Founded in 2017, cryptocurrency loan company Celsius Network LLC made a big splash in the brave new world of decentralized finance. Its brash founder and CEO, Alex Mashinsky, insisted that Celsius could provide interest rates as high as 18% a year on digital currency deposits because his company wasn’t as greedy as traditional banks. According to Bloomberg News in December 2021, Mashinsky boasted, “The beauty of what Celsius managed to do is that we deliver yield, we pay it to the people who would never be able to do it themselves, we take it from the rich, and we beat the index.” The company’s Twitter account posted stories in 2021 of clients who cashed in their savings for their kids’ education in order to put money in Celsius’ high-yielding accounts with testimonials like “I don’t trust the banking system, but I trust #Celsius.” And it wasn’t just all anecdotal enthusiasm, Celsius had accumulated almost $12 billion in assets by May 2022 from yield-hungry clients, including a sizable investment from the Canadian pension fund Caisse de Dépôt et Placement du Québec.

Unfortunately, on June 12th, Celsius froze all withdrawals on its platform citing “extreme market conditions.” On June 19th, the company halted all discussions on its normally boisterous social media feeds. By June 26th, news broke that the company was hiring advisors to prepare for potential bankruptcy. How did it all go wrong?

The schematic above shows the basic functioning of all lending platforms, from the traditional neighborhood bank to the latest cryptocurrency lending companies like Celsius. Money (in the form of dollars or cryptocurrency) is deposited with the lender. The lender uses these deposits to fund loans to borrowers at some interest rate, thereby transforming short-term liabilities (the deposits) into longer-term assets (the loans). The depositors receive the interest payments minus the lender’s cut as compensation for keeping their money with the lender.

Celsius greatly increased the yield to its depositors by making very risky loans – mostly lending digital money to crypto speculators who wanted to make leveraged bets on those currencies. Traditional banks, especially since the Global Financial Crisis of 2008, are severely restricted on the use of leverage in their investments. Also, banks are required to maintain an equity capital buffer to protect against bad loans and liquidity thresholds to protect against a run on withdrawals. Both requirements reduce the amount of money that banks can pass back to depositors. There are also fees for federal regulators and government-backed deposit insurance that diminish returns. By operating in the unregulated world of decentralized finance, Celsius was unburdened with these restrictions, so they could squeeze out as much yield as possible for their clients. However, when the price of cryptocurrencies began to plummet in the bear market, Celsius was left completely unprotected. Most of the speculative bets that Celsius financed quickly collapsed, and they had no capital cushion or liquidity buffer to protect their customers’ assets. It wasn’t just the sizable interest payments that quickly disappeared but also the deposits.

It is understandable that some people are skeptical of the practices of the traditional banking industry and the efficacy of the regulations to rein in its worst impulses. However, the cautionary tale of Celsius shows that it is foolish to toss all that skepticism aside when anyone new comes along promising an unbeatable alternative. Even unregulated lenders must obey the laws of economics and there is a hefty price to be paid by those who think they can evade those laws.

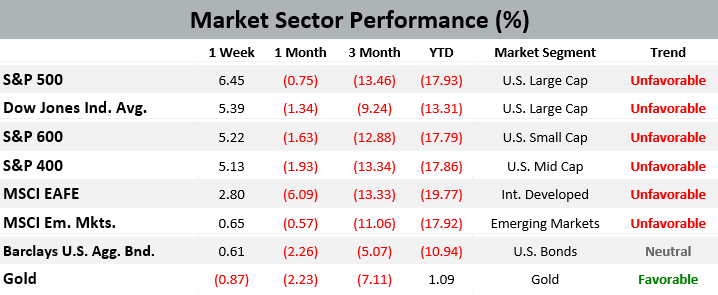

Past performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

There were no trades in EWM Investment Solutions models during the week ending on June 25th, 2022. All major equity market sectors are currently in a long-term unfavorable trend, and the Asset Allocation models remain at their lowest possible tactical equity exposures, with domestic stocks favored over international shares.

Quote of the Week

Somebody is lying. Either the bank is lying or Celsius is lying.

Excerpt from Celsius Network LLC founder and CEO Alex Mashinsky’s interview with Bloomberg Businessweek on how his company is able to provide much higher interest rates on deposits than traditional banks.

On A Lighter Note

The promotion around the latest Jurassic World movie earlier this month made this writer realize that one of the surest signs that you are no longer a kid isn’t some big life-changing event like graduating high school or getting your first job, no – it’s when you can’t remember the last time someone asked you about your favorite dinosaur.

Nowadays, all casual conversations with strangers on the street seem to start off with platitudes like “How about that market?” or “Some weather we’re having, huh?” and generally devolve from there. But there was a time, several decades ago, when every new person you met on the playground would go right to the important issues of the day and demand to know, “What’s your favorite dinosaur?” And boy did I have an answer ready to deliver – the sturdy stegosaurus.

The stegosaurus was a herbivore, so he wasn’t looking for trouble, but you knew that when things went down he could send any prehistoric opponent to frown town. With plates of armor on his back, and sharp sticks on his tail, he could handle himself in any dinosaur dustup. And although some scientists claim his ping pong ball-sized brain shows that the stegosaurus was history’s dumbest dinosaur, he did live for over 10 million years – twice as long as that Hollywood-hype job the velociraptor.

An argument as simple as 123 Q.E.D.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on June 17, 2022 to closing price on June 24, 2022

1 Month = closing price on May 24, 2022 to closing price on June 24, 2022

3 Month = closing price on March 24, 2022 to closing price on June 24, 2022

YTD = closing price on December 31, 2021 to closing price on June 24, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.