“A bird in the hand is worth two in the bush” goes the famous English proverb first put down on paper by the naturalist John Ray in 1670. This folk wisdom emphasizes that the value of a potential gain (the birds in the bush) needs to be discounted for the risk and time involved in the new endeavor so that it can be properly compared to the wealth that we already do have. For John Ray, the present value of the two birds in the bush was equal to the one he currently possessed. This axiom about discounting the future had many precursors throughout the history of Western civilization. A little over a hundred years before John Ray, the English writer John Heywood published a glossary of aphorisms that included, “Better one bird in the hand than ten in the woods.” In fact, the ancient Romans and Greeks had their own versions of the bird proverb, while maybe the earliest version comes from the Middle East by way of the Story of Ahikar circa 600 B.C., where the eponymous protagonist lectures an Assyrian king that “better is a sparrow held in the hand than a thousand flying in the air.” So you can see that throughout history people have realized the importance of discounting possible future gains to weigh their present value. Those discount factors may differ by an order of magnitude or two (apparently it’s a lot easier to capture birds in a bush than sparrows in the sky), but it was agreed that a wise person always considered them.

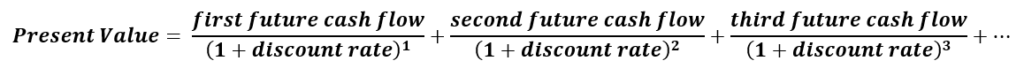

Today’s stock investors face a similar situation to our bird-obsessed predecessors. Fundamentally, the price of a share of stock is the discounted present value of the company’s future cash flows. Owning a share of a company means that the investor has a stake in these future flows, whether they are distributed as dividends or reinvested in the business. By purchasing a stock, the investor is, at least implicitly, indicating that he believes the present value of the future cash flows is greater than the current share price. But how can these future cash flows be properly valued? Stock analysts spend years developing models that look at past results of similar companies and calculate theoretical market sizes in attempt to help give a quantitative answer. Many times they produce an equation similar to the one below:

Where the discount rate usually represents an opportunity cost of not being able to put your money elsewhere. Then through some algebraic alchemy and spreadsheet sorcery, estimated values can be spit out. However, the answers are always very sensitive to the input variables and even the best analysts can vary widely in their discounted present values, just as the proverbs of the past differed dramatically on the degree of their bird discount. However, through the public stock markets, these differing views are processed and aggregated, with the current share price of a stock representing in some way a crowd-sourced average of everyone’s estimation of discounted future value.

