Will the yield curve go inverted? One can almost hear Roy Acuff paraphrasing his classic song. This is what all the financial pundits are talking about now, and everybody is castigating the Federal Open Market Committee for “getting it wrong” no matter what their approach is to domestic monetary policy. An inverted yield curve is where the short end of a curve of yields of U.S. Treasuries of various maturities is above the longer end of the curve. This signals that the term premium has disappeared, meaning that people are not willing to take on longer term risk in their fixed income. They see short-term market disruptions as a more important factor than long-term growth. Looking at the chart below, we can see that the most important measure of the term premium of the curve, 10-year yield (10y) minus 2-year yield (2y), is close to inversion but not quite there yet.

What does it mean really if there is an inversion? History tells us that a recession is more likely if there is an inversion of the 10y’s and 2y’s. But it does not tell us what kind of recession that will be. Will it be deep, or shallow? Will there be a bear market in stocks or not? When will the recession occur? Will there even be a recession? The answer on all of these is rather unclear.

Recessions are defined as periods where GDP growth rate is negative, but nowhere does it say that there must be a large contraction of GDP. There have been yield curve inversions without recessions, see the 2018 inversion. The COVID recession should not be considered an outcome of the 2020 inversion for although economic growth was definitely slowing in that year there was no guarantee of a recession without the influence of the global pandemic. There have been very shallow recessions in the past, particularly in 1949, 1970, and 2001 where GDP barely registered a dip. There have been recessions where the stock market has not entered into a bear market (defined as a drawdown of -20% or worse), see 1949, 1954, 1960, and 1991 in the chart above. The shallowest recession since WWI, in 2001, produced the third largest drawdown. While the 1958 recession, where the economy contracted -3.6%, barely registered a -20% drawdown. Several of the drawdowns associated with the recessions occurred outside of the official recession window. There have even been bear markets that have occurred outside of recessions.

There are many reasons why we don’t make predictions about where the market is going. The uncertainty around timing when a drawdown is coming and the depth and duration of that drawdown are just too great. When faced with situations like an inverted yield curve it is wise to use caution in investing (as it always is), but also in making predictions.

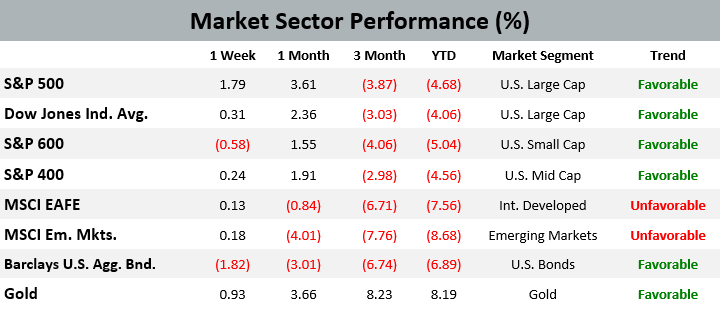

Performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

On Tuesday, March 21st, the EWM Emerging Growth Companies model removed a holding in the electric vehicle industry. There were no other trades in the EWM Investment Solutions models during the week ending on March 26th, 2022, with domestic equity market sectors still maintaining their long-term favorable trend.

Quote of the Week

Amalgamated Investments Co., parent of Amalgamated Bank of Chicago, may pursue compensatory damages from Amalgamated Financial Corp. in New York for allegedly breaching terms of their merger agreement.

The opening line in a news article in American Banker last week about the failed amalgamation of Amalgamated Investments and Amalgamated Financial. Any sentence filled with such a battery of banal banking brand names will always be recognized by this newsletter.

EWM News

On Tuesday, March 22nd, employees from multiple branches of Executive Wealth Management packed almost 11,000 meals to help feed the growing number of Ukrainian refugees in Eastern Europe. An assembly line of volunteers packaged meals of vitamin-enriched oatmeal and beans and rice ready to be shipped to Poland and Romania to help feed those displaced by the war. The supplies and packing expertise were provided by Lifeline Christian Missions, and EWM was joined in the endeavor by Ukrainian native Oksana Pronych and her husband Nick Deychakiwsky, who gave heartfelt testimony on the suffering of loved ones in Ukraine.

EWM Chief Operating Officer Michael Lay was featured on WJR’s All Talk with Tom Jordan & Kevin Dietz to discuss this recent effort to help feed refugees and the importance Executive Wealth Management places on volunteer work. The link to that episode is directly below:

WXYZ Channel 7 also interviewed some of the EWM volunteers for a news segment that is featured below:

The latest episode of the PurposeCity podcast featuring Oksana and Nick along with Lifeline Christian Missions Vice President, Audra Norman, is linked below. Oksana talks about her family’s plight while fleeing their home in Kyiv and about her brother-in-law, who has stayed in Ukraine as part of the resistance. Nick sings a Ukrainian resistance anthem while playing a bandura, a lute-like stringed instrument native to Ukraine. Also, Audra explains how Lifeline goes about getting meals to refugees as quickly and efficiently as possible.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on March 18, 2022 to closing price on March 25, 2022

1 Month = closing price on February 25, 2022 to closing price on March 25, 2022

3 Month = closing price on December 23, 2021 to closing price on March 25, 2022

YTD = closing price on December 31, 2021 to closing price on March 25, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.