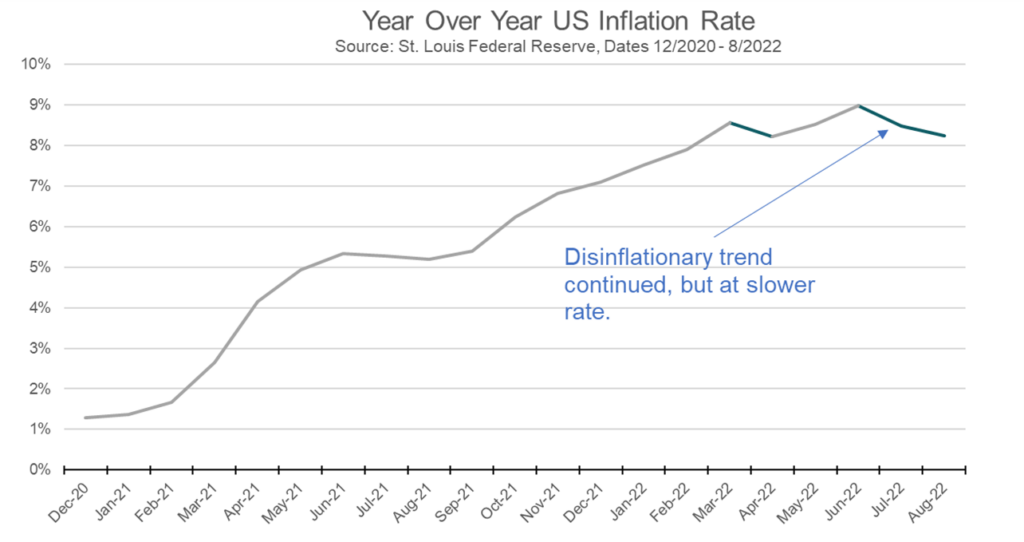

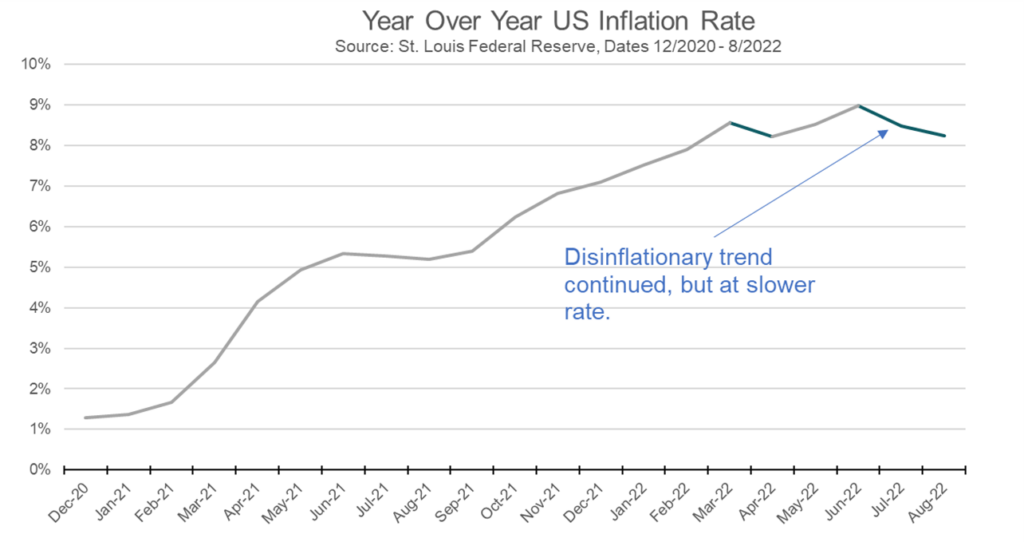

Inflation came in hot for August. The overall direction of headline inflation was expected, in that it was down, but it was not down enough for the collective mind of the market, so equities fell significantly on the release of the latest Consumer Price Index report last Tuesday. For a minute, the Fed Funds Futures markets began seriously pricing in a 1% hike in the benchmark short-term interest rate for the central bank’s next meeting this Wednesday, though that looks less likely now. There should be relatively little fuss around the Fed meeting on the 21st, with a 0.75% priced into market expectations.

As to why the markets fell so much on the latest inflation news, it is difficult to say. We know that the Fed is going to be aggressive in fighting inflation. They have proclaimed “higher [rates] for longer” and “economic pain” several times now, and we don’t believe they will veer from that course at the next policy meeting. But we still see markets move on small surprises, and this can be disconcerting. We do expect market moves to continue to be exaggerated this year, both up and down on very little news.

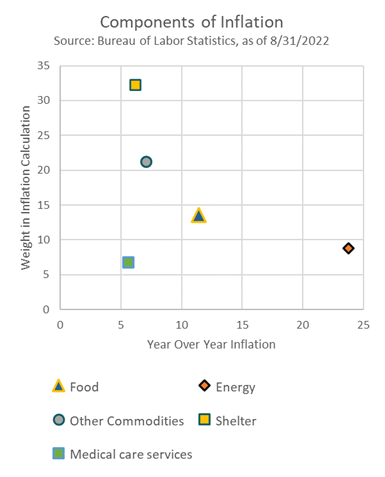

If we dig into the inflation report, we can see some items that were unsettling for the market. The most important was that “core inflation” increased on a year-over-year basis. This was fueled in part by the heating up of rent prices. Rents lag home prices, and as we have discussed in the recent past, home price increases have, for the most part, stalled out their recent price ascent. Energy prices are down significantly over the short-term, but still holding up on a year-over-year basis. Food inflation has proved stickier than predicted with food at home. All of this is what the market is attempting to digest.

We continue to be underweight equities and overweight cash during this time. Equities and fixed income have produced poor results this year, while traditional inflation-hedging assets such as gold have proved themselves to be ineffective during this recent inflation run- up as well. It has been even worse for digital assets that once claimed to be the new modern inflation hedges, with Bitcoin down -70% from its 2021 all-time highs. There is a unique narrative crafted for every move the market makes, and we work to keep these just-so stories from seeping into our decision-making process.

Click the link below to sign up for the full EWM Weekly Newsletter.

It’s packed with additional resources to help you Live with Confidence!

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on September 12, 2022 to closing price on September 16, 2022

1 Month = closing price on August 16, 2022 to closing price on September 16, 2022

3 Month = closing price on June 16, 2022 to closing price on September 16, 2022

YTD = closing price on December 31, 2021 to closing price on September 16, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.