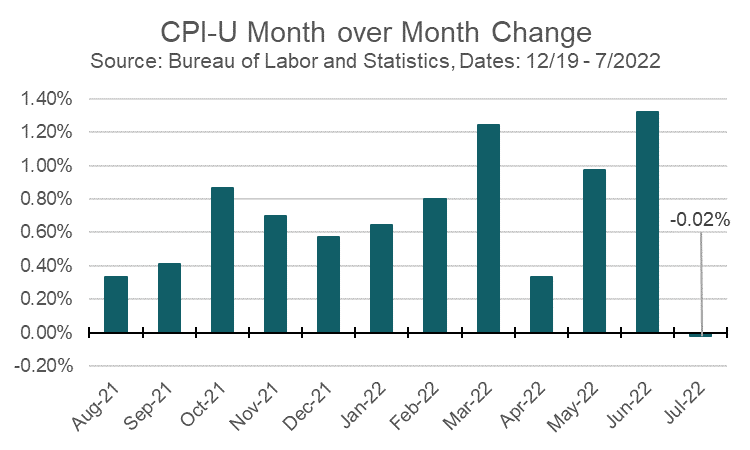

However, it can be difficult to decipher meaningful trends in month-over-month data, so below is the year-over-year growth on a long-term basis. Note that rapid inflation tends to turn into rapid disinflation, that is prices rising at a slower rate, very rapidly once it rolls over. You can see this clearly in the late 1940’s and the 1970’s.

The question that remains to be answered is if this is a new turning point lower for inflation or is this just a head fake and inflation will reaccelerate on a year-over-year basis again? We had an encouraging print in April showing a possible turning point, but that falling trend was not confirmed by subsequent months.

Disinflation suggests that the Federal Reserve can pivot quicker if current economic conditions deteriorate further into recession. While we have had two consecutive quarters of negative economic growth and that normally suggests a recession, there are more inputs that we have pointed out in past newsletters, and the Fed is not convinced that it has done enough to quell inflation. But with more inflation reports like the last one, we can be pretty sure that surprise rate hikes will not be in our future.

The main sticking point in core inflation now is housing. During the pandemic and soon after, there was a dearth of homes for sale. Demand was strong, but people were not willing to move. This caused prices to spike. We are now seeing more homes come on the market. That coupled with the fact that mortgage rates are increasing is causing a chill on the frothy conditions that surrounded the housing market since pandemic times. So, one of the key inputs to core inflation (inflation less energy and food) is set to begin to slow.

We don’t know if the economy can land without incident. If we look out at Financial Twitter or the broader mass of economic punditry, we could assume that we are heading into a depression, but that is not necessarily held out in the data.

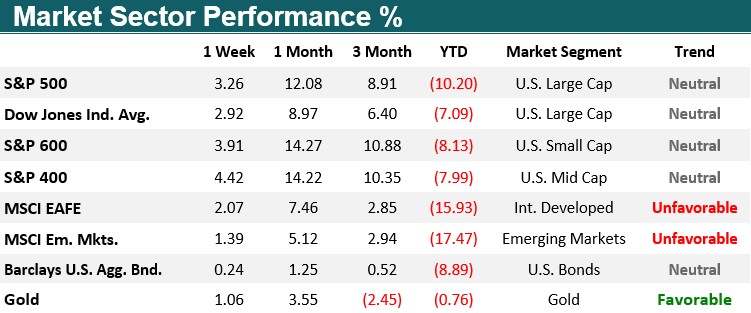

Past performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

By market’s close on Wednesday, August 10th, the broad domestic equity markets transitioned into a neutral trend. On the following day, the EWM Investment Solutions Asset Allocation models increased their exposure to U.S. stocks. Also, the Alternative Asset Opportunity model removed a bear market holding, while the Equity models reduced their defensive cash allocations in order to augment positions in undervalued companies.

There were no other trades in EWM Investment Solutions models during the week ending on August 13th, 2022. All major domestic equity market sectors are currently in a neutral trend, while international equity remains in a long-term unfavorable position.

