Chairman Powell made a speech on Friday, August 26th, at Jackson Hole, Wyoming. During the speech, he said that we could see “higher for longer” inflation and that “economic pain” may be necessary to curb that inflation. This means a more restrictive monetary policy out of the Federal Reserve Bank. And just like that, the equity market reacted like somebody poured a bucket of water over the rally that had been heating up into the close of August. Successive interviews by regional bank heads have stuck to the same script, and the equity markets have continued to fall over the past week in response.

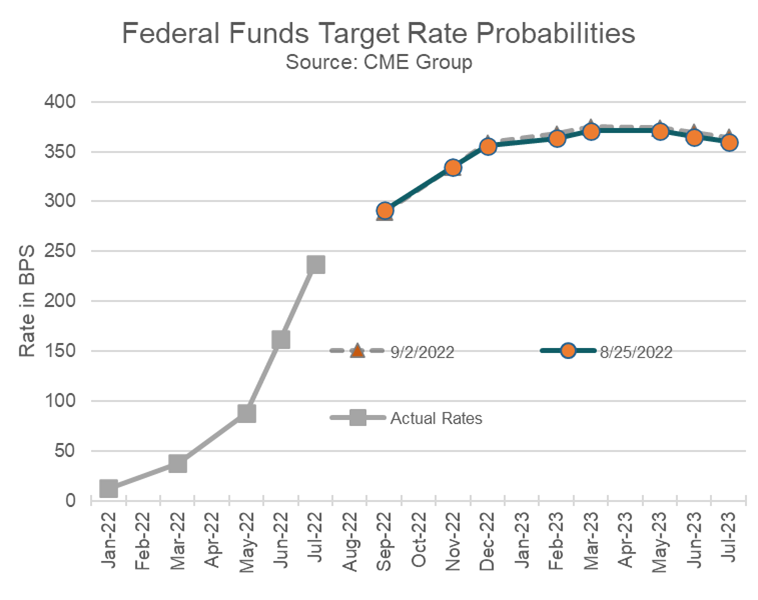

But the bond markets were unfazed by his speech. The chart above shows that in the Fed Funds futures markets, the forward short-term interest rates are virtually unchanged between the day before the Chairman’s speech (8/25/2022) and one week later (9/2/2022), where 1 basis point (BPS) equals 0.01%. This tells us that the bond market was almost entirely unmoved by Powell’s speech. Members of the Federal Reserve Open Market Committee have been telegraphing the Chairman’s message all summer. So Powell’s speech shouldn’t have caught anyone off guard.

