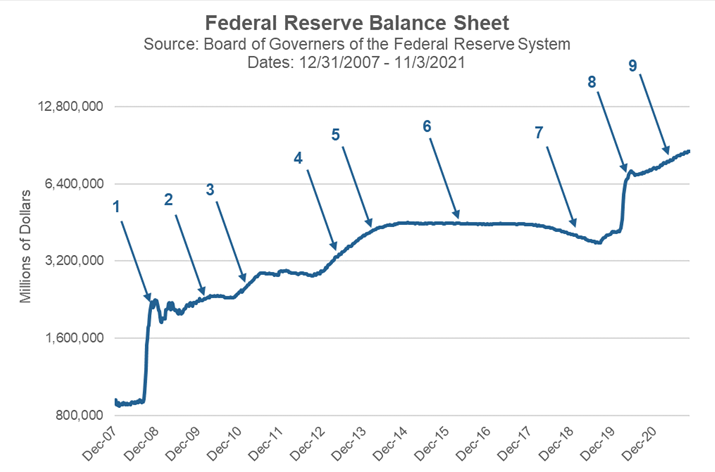

The taper announcement finally came. In what had to be one of the most obvious press releases, last week the Federal Open Market Committee declared that they would begin to taper their bond buying program that was enacted during the depths of the liquidity crisis that happened as a result of the COVID calamity. What does this mean from a historical perspective? Coming out of the Great Recession (2008 – 2009) there were all sorts of programs that were tried to jump start the economy, ending with the runoff of the Fed balance sheet that began in 2018. All told it was a 10-year cycle that never got us back to pre-Global Financial Crisis balance sheet levels. The following is a brief timeline of how events played out on the graph below.

1.The Federal Reserve opens emergency asset purchases in the face of the Global Financial Crisis (GFC).

2. Quantitative Easing 1 (12/2008 – 3/2010)

3. Quantitative Easing 2 (11/2010 – 6/2011)

4. Quantitative Easing 3 (9/2012 – 1/2014)

5. Initial Tapering (1/2014 – 10/2014)

6. Stability of the balance sheet (2014 – 2018)

7. Runoff of balance sheet begins

8. The Federal Reserve opens emergency asset purchases in the face of the Global COVID Pandemic Crisis.

9. The Fed continues asset purchases to ensure the economy is functioning and yields stay low to facilitate economic activity.

With the taper announcement last week, we are now back to the same environment historically as number 5 – Initial Tapering (1/2014 – 10/2014). We should look at this graph with the understanding that the Fed went big this time around, bigger than it did for the GFC. The chart is logarithmic to underscore the danger of starting from an inflated base, but the absolute dollar amount this time has been immense. There was also a significantly larger fiscal response by the government as well. Judging by the return of consumer demand this policy response has been successful. Do we have inflation right now? Yes. Is inflation worth it to avoid a catastrophic economic event? It happened, and we will let history sort out the overall benefits. But initially, we are doing good from an economic standpoint. So good that tapering, the event that took 5 years to get to after the GFC, has been announced and is beginning a mere 19 months after the initial COVID-induced crisis.

Will we be seeing fits and starts to the tapering? Looking out the economy is stronger than it was after the GFC: credit is flowing better, bank balance sheets have had no setbacks, and consumer spending is above levels pre-pandemic. So overall it looks like we won’t see the taps turned back on by the central bank until the next crisis, and there will always be the next crisis. The question is will we have been able to re-start number 7, the runoff of balance sheet assets, by that point? It is always better to start from a lower base.

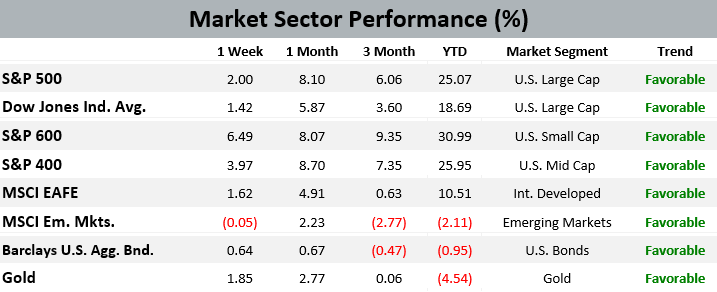

What does this mean from a money management standpoint? That all remains to be seen, but if history is any guide this will not be bearish for stocks. From the end of 2013 through 2017 the S&P gained 12% on an annualized basis. The aggregate bond index gained 3% on an annualized basis during that time frame as well, though it was starting from a higher-yielding place. Knowing that this is only 1 data point; and therefore not a very robust sample size, it is most important just to note that last time it worked out well. The future is always unknowable, and that is why we always watch the markets closely and react to changing circumstances as they arise.

Model Update

On Monday, November 1st, the Fortunatus Opportunity models underwent their monthly relative strength rotations. The Global model increased its allocation to the technology sector and reduced its exposure to domestic mid-cap stocks.

There were no other trades in the Fortunatus models during the week ending on November 6th, 2021. The major equity market sectors remain in a long-term favorable trend, and the Fortunatus Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Past performance is no guarantee of future results. Trend signals are proprietary research of Fortunatus Investments, LLC, a Registered Investment Advisor with the Securities and Exchange Commission (SEC). Reference to registration does not imply any particular level of qualification or skill. Prior to June 2014, Fortunatus Investments was a wholly-owned subsidiary of Executive Wealth Management, LLC and they continue to share common ownership and control. The data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Quote of the Week

The sleep deprivation, the treatment by senior bankers, the mental and physical stress … I’ve been through foster care and this is arguably worse.

An anonymous comment from a junior analyst at Goldman Sachs contained in “Working Conditions Survey” – a presentation about the abusive workplace atmosphere at the famous investment bank created by first-year employees. The growing discord between junior and senior bankers on Wall Street, that was only exacerbated by the Covid pandemic, is detailed in an article by Jen Wieczner published in New York Magazine last week.

EWM News

Executive Wealth Management Founder and Director Bert Herzog shared the story of how the financial planning firm continues to grow one relationship at a time over 20 years during a recent PurposeCity podcast. He also discussed the value of building a business built on trust, compassion, and community in an ever-increasing digitally distant business environment and how the two can co-exist. Bert explained that having compassion for clients means providing as many solutions to support them as possible and how EWM is embracing this challenge. You can listen to the entire interview by clicking on the image directly below:

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on October 29, 2021 to closing price on November 5, 2021

1 Month = closing price on October 5, 2021 to closing price on November 5, 2021

3 Month = closing price on August 5, 2021 to closing price on November 5, 2021

YTD = closing price on December 31, 2020 to closing price on November 5, 2021

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.