Quote of the Week

“Lollipops Hustle on Amazon Costs Family Candy Business Millions”

The title of a recent article in Bloomberg Technology by Spencer Soper that detailed how rogue merchants have been purchasing Dum Dum suckers at a steep discount from Sam’s Club and then reselling them at a markup on Amazon, significantly undercutting the sales by Spangler Candy Co., the candy’s original manufacturer. The widespread and unchecked sugary price arbitrage has many wishing for the days when the industry was firmly regulated by the Lollipop Guild.

Out & About

Click the podcast above to hear long-time TV personality, Chuck Gadica and EWM Chief of Marketing, Ken McMullen sit down with Livingston County’s Walk to End Alzheimer’s Senior Development Manager, Nicole Colley, and CEO, Jennifer Lepard.

This year, Chuck Gadica will again be the Walk Day Emcee!

Click the button below to learn more about the Walk or how you can become more involved! #endalz

EWM In the News

EWM hosted a donation drive for LACASA Center in first half of May, collecting various items for the Center and its guests. Click below to read more about the donation drive!

A Live With Confidence Minute: Estate Transfers

Chris Hopkins

Private Wealth Advisor

Could Custodial IRAs Help Young Adults Buy Homes?

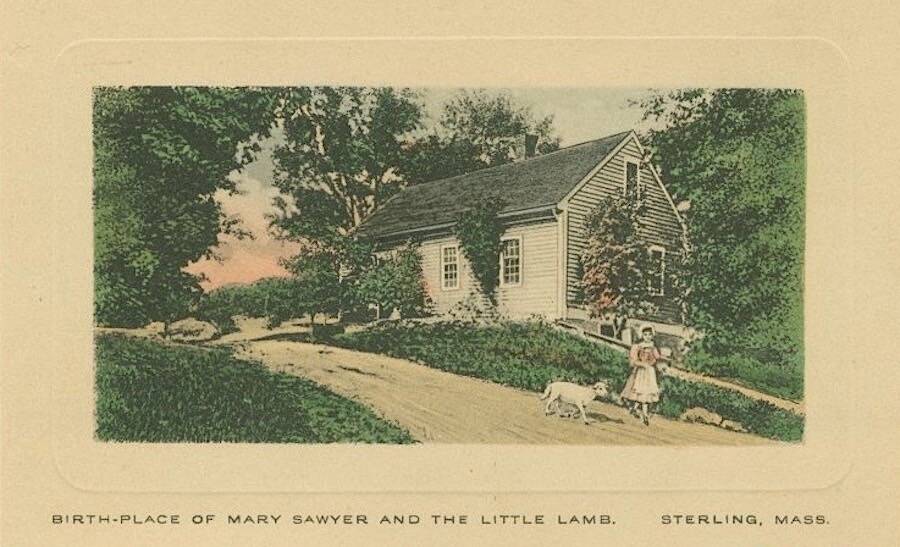

It turns out, Mary did have a Little Lamb.

Born in 1806 in Sterling, Massachusetts, Mary Sawyer found a frail abandoned little lamb as a young girl. Over time, Mary nursed the lamb back to health, and the lamb began to go everywhere that Mary went, Mary went, Mary went. One day Mary tried to sneak the lamb into the school, her school unnoticed so as not to leave it home alone, but it couldn’t keep quiet, and the lamb was soon discovered. A child pointed out that Mary had a little lamb, little lamb, little lamb. The next day an upperclassman, John Rohlstone handed Mary a slip of paper that had the now infamous nursery rhyme on it. Additional lines were added and published in 1830 by author Sarah Josepha. The rhyme was eventually put in song form to the melody of a minstrel song ‘Goodbye Ladies.’

Mary’s little lamb had three lambs of her own but was killed at age four by the family cow.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on August 5, 2022 to closing price on August 12, 2022

1 Month = closing price on July 12, 2022 to closing price on August 12, 2022

3 Month = closing price on May 12, 2022 to closing price on August 12, 2022

YTD = closing price on December 31, 2021 to closing price on August 12, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.