We know that there are differences between long-term existential crisis and short-term. We mentioned the Russia / Ukraine conflict last week in passing while discussing what are large existential crises and what are only sources of uncertainty around the financial world. As we said then, the brewing conflict is important but largely tangential to financial markets in the U.S. According to data provider FactSet, the companies of the S&P 500 receive roughly 0.9% of their revenue from Russia and 0.12% from Ukraine. We are dealing with a region that is not currently enmeshed with our companies, due in no small part to the lack of the rule of law in Russia.

While there has been an uptick in talking about the Ukraine crisis on recent corporate earnings calls, the situation has only been discussed in 4% of the calls while inflation has been discussed on 72% of the calls. Most of the mentions on the calls recount how this has happened before and the companies learned how to deal with disruption in the region after Russia invaded Ukraine in 2014 and subsequently annexed the Crimean Peninsula.

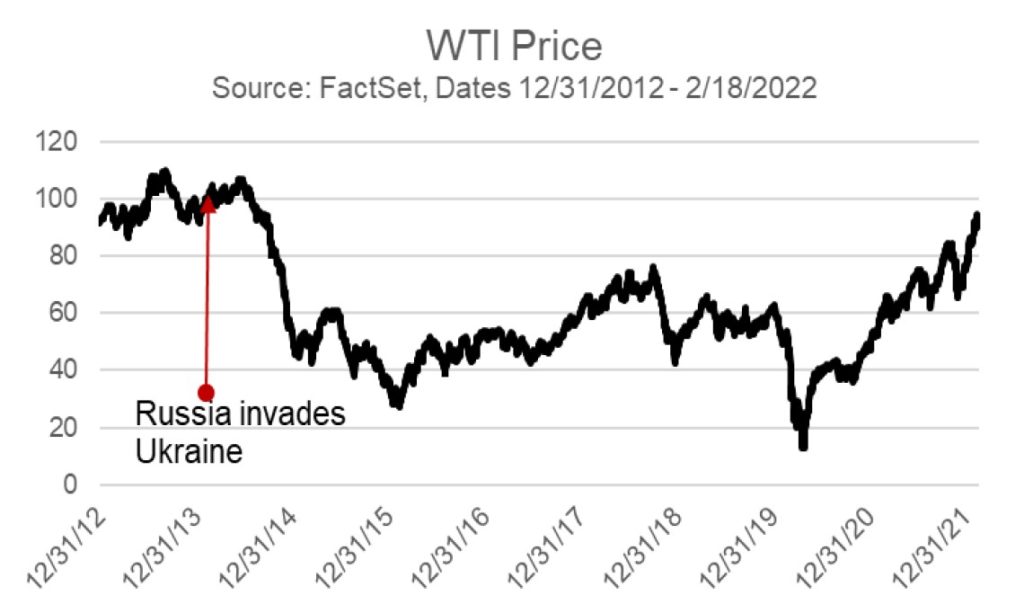

What are the long-term impacts that another Russian invasion of Ukraine could have? We could see oil stay higher for longer, though this is not a given. Looking at the chart below, the last time there was massive upheaval in the region it did not lead to an oil price shock. The important thing to remember about this chart is that OPEC made a decision to flood the market with cheap oil in 2014 in response to American frackers eating up too much of the market for their liking. The fracking industry was profligate with investors’ money and when prices fell in 2014 and once again in 2020 there was a rash of bankruptcies across the industry. That explains some of the reasons that US oil production has not picked up in response to recent higher oil prices.