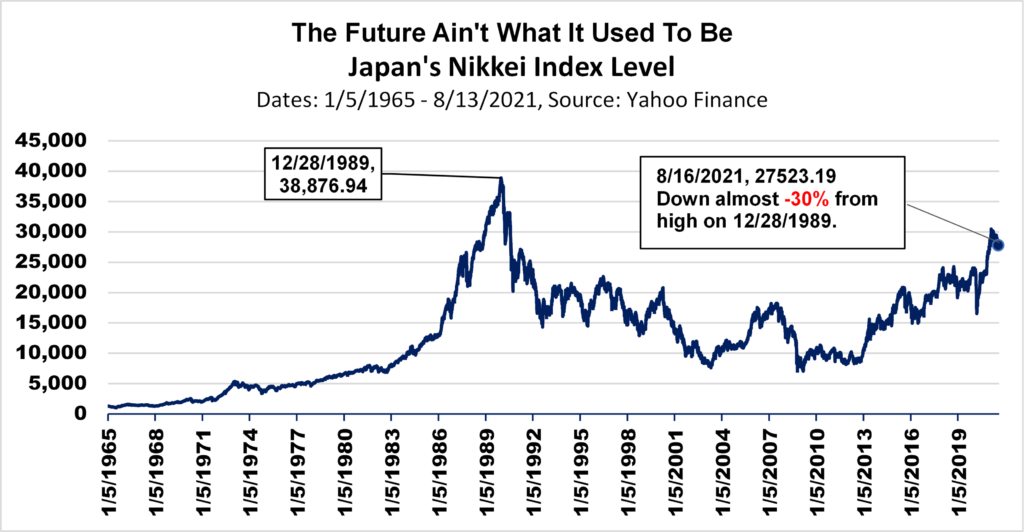

Well, I’d trade all my tomorrows for one single yesterday — “Me and Bobby McGee” by Kris Kristofferson. Our estimates of future value can turn quickly and negatively, as the song lyrics above eloquently note. One standout example of this in the stock world is the Japanese equity market. During much of the 1980s the technological and industrial potential of Japanese companies had no rival. It seemed that corporate Japan would one day bestride the business world like a colossus. The shares of Japanese stocks were being priced as if their future cash flows would come from such a dominant position; with the Nikkei, the benchmark Japanese equity index, skyrocketing to its peak on 12/28/1989. However, the Japanese asset price bubble overextended and eventually popped. Their economy stagnated, producing a “Lost Decade” in the 1990s, followed by another “Lost Decade”, and then another. Stock prices plummeted, and even today (8/16/2021), the Nikkei index is still almost -30% below its value over three decades ago.

Quote of the Week

Offshore and off-the-wall — Charlie Smith’s capricious misadventures are a lighthearted glimpse of how one likeable rascal copes with the three-headed hydra of globalization, rampant taxation and creeping regulation. The Amazon.com description of the 2006 work of financial fiction about securities fraud and money laundering entitled Footloose – Charlie Smith’s Offshore Chronicles by Fred Sharp. Last week, the SEC charged that same Fred Sharp and several of his associates with securities fraud and money laundering from 2011 to 2019, activities that allegedly facilitated over 1 billion dollars worth of illegal financial transactions by methods that were almost identical to the ones used by the protagonist of the book. |

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Update

There were no trades in the Fortunatus models during the week ending on August 14th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

On a Lighter Note

When you start your studies in computer programming, you are given simple tasks like sorting bubbles and counting all the leaves on a tree, but when you begin to design code for real projects, you learn that there are two different approaches: object oriented programming (OOP) which emphasizes data encapsulation and functional programming (FP) which features referential transparency. Why the need for two styles? Well, the shortcomings in each approach can be easily seen if we are transported Tron-style into a world inhabited solely by computer code….

So you are walking down a digital road when you are accosted by an OOP code module that challenges you to a street fight – a common occurrence in the world of software. Because your opponent’s a wee little man with large spectacles, you have no trouble in the skirmish and send him on his way. However, he comes back three months later and challenges you again. He looks like the same guy you fought before; but, unbeknownst to you, he has been training in a Shaolin temple learning the ancient art of dim mak or “death touch”. Because he is OOP code, this deadly data point is hidden (or encapsulated), so you are caught completely unaware of your impending doom.

After a lengthy period of convalescence, you decide that you’re a lover not a fighter. So you meet a nice FP code module for a date since you know she won’t have a hidden agenda. But because she is FP code, there has to be absolutely no surprises (complete referential transparency) right from the beginning. Thus, she must make you aware of even the most trivial personal trivia, like what temperature she finds breakfast porridge unpalatable and what’s her acceptable thread count for bed linens

. As she starts to rank every episode of Law & Order: Special Victims Unit by creepiest villain, you realize this is never going to go anywhere, so you jump out of a window to escape (this is safe because the glass is made out of bits and bytes). What can you do now? Maybe check if there is anything interesting on your computer, but you’re already inside the computer…

So what is the moral of the story? Well, that building things is hard and there is no one right way to do anything; and also, I guess, that you probably shouldn’t try to fight or date computer software.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on August 6, 2021 to closing price on August 13, 2021

1 Month = closing price on July 13, 2021 to closing price on August 13, 2021

3 Month = closing price on May 13, 2021 to closing price on August 13, 2021

YTD = closing price on December 31, 2020 to closing price on August 13, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.