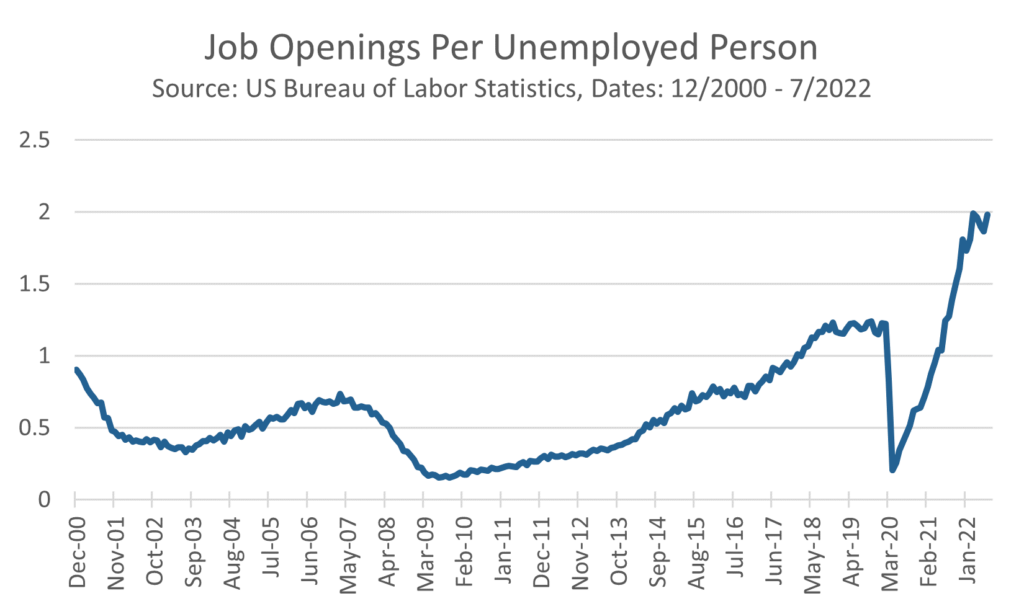

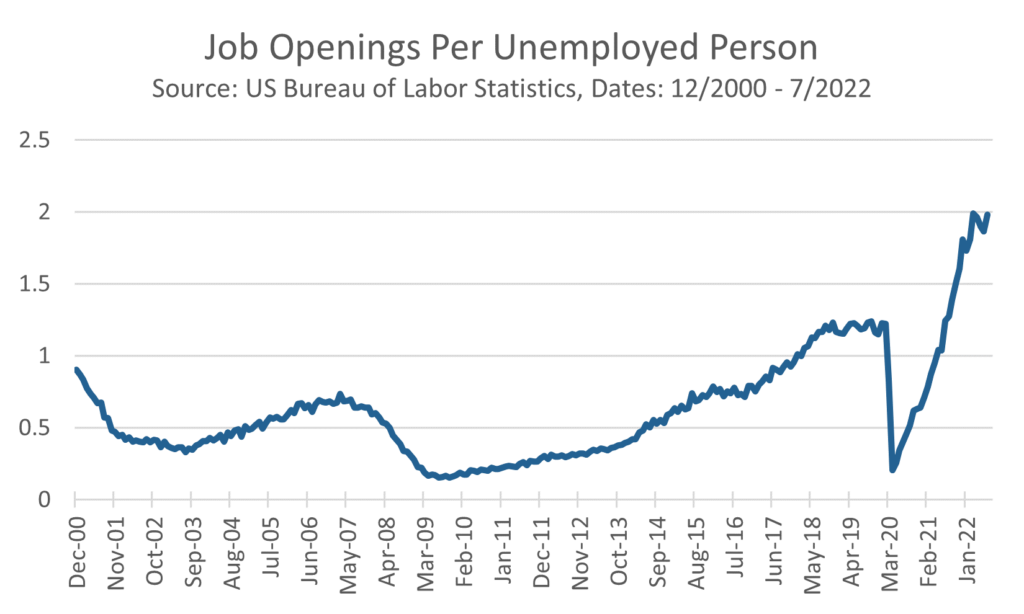

What do we think that the FOMC is looking for before they can pivot away from a hawkish monetary policy? They want to see inflation under control, and they will, as always, be data dependent. We have noted several times that commodity input prices have fallen from their peaks and for now that portion of input inflation is receding significantly. The Fed has cited a still quite loose job market as a particular problem. As seen in the chart below, there are currently roughly 2 job openings for every unemployed person in the United States. This is far above the long-term levels. This is also something that is causing wage inflation. Is there good news on this front?

Well, on Friday, September 2nd, there was an encouraging jobs report. Wage growth surprised to the downside, payrolls surprised to the upside, and the unemployment level rose. This was a Goldilocks jobs report. Rising unemployment rates alongside a significant growth in payrolls is a sign of increased labor force participation. If we string a few of these reports together, we can bend the line in the chart above back down to more historical levels. If that line falls, then wage inflation can come back down to pre-pandemic levels.

As always, this Fed is “data dependent”, and what they say about the future today is not what is going to happen tomorrow at a 100% certainty. Remember, they believed that inflation was not going to be a problem in 2021, until the data told them that it was here for longer. The Fed will modulate its position based the underlying conditions. They don’t have any better idea of where inflation will be in 6 months than anyone else.

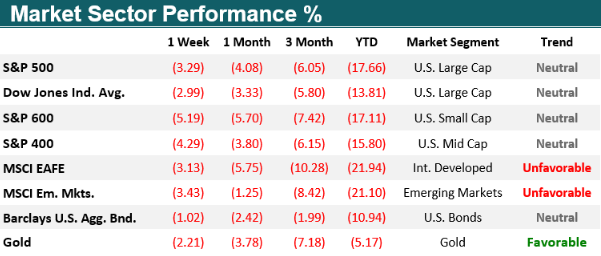

Past performance is no guarantee of future results. Trend signals are proprietary research of EWM Investment Solutions, a wholly owned subsidiary of Executive Wealth Management, LLC. Data source for returns is FactSet Research Systems Inc. This chart is not intended to provide investment advice and should not be considered as a recommendation. One cannot invest directly in an index. Executive Wealth Management does not guarantee the accuracy of this data.

Model Updates

On Monday, August 29th, the Global Opportunity model underwent its monthly relative strength rotation. The model exited a position in inflation-protected bonds in order to add a new fund focused on natural resource companies.

There were no other trades in EWM Investment Solutions models during the week ending on September 3rd, 2022. All major domestic equity market sectors are currently in a neutral trend, while international equity remains in a long-term unfavorable position.

Quote of the Week

“Surviving bear markets requires you to manage both volatility and your emotions. That means that while it’s okay to feel bearish at times, it’s not okay to stay bearish. Bear markets don’t last forever”

A reminder from Ben Carlson’s financial blog A Wealth of Common Sense that excessive

emotional negativity can quickly lead to prolonged financial negativity.

Out & About

Hartland Senior Center

September 13, 202211:30 a.m. – 1:00 p.m.

Lunch | Beverages | Prizes

Jimmie Plaskey, EWM Director & Private Wealth Advisor, will speak on income planning and long-term care insurance benefits.

Contact Jimmie Plaskey to register: jplaskey@ewmadvisors.com or (810) 355-7929

EWM In the News

On August 16, 2022, two local businesses came together to participate in a home build with Livingston County Habitat for Humanity.

A Live With Confidence Minute: Estate Planning

Senior Estate Planning Attorney

Marines win Battle Armed with Tootsie Rolls

U.S. Marines were surrounded and outnumbered by Chinese and North Korean troops as much as 10-to-1 during the Korean War. Temperatures fell to 40 degrees below zero; vehicle batteries cracked, weapons wouldn’t cycle, the weather inhibited resupply missions, the ammo was low, and bullet holes wreaked havoc on the vehicles.

Just when it seemed all was lost, parachutes of ammo arrived! The Marines desperately opened the boxes only to find thousands of Tootsie Rolls. The code word for 60mm mortar rounds was ‘Tootsie Rolls.’ The radio operator did not have the code sheet but knew the call was urgent, so he ordered a drop of candy ASAP!!

The sweet treat was exactly what the Marines needed, as fate would have it. Actual 60mm mortar rounds would have only postponed their inevitable doom. However, the candy gave the hungry soldiers the calories they needed for energy to fight. The Tootsie Rolls were frozen solid. The soldiers warmed them to putty in their mouths, pasted them on the bullet holes, and cracked pipes of their vehicles. As they froze again, it provided a temporary seal allowing them maneuverability and providing the same function to get guns working again.

Approximately 12,000 United States Marines, fueled by small candies, had a victory that day over 120,000 Chinese Communists. To this day, when those Marines have reunions, the Tootsie Roll Company sends boxes to them.

Executive Wealth Management (EWM) is a Registered Investment Advisor with the Securities and Exchange Commission. Reference to registration does not imply any particular level of qualification or skill. Investment Advisor Representatives of Executive Wealth Management, LLC offer Investment Advice and Financial Planning Services to customers located within the United States. Brokerage products and services offered through Private Client Services Member FINRA/SIPC. Private Client Services and Executive Wealth Management are unaffiliated entities. EWM does not offer tax or legal advice. Please do not transmit orders or instructions regarding your accounts by email. For your protection, EWM does not accept nor act on such instructions. Please speak directly with your representative if you need to give instructions related to your account. If there have been any changes to your personal or financial situation, please contact your Private Wealth Advisor.

Returns are calculated as indicated below with reinvested dividends not considered except for the Barclays U.S. Aggregate Bond Index. Data source for returns is FactSet Research Systems Inc. The London Gold PM Fix Price is used to calculate returns for gold.

1 Week = closing price on August 26, 2022 to closing price on September 2, 2022

1 Month = closing price on August 2, 2022 to closing price on September 2, 2022

3 Month = closing price on June 2, 2022 to closing price on September 2, 2022

YTD = closing price on December 31, 2021 to closing price on September 2, 2022

All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Material provided is for information purposes only and should not be used or construed as an offer to sell, or solicitation of an offer to buy nor recommend any security. Any commentaries, articles of other opinions herein are intended to be general in nature and for current interest. Some of the material may be supplied by companies not affiliated with EWM and is not guaranteed for accuracy, timeliness, completeness or usefulness and EWM is not liable or responsible for any content advertising products or services.

Copyright © 2022 Executive Wealth Management. All rights reserved.