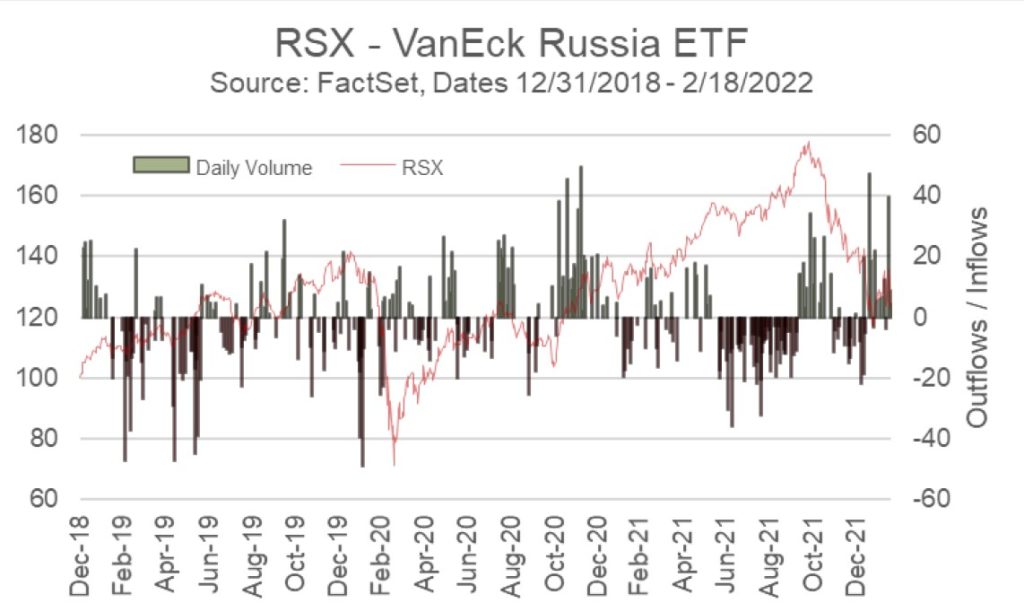

There are also those who have seen the Ukraine crisis as an investment opportunity. RSX – the VanEck Russia exchange traded fund (ETF) – has seen a large set of inflows since the beginning of 2022, with many of those investors probably betting on a speedy conclusion to the crisis. We don’t know how events will playout in the long run, but we do know that we had and continue to have low exposure to the region precisely because of what is happening right now.

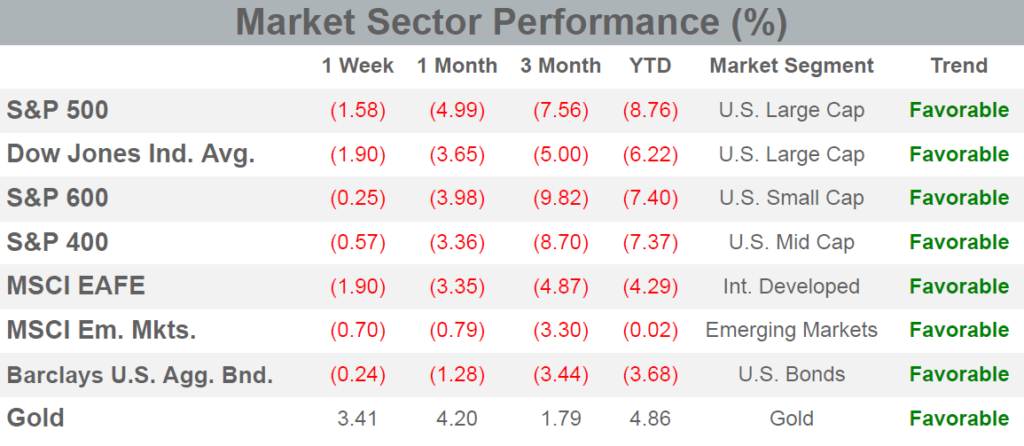

Performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

There were no trades in the EWM Investment Solutions models during the week ending on February 19th,2022. The major equity market sectors remain in a long-term favorable trend, and the Asset Allocation models are near their maximum allowable equity exposure with domestic stocks favored over international shares.

Quote of the Week

In numerology, you reduce. So 2/22/2022 adds up to 12. Then you add the 1 and2 to get 3. And that number, 3, is consequential, after the 1 and 2. So it re-forms the sequence. It’s like a new beginning and also self-expression. That’s a very powerful tool.

Arithmetical insight about today’s date from an Irish fortune teller who goes by the name “CelticSeer” in the February21st, 2022 edition of the New York Post. This “Twosday” or 2/22/22 has many looking for hidden significance in the numerical repetition.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on February 4, 2022 to closing price on February 11, 2022

1 Month = closing price on January 11, 2022 to closing price on February 11, 2022

3 Month = closing price on November 11, 2021 to closing price on February 11, 2022

YTD = closing price on December 31, 2021 to closing price on February 11, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2021 Executive Wealth Management. All rights reserved.