When asked by a reporter in 1976 what attribute a player needed to succeed in the NFL as a defensive back, Detroit Lions Hall of Famer Lem Barney quickly responded, “What a cornerback truly needs is a short memory.” Barney knew that even the best cornerbacks would occasionally give up plays that would cost his team a touchdown during a game, but the best way that the defender could help them win was to quickly forget the failures and to maintain supreme confidence in his ability to get the job done in the future.

Just like NFL cornerbacks, the public purveyors of pessimistic market news also have short memories. Convinced that every market downturn has eerie similarities to the Great Depression or the Global Financial Crisis, the “permabears” have predicted 10 out of the last 1 bear markets. Every mistaken call in the past to remove risk from your portfolios is quickly forgotten, and the prognosticators go on television or social media confidently stating that the next drawdown will be the mother of all market crashes. One day, the prophets of doom and gloom will be right, even the cornerbacks on the 0-16 2008 Detroit Lions occasionally made a good play – emphasis on occasionally. However, for investors it is important to not have a short memory about the past portfolio recommendations from these forecasters of despair – the premature removal of risk assets can be just as devastating to returns as a bear market.

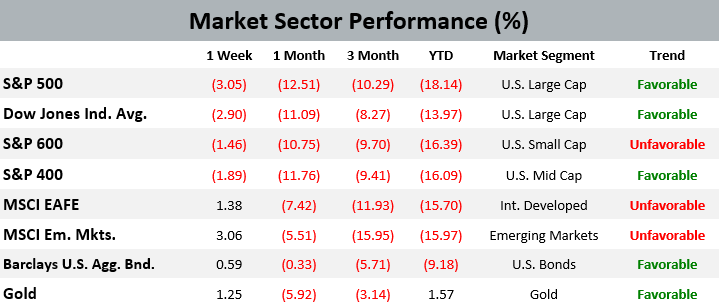

Nevertheless, what has made this current stock market downturn unnerving for so many investors has been the concurrent fall in fixed income. Looking at the chart above, as of May 20th, the year-to-date total return on the S&P 500 is -17.67% coupled with a -9.18% drop in the Bloomberg Aggregate Bond Index. Since the bond index began in 1975, it has not had a negative year at the same time as the S&P 500. Fixed income is intended to stabilize many portfolios, and while a mixture of stocks and bonds has not lost as much as all-equity portfolios, investors would certainly prefer more ballast from their bonds. The persistence of significant inflationary pressures on the U.S. economy could continue this harmful trend, but no one knows how long it will last.

One small solace for long-term investors is that they are no longer subjected to the most insidious trap of bull markets – FOMO, or the fear of missing out. During 2019-2021, stories about the quick and easy riches obtained by investing in cryptocurrencies, meme stocks, SPACs, algorithmic stable coins, or non-fungible tokens bombarded the average market observer. It takes a lot of discipline not to feel like you are missing out on the next big thing when new inscrutable asset classes skyrocket in price. However, as the market mood flips and capital discipline now becomes more important, the frivolous securities of the last few years have collapsed in value. This can be seen by comparing the total return since the start of 2020 of the S&P 500 and the ARK Innovation ETF (ticker symbol: ARKK) which gained fame in 2020 by investing in some of the most fickle and faddish sectors of the financial world. ARKK is down -16.49% since 12/31/2019 despite its meteoric rise in 2020 and early 2021, while the S&P 500 is still up over 25% during the same time period despite the recent downturn. For those who didn’t get taken in by the get rich quick schemes of the last two years, now there is no FOMO only JOMO – the Joy of Missing Out.

Performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

There were no trades in the EWM Investment Solutions models during the week ending on May 21st, 2022. Large-cap domestic equity still maintains its long-term favorable trend, and U.S. stocks remain over-weighted versus international shares in EWM’s Asset Allocation models.

Quote of the Week

Concentration in your portfolio can certainly make you wealthier if you hit the lottery but it can also make you poor in a hurry.

Ben Carlson, author of the A Wealth of Common Sense blog, commenting last week about the dangers of an undiversified portfolio in a down-trending market.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on May 6, 2022 to closing price on May 13, 2022

1 Month = closing price on April 13, 2022 to closing price on May 13, 2022

3 Month = closing price on February 11, 2022 to closing price on May 13, 2022

YTD = closing price on December 31, 2021 to closing price on May 13